What is e-Invoice? What is the e-Invoice system?

Electronic invoicing refers to the digital exchange of accounting documents between buyers and sellers, including credit notes, debit notes, waybills, and more. Transaction data is submitted to the tax authority for validation before being forwarded to the recipient. These documents are typically formatted as XML or JSON files, containing all necessary details. In most cases, PDF files are generally not recognized as valid electronic formats.

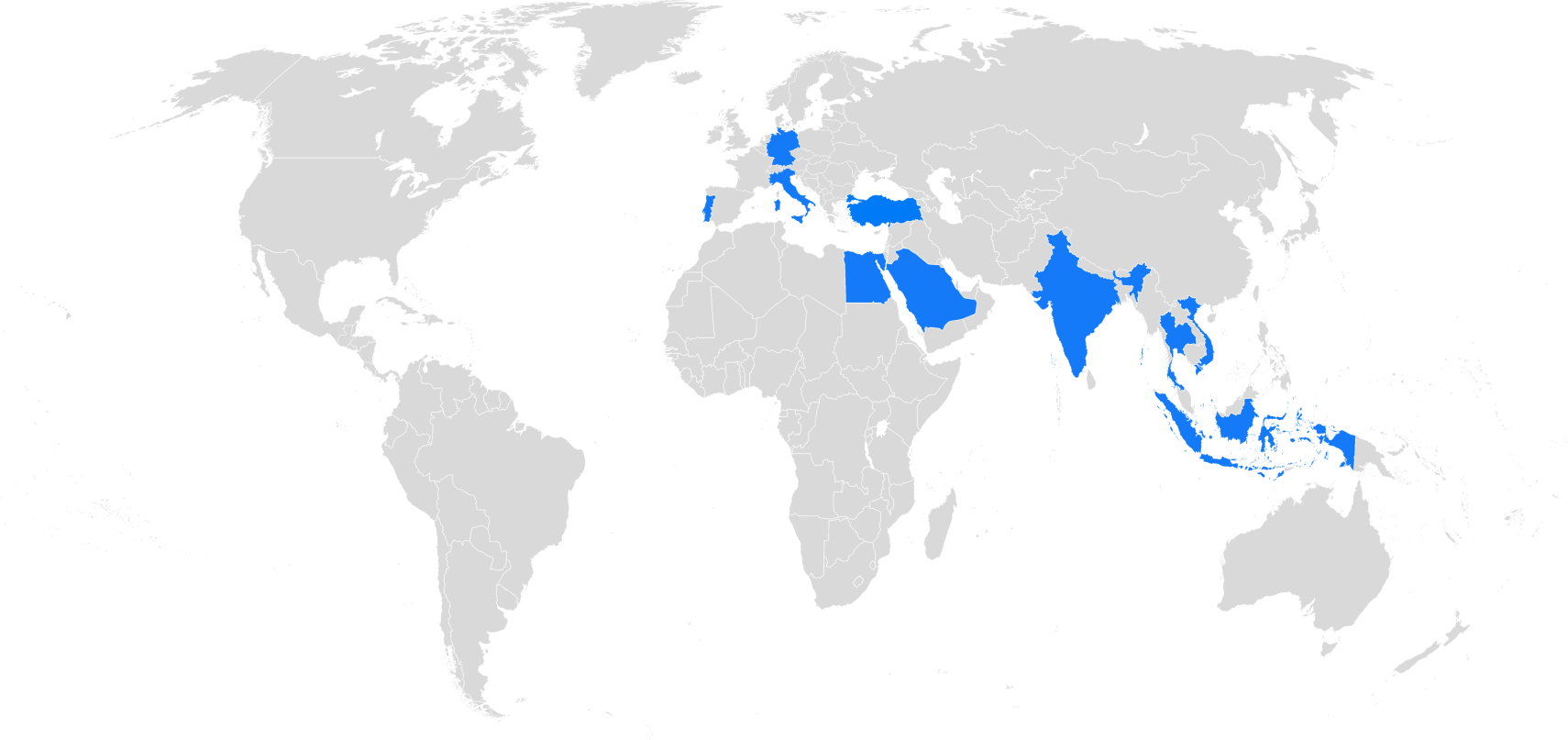

The business-to-business (b2b) e-Invoice obligation is currently in place in many countries globally including Turkey, Italy, Argentina and Mexico, which are the pioneers of the regulation. In the coming years, France, Germany, Poland and Greece are expected to apply for deregulation from EU law which asks for buyer’s consent to receive invoices in electronic format. After that, they can make b2b e-Invoicing mandatory. In addition European Union Governments such as Germany and Portugal are in the process of mandating business-to-government or b2g e-Invoicing for all taxpayers.

How does e-Invoice work?

The electronic invoicing process can be summarized in three main steps: (where is the third step?)

- Businesses must extract the relevant invoice data from their accounting system.

- The electronic document is created by the supplier before submission to the tax authority.

- Once the tax authority assesses and validates the e-Documents according to the standards, it either

– transmits them directly to recipient in electronic or PDF form

– sends them back to the supplier which should send them to the recipient.

SNI’s solution streamlines this workflow. SNI SAP e-Invoice solution automatically extracts the relevant invoice data and formats them as electronic XML (or JSON) files. Users can monitor the whole progress using SNI’s e-Invoice Cockpit. Via the SNI Connector, the e-Documents are submitted to the tax authority for validation. If successfully validated, the invoice is forwarded to the counterparty. For incoming files from suppliers, SNI is able to receive the documents for SAP at the incoming e-Invoice Cockpit.

Who is eligible for e-Invoice?

Every business that sells goods and provides services, whether subject to tax or not, can benefit from electronic invoicing. Large enterprises usually prefer to adopt digital invoice systems. This motivation comes from the large number of invoices they issue from their ERP accounting software. The time savings and cost advantages of electronic invoicing highly reflect on their choices to switch to electronic invoicing. However, recent years witness that small and medium enterprises are increasingly issuing e-Invoices either within their accounting software or externally by a service provider.

e-Invoicing countries

Currently, sending and receiving e-Invoices between businesses is mandatory in the following countries:

- Italy

- Turkey

- India

- Indonesia

- Peru

- Chile

- Argentina

- Mexico

- Brazil

- South Korea

- Taiwan

- Colombia

- Uruguay

- Saudi Arabia

- Egypt

- Portugal

- Germany

However, the type of businesses under obligation usually depends on the revenue, number of invoices issued or industry. For example, In India the companies currently obliged to issue e-Invoices are those that have revenue over 500 Rs crore.

Electronic invoicing is mandatory between taxpayers

What is e-Invoicing in SAP?

e-Invoicing helps to conduct current invoicing processes in an electronic environment instead of paperwork. Customers are able to generate invoices, process the invoice information, make transitions via sending to the relevant tax authorities for file validation and transmission to the receivers.

How do I look up an invoice in SAP?

The key users are able to monitor and track generated e-Invoices easily on SNI e-Invoice Cockpit which is a simple user-friendly interface. Created e-Invoices through invoice printing programs are gathered in the SNI e-Invoice Cockpit with a unique e-Document number, invoice-specific information such as serial number, object key, creation date, time and so on. In the selection screen of the cockpit, the final user is able to use filters for specific searches.