Details of the new input tax credit system, named the Qualified Invoice Based Method, have been announced by the National Tax Agency and E-Invoice Promotion Association (EIPA) in 2020. One of the most important parts of the system is the Qualified Invoice System. The platform is available to taxpayers from October 2023 and the implementation process will continue between 2023 and 2029.

Only registered taxable entities can issue a qualified invoice. Companies whose sales are equal to or less than 10 million Japanese Yen (JPY) are not eligible. Target businesses must be eligible to pay the Japanese Consumption Tax (JCT).

Before the Qualified Invoice Based Method, there was a traditional way of generating e-Invoices. Below you can see the difference between the traditional system and the new automated system created with the digitalization of invoicing system in Japan . Issuing invoices in the traditional way will remain possible, but taxpayers who want to digitize their processes must register by the end of 30 September 2023.

Paper based invoicing process:

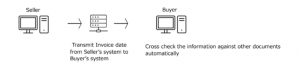

Automated alternative:

Technical Details

Qualified Invoice Based Method is applicable for both business-to-government (B2G) and business-to-business (B2B) transactions. Issued electronic invoices are generated in the taxpayer’s accounting system, must be in XML format, and must meet the legal and technical requirements of PEPPOL’s BIS Billing 3.0. A digital signature is not required and e-documents must be stored 10 years after issuance year. The PEPPOL network supports and facilitates the transmission of e-documents.

Every invoice created must contain the following information:

- Supplier name

- Supplier registration number

- Transaction date

- Tax rate

- Transaction description (for example the reduced tax rate)

- Taxable amount according to tax rate

- Tax amount per tax rate (expressed in JPY)

- Buyer name

The currency of the tax amount on qualified invoices must be in JPY. If the invoice is in a foreign currency it must be converted to JPY.

PEPPOL International Invoicing Model (PINT)

In September 2021 Japan became a PEPPOL authority called PEPPOL BIS Billing JP and started cooperating with the E-Invoice Promotion Association (EIPA) and OpenPEPPOL. Specific to Japan PEPPOL International Invoicing Model (PINT) developed by EIPA and PEPPOL authority. One of the most important roles of the PINT model is to facilitate cross-border transactions, and was developed in accordance with European core invoice (EN-16931) and PEPPOL BIS Billing 3.0 standards.

Companies who want to work as a PEPPOL Service Provider are required to be approved by the PEPPOL authority of Japan, Japan’s Digital Agency. There is an accreditation process called the “acknowledgement process”. An official list of service providers is published on the website of Japan’s Digital Agency.

How can SNI help you?

SNI offers SAP solution for generating and transmitting qualified invoices between public authorities and private entities.

With the SNI’s solution, extract taxpayers’ data from their accounting systems and directly convert it into the required XML format. It is transmittable through the PEPPOL Network by Access Point Providers.

SNI is already a PEPPOL access point and has completed the accreditation process of Japan’s Digital Agency.

SNI’s solution provides complete support for both outbound and inbound invoices. Outbound invoices are transmitted to the tax authorities through official APIs or web services. Similarly, for inbound invoices (issued by suppliers to clients), solution automatically retrieves data at regular intervals using the appropriate APIs or web services provided by the tax authorities.

All inbound invoices are displayed on SNI’s Inbound Cockpit, a dedicated interface designed to enhance the user experience and allow efficient management. Each invoice is available in both XML and (human-readable) HTML/PDF formats, ensuring detailed insight and compliance with regulatory requirements.

SNI’s invoice reconciliation feature offers seamless validation of incoming invoices by automatically matching them with purchase orders, delivery notes, or other internal records. This feature simplifies the validation of incoming invoices, reduces manual effort, and minimizes errors thus offering a quick resolution. With enhanced accuracy and efficiency, businesses can gain better control over their financial workflows and ensure smooth operations.

SNI solution integrates with clients’ systems without the need for updates to existing system versions and is independent of SAP versions. SNI’s SAP solution is compatible with SAP ECC 4.7 and above, as well as SAP Business Technology Platform (BTP), SAP R3 and SAP S/4HANA. In addition, SNI provides ERP-independent solutions designed to integrate with any ERP system clients may use.