What is SAF-T FAIA?

FAIA is a version of OECD’s SAF-T implemented in Luxembourg for VAT audit purposes. It aims to digitalize and standardize VAT reporting.

Obligation to use SAF-T in Luxembourg

Implementation of FAIA started in 2011. It is mandatory to report on demand prior to an audit for companies with VAT compliance obligations. The reporting threshold in Luxembourg is revenue of €112,000 per year. The data reported is generally for an accounting year.

Luxembourg SAF-T format:

FAIA is based on OECD’s SAF-T Version 2.0.

Luxembourg SAF-T requirements are as follows:

– Header

– Masterfile (General Ledger Accounts, Customers, Suppliers)

– General Ledger Entries

– Source Documents (Sales Invoices, Purchase Invoices)

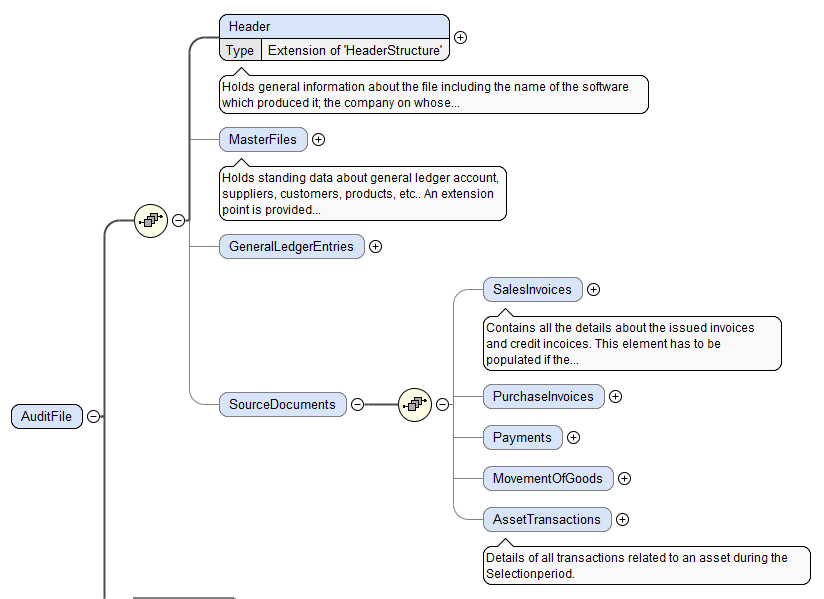

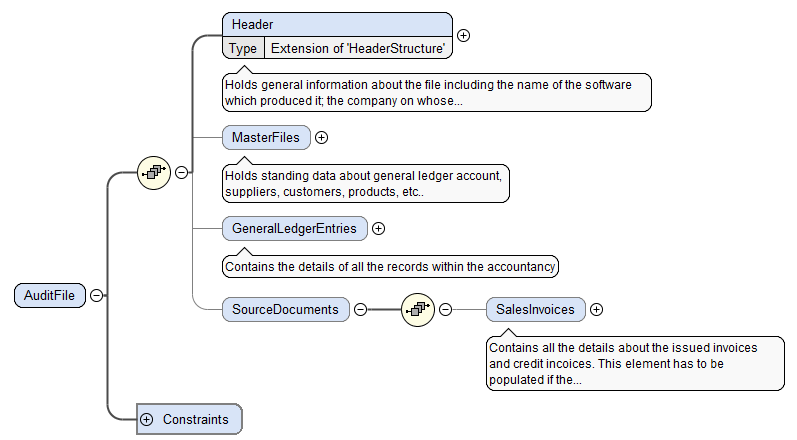

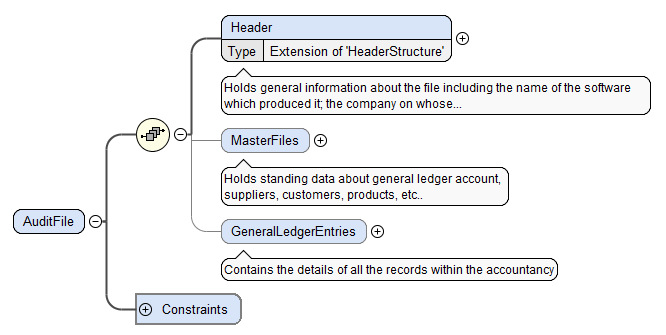

Principally the format is XML. There are three FAIA schemas:

The diagram FAIA_v2.01_full.xsd or FAIA Full Schema: for the majority of companies with full accounting software packages. It is to be used when the system used is integrated, i.e., when the accounting module, the billing module, the inventory management module, etc., are one system.

The diagram FAIA_v2.01_reduced_version_A or FAIA Reduced: for businesses using separate accounting and invoicing software. It is to be used when only the accounting module and the billing module are integrated.

The FAIA_v2.01_reduced_version_B or FAIA Reduced B: only using accounting software. This schema is to be used when only an accounting module exists. (The other databases must then be able to be exported in a delimited and structured format, ensuring that there is a reference key between the accounting and the other different databases.

XML Fields and Descriptions

Generally, all fields, elements, present in the taxable person’s system must be included in the FAIA file, even if they are qualified as optional. Therefore:

- If a field is required and used in the system, it must be included in the file (XML tags must be present)

- If a field is mandatory but not used in the system, it must also be included in the file (XML tags must be present)

- If a field is optional and used in the system, it must be included in the file (XML tags must be present)

- If a field is optional but not used in the system, it should not be included in the file (XML tags must not be present)

Header

The Header element will contain general information about the taxable person as well as information on exporting to FAIA format.

MasterFiles

The MasterFile element will contain different unique elements that will be used in the file structure.

GeneralLedgerEntries

This element will contain the accounting operations corresponding to a determined period. When the administration requests a FAIA file for control, the export will relate to a closed financial year, the amounts of which will be fixed and no longer subject to modification. In general, the request will relate to a whole financial year starting on 01/01 and ending on 31/12.

SourceDocuments

The SourceDocuments element will contain details of input and output invoices, payments, movement of goods, and AssetsTransaction.

How can SNI SAP solution help you with FAIA?

SNI solution helps you to retrieve client’s data, followed by mapping and processing this data in order to convert into XML file on the government’s request. Since SNI gives importance to data consistency, data retrieving and XML transformation processes are completed in the client’s SAP.