What does making tax digital mean?

Making Tax Digital (MTD) is a UK tax legislation regulated by HMRC (HM Revenue and Customs). There are two types of MTD: MTD for VAT and MTD for Income Tax

Who needs to register for MTD? Is MTD compulsory?

Since 2019 UK VAT-registered businesses with a taxable turnover above the threshold of £85,000 are required to keep digital records under MTD for VAT. Moreover, they must submit their VAT return to HMRC using MTD-compatible software. It doesn’t change the deadlines for submitting VAT returns.

Making Tax Digital for Income Tax is for income tax reporting and currently voluntary. It will be mandatory from April 2023 only for self-employed businesses and landlords with annual business or property income.

Who is exempt from making tax digital for vat?

If a business is: a) under the VAT threshold, b) exempt from filing online VAT returns or c) subject to an insolvency procedure, then it is exempt from mtd.

If a business’ taxable turnover has dropped below the VAT threshold after 2019, it is still under obligation (unless it deregisters from VAT). A business under the threshold can sign up voluntarily.

What is the best software for making tax digital?

A MTD-Compatible software is the best software for MTD. MTD-Compatible software supports the MTD obligations of keeping digital VAT records and exchanging data digitally with HMRC. It also provides digital links between software.

What is a digital link for MTD?

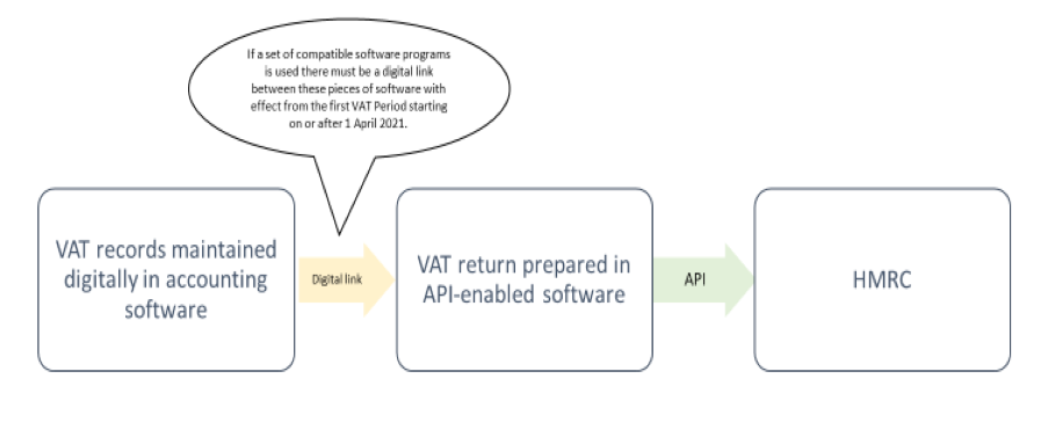

If more than one software is used by a business, data between those software must also be exchanged digitally. Until April 2021, there is a soft landing period which HMRC allows manual transfer of data by copying and pasting. However, as of 1 April 2021, businesses must make sure that there exist digital links (such as automated data transfer, API transfer, upload and download of XML files, emailing spreadsheets, etc) between software. Copy and paste will no longer be accepted as a way to transfer information.

SNI offers a MTD-Compatible Software approved by HMRC

SNI has developed an SAP add-on to help large businesses comply with MTD for VAT regulation. VAT records are retrieved from SAP modules to SNI cockpit by automated data transfer. SNI provides a secure digital link (API) between SAP system and HMRC. It is designed to submit the VAT return (bridging software). The transfer of information is purely digital.

Using ERP accounting software and API enabled software:

source: gov.uk

What is MTD Bridging Software?

‘Bridging software’ is a digital application that can get data from other applications and send the required data digitally to HMRC in the official format.

MTD Myths Debunked by HMRC

HMRC released Mythbusters of Making Tax Digital for VAT on its website. Some of them are listed below:

Myth 1: Under MTD, businesses report more information than they do before.

Not correct. It does not force you to keep additional records or provide more information.

Myth 2: Businesses above the VAT threshold can choose not to join MTD for VAT and continue to submit returns as before.

Not correct. Businesses above the threshold must join MTD and submit VAT returns by MTD’s service.

Myth 3: MTD won’t reduce errors.

Not correct. According to a YouGov poll, 61% of businesses said they have previously lost receipts and errors occur in the manual transfer or calculation.

MTD effectively reduces the time businesses spend on administration in the long run and makes it easier for them to get their tax right according to an independent evaluation of MTD’s impact on small businesses published in March 2020.