The Peppol (Pan-European Public Procurement On-Line) network is a globally recognized e-procurement and e-invoicing framework that enables secure and standardized document exchange between businesses and government entities. Traditionally, Peppol operated on a 4-Corner Model, but recent developments have introduced a 5-Corner Model to enhance compliance and interoperability, especially in countries with stricter e-invoicing regulations.

This article explores the differences between the two models and examines their applications in Malaysia’s e-invoicing system, the UAE’s e-invoicing mandate, and Belgium’s Peppol-based e-invoicing.

1. Peppol 4-Corner Model

The 4-Corner Model is the traditional Peppol framework, consisting of:

- Sender (Corner 1) – The business or entity sending the invoice.

- Sender Access Point (Corner 2) – A Peppol-certified service provider that formats and transmits the document.

- Recipient Access Point (Corner 3) – The recipient’s Peppol service provider that receives and processes the document.

- Recipient (Corner 4) – The business or government agency receiving the invoice.

How does it work?

- The sender submits an invoice via their Access Point (AP).

- The AP routes the invoice through the Peppol network to the recipient’s AP.

- The recipient’s AP delivers the invoice in the required format.

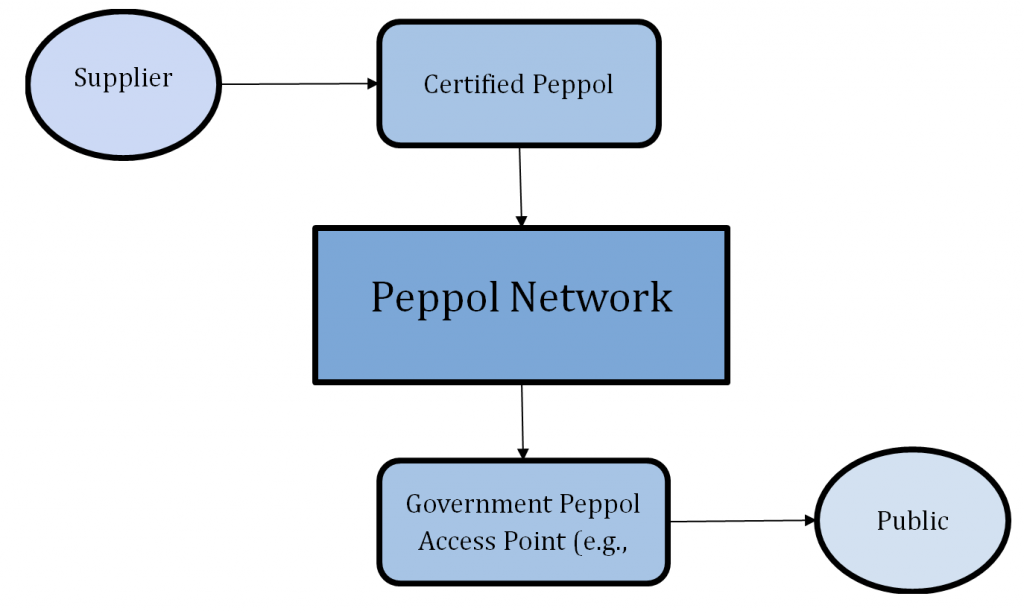

Example: Belgium’s E-Invoicing

Belgium mandates B2G e-invoicing via Peppol using the 4-Corner Model.

- Supplier → Peppol AP (e.g., SNI) → Peppol Network → Government AP (e.g., Mercurius) → Public Agency

Belgium B2B e-invoicing via Peppol will start in January 2026 as an example of the 4-Corner Model, with invoice reporting to the tax authority to be included by 2028.

2. Peppol 5-Corner Model

The 5-Corner Model introduces an additional “Validation/Compliance Layer” (Corner 3.5) to meet regulatory requirements, such as real-time reporting and tax authority clearance.

Key Differences:

- Additional Compliance Service (Corner 3.5): A government or third-party validator checks invoices before delivery.

- Mandatory in some jurisdictions: This is used in countries requiring pre-clearance (such as Malaysia and the UAE).

Example 1: Malaysia’s e-Invoice System (LHDN)

Malaysia’s e-invoice mandate (2024-2025) requires invoices to be validated by the tax authority (LHDN) before reaching the buyer.

- Supplier → Peppol Access Point → LHDN Validation (Corner 3.5) → Buyer’s Access Point → Buyer

- Ensures real-time reporting and compliance with Malaysian tax laws.

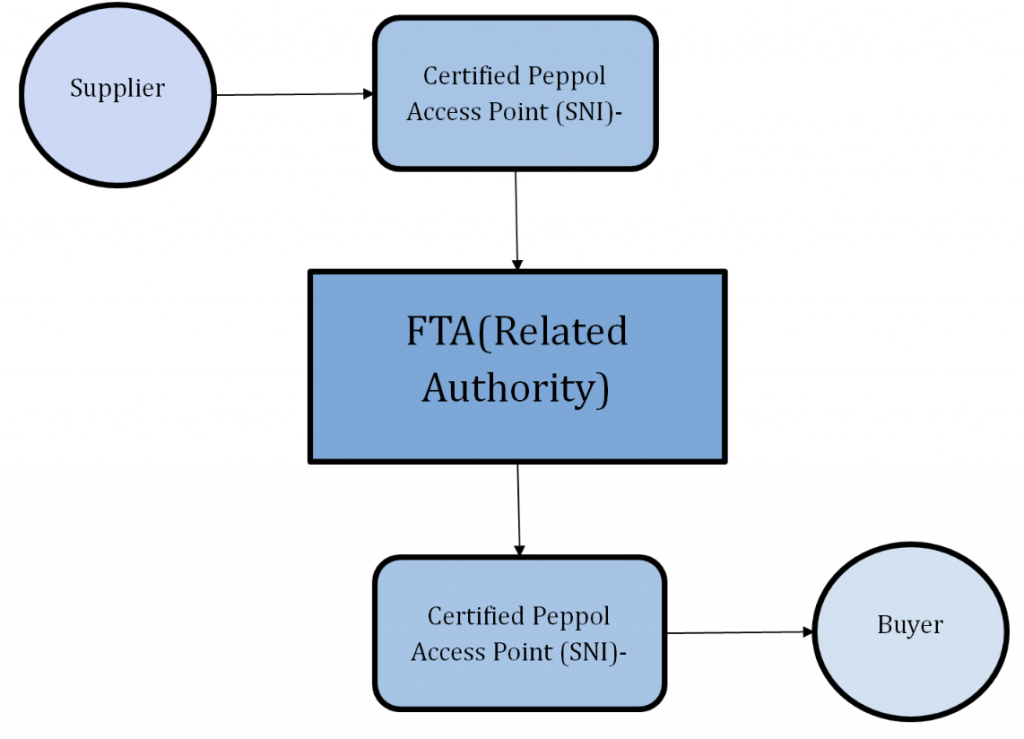

Example 2: The UAE’s e-Invoice System (FTA Compliance)

The UAE’s Federal Tax Authority (FTA) mandates e-invoicing under Phase 2 (2024-2025).

- Supplier → Peppol Access Point → FTA Clearance (Corner 3.5) → Customer’s Access Point → Buyer

- Ensures VAT compliance and fraud prevention.

The Main Differences Between the 4-Corner and 5-Corner Models

|

Feature |

4-Corner Model |

5-Corner Model |

|

Compliance Check |

No mandatory validation |

Tax authority clearance (e.g., LHDN, FTA) |

|

Use Case |

B2B and B2G (e.g., Belgium) |

Mandatory e-invoicing (e.g., Malaysia, UAE) |

|

Real-Time Reporting |

Optional |

Required |

|

Regulatory Control |

Low |

High (Government oversight) |

- The 4-Corner Model remains efficient for standard B2B/B2G transactions (as in Belgium and Poland).

- The 5-Corner Model is essential for real-time tax compliance (as in Malaysia and the UAE).

3. Benefits of the Peppol Network for Businesses

The Peppol network provides significant benefits to businesses looking to streamline their invoicing processes. By adopting Peppol, businesses can experience:

- Increased Efficiency: The Peppol network allows for seamless, standardized document exchange between businesses and government entities. This reduces the need for manual data entry and minimizes errors.

- Cost Reduction: With e-invoicing on the Peppol network, businesses can save on paper, postage, storage, and administrative costs associated with traditional invoicing.

- Compliance Assurance: Peppol ensures that invoices are sent in a standardized format, which simplifies compliance with local tax and legal requirements. For instance, real-time reporting and tax authority clearance in some countries (like the UAE and Malaysia) are facilitated through the 5-Corner Model.

- Global Standardization: The network supports interoperability between multiple systems across different countries, allowing businesses to expand their operations internationally without dealing with various incompatible invoicing systems.

4. How to Connect to Peppol – How to Get Started

To get started with Peppol, businesses must first select a Peppol Access Point (AP). This Access Point is a certified service provider that facilitates the exchange of documents between the sender and receiver. The steps for connecting to Peppol are as follows:

- Step 1: Choose a Peppol Access Point: Businesses must partner with a Peppol-certified Access Point, such as SNI or other providers, which will handle the secure transmission of invoices.

- Step 2: Registration and Setup: Once an Access Point is chosen, businesses must register on the platform and integrate their systems (such as ERP software) with the Access Point. This integration ensures that invoices are generated and sent in the required Peppol format.

- Step 3: Start Invoicing: After successful integration, businesses can begin sending and receiving e-invoices via Peppol, either to government entities (for B2G transactions) or other businesses (for B2B transactions).

5. Global Scope of Peppol – Which Countries Are Using It?

Peppol’s adoption has rapidly expanded across the globe. While it began in Europe as a public procurement framework, its scope now extends far beyond, including numerous countries across different continents. Some key regions where Peppol is currently used include:

- Europe: Peppol is widely used in European countries such as Belgium, Italy, the Netherlands, and Poland for both B2G and B2B transactions. Belgium, for example, mandates B2G invoicing via Peppol.

- Asia: Countries like Malaysia and Singapore have also adopted Peppol for their e-invoicing systems. In Malaysia, businesses must have their invoices validated by the tax authority (LHDN) via the Peppol network.

- Middle East: The UAE is introducing Peppol-based e-invoicing as part of its VAT compliance efforts under the Federal Tax Authority (FTA) regulations.

- Australia and New Zealand: Both countries have adopted Peppol for government procurement and are expanding its use for B2B transactions.

Peppol’s growing adoption indicates its potential for facilitating global e-invoicing and procurement, helping businesses expand beyond their local markets with ease.

As more countries adopt Peppol-based e-invoicing, businesses must choose the appropriate model based on local regulations. Companies operating in Malaysia, the UAE, Belgium, and other countries with Peppol-based regulations should ensure that their Peppol Access Points are equipped to support the required compliance layers.