Published: July 2025

Tax fraud continues to cost governments hundreds of billions annually. As fraudulent schemes grow more sophisticated, tax authorities are turning to Artificial Intelligence (AI) and Machine Learning (ML) to help detect fraud faster, earlier, and with greater accuracy. These tools are not conducting audits in the traditional sense; they redefine how authorities identify risk and prioritize enforcement long before an audit begins.

From Red Flags to Algorithms

Conventional tax enforcement relies on rules-based systems, manual checks, and red-flag indicators. While these methods still have value, they struggle to keep up with the complexity and volume of today’s financial data, especially in areas like Value Added Tax (VAT).

Machine learning systems, on the other hand, can:

- Analyze millions of transactions in seconds

- Identify patterns associated with fraud

- Flag high-risk behavior across networks of taxpayers

- Continuously learn and improve detection accuracy over time

These capabilities allow tax administrations to move from reactive enforcement to proactive fraud prevention.

How Governments Are Using AI to Detect Tax Fraud

The shift from manual audits to data-driven fraud detection is already well underway in many countries. Tax authorities are using AI to uncover suspicious behavior, identify fraudulent VAT refund claims, and freeze assets before funds disappear. These systems don’t perform audits themselves. Instead, they serve as intelligent filters, flagging the most high-risk cases for deeper investigation. Below are some of the most advanced and widely cited examples of how AI-powered detection is reshaping modern tax enforcement.

Poland – STIR: Machine Learning in Real-Time Risk Monitoring

Poland’s STIR (System Teleinformatyczny Izby Rozliczeniowej) is one of Europe’s most advanced examples of AI-supported tax fraud detection. Designed to combat VAT fraud, STIR monitors business bank accounts in real time and uses machine learning to assess fraud risk.

STIR collects daily transaction data from banks and credit unions, including transfers, balances, and login locations. Machine learning algorithms analyze patterns to flag behaviors like rapid movement of funds, inconsistent transaction geography, or suspicious cash flows. Accounts identified as high-risk can be frozen immediately for 72 hours, or up to 3 months with further justification.

In 2023 alone, STIR enabled authorities to freeze 1,188 bank accounts linked to 312 businesses, securing over PLN 88.5 million (approximately €20 million). This represents year-over-year increases of 4.4%, 17.3%, and 14.3%, respectively. This system, credited with helping reduce Poland’s VAT gap significantly, is not an audit mechanism but a fraud detection and prevention tool that allows authorities to act before funds vanish.

United Kingdom – HMRC’s Connect System

The UK’s HM Revenue & Customs (HMRC) operates Connect, a sophisticated AI-powered platform launched in 2010 to enhance tax fraud detection and case selection.

Connect integrates data from over 30 sources, including tax filings, bank records, property transactions, travel logs, and even social media. Machine learning algorithms assess discrepancies between declared income and actual lifestyle, flagging potential evasion. It also maps networks between individuals and businesses to expose shell companies and VAT fraud rings.

Behind Connect is HMRC’s dedicated Risk & Intelligence Service (RIS), a specialized unit responsible for developing risk models, managing data pipelines, and building the advanced analytics that drive Connect’s performance. RIS plays a key role in identifying fraud trends, designing machine learning tools, and prioritizing high-risk cases across income tax, VAT, and corporate filings. It functions not just as a support service but as a strategic intelligence hub within HMRC’s enforcement structure.

In its first few years, Connect helped HMRC recover over £3 billion in tax revenue. It has proven especially effective in identifying carousel VAT fraud, where goods are repeatedly traded across borders in fake chains to exploit VAT refund systems.

Austria – AI-Driven Analytics Recover Millions in Tax Revenue

Austria is rapidly emerging as a leader in AI-based tax enforcement. In 2023, the Ministry of Finance’s Predictive Analytics Competence Centre (PACC) analyzed around 6.5 million tax cases using a combination of machine learning, real-time risk scoring, and text mining tools. The system focused on key areas including VAT, income tax, corporate tax, and COVID-19-related subsidies, flagging nearly 375,000 implausible or suspicious declarations. The result was over €185 million in additional tax revenue recovered within a single year. Austria’s use of network analysis and ex-ante risk models allowed authorities to detect fraud patterns early, especially in new business registrations and e-commerce transactions; marking a shift toward preemptive and automated fraud prevention on a national scale.

Data Foundations: Digital Reporting as a Catalyst for AI

What makes these developments possible is not just the power of AI, but the volume and quality of data tax authorities now receive. Across Europe and beyond, governments have introduced digital reporting obligations such as SAF-T (Standard Audit File for Tax), structured e-invoicing, and real-time transaction reporting. These frameworks require businesses to submit financial data in standardized, machine-readable formats.

This shift toward structured data gives authorities access to clean, consistent, and high-frequency information, which is ideal for machine learning models. As more countries adopt real-time e-reporting infrastructure, AI tools can be applied not only for fraud detection, but for ongoing behavioral analysis, compliance monitoring, and early intervention, all without relying solely on traditional audits.

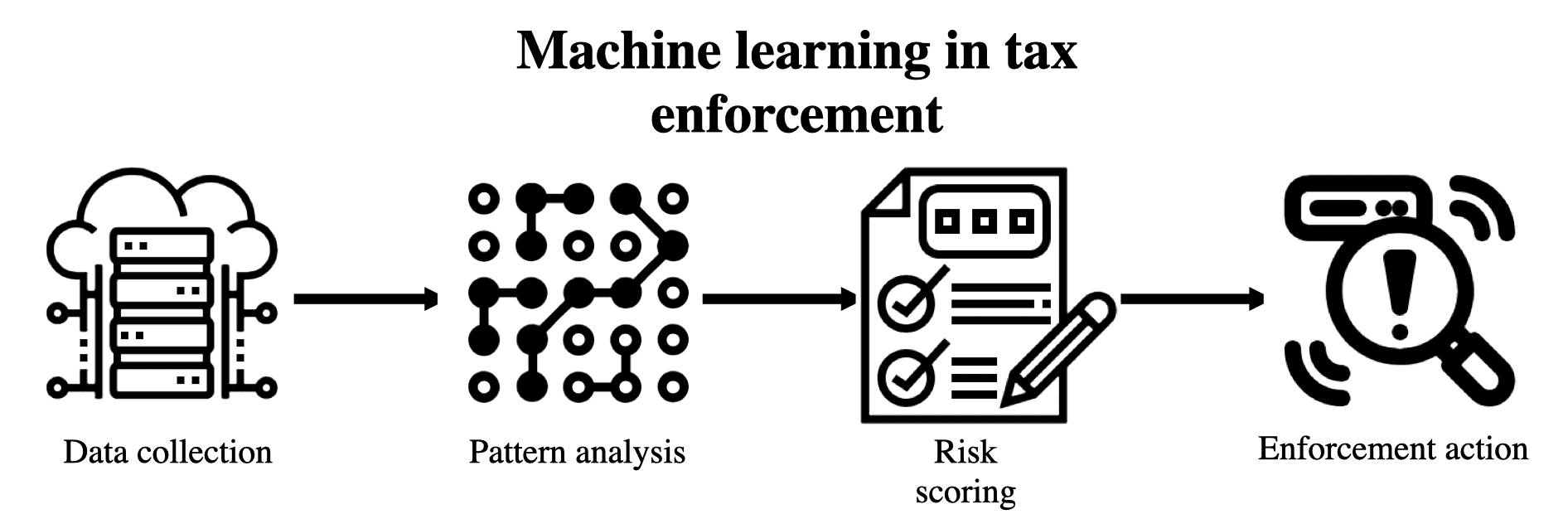

How Machine Learning Powers Detection

All these systems rely on machine learning, the AI technique that enables computers to learn from data and improve over time.

Machine learning powers:

- Anomaly detection: spotting unusual or suspicious activity

- Risk scoring: ranking taxpayers or transactions based on likelihood of fraud

- Behavioral profiling: comparing activity to norms within sectors or peer groups

- Network analysis: linking entities across systems to uncover coordinated fraud

These tools don’t replace human judgment; they augment it, helping authorities focus on the right targets.

AI Is Transforming Tax Fraud Detection

AI and machine learning are reshaping how governments combat tax fraud. Tools like STIR in Poland, Connect in the UK, and Austria’s PACC show that intelligent detection is not only possible, it’s already delivering measurable results.

These technologies don’t eliminate the need for human auditors. Instead, they empower auditors, making enforcement faster, more targeted, and more effective. As fraud evolves, so must tax enforcement. And AI is leading that transformation.