On 27th November 2020 another important step was taken by the German government in the digitalisation of invoicing across all regions. So far, the e-invoicing requirement was imposed on the recipients (i.e. public authorities at different administration levels). As of the aforementioned date the e-invoicing mandate was extended and now embraces suppliers and contractors delivering goods or services to public operators (mainly for federal authorities, with state level to follow). Below is a brief outlook on the current X-Rechnung application in Germany.

Source of the X-Rechnung mandate

The X-Rechnung solution arises from the European norm (EN 16931) created to maximize the harmonization of e-invoicing towards public administration across EU (for B2G e-invoicing). The core of this norm includes the semantic data model, which remains unaffected by any country-specific rules (ie. there exists a uniform e-invoice model that can be implemented and allows the free exchange of these documents between operators from various EU jurisdictions). It also remains neutral from the perspective of a particular syntax used for sending or receiving the e-invoice. Suppliers of German public administration (with a few exceptions) are now required to prepare and send such compliant e-invoices through one of the syntaxes defined by EU (e.g. UBL). At the same time the authorities are equally required to allow receipt and processing of these e-invoices.

Still, it is worth noting that the EU standard allows for certain specifications or extensions, which may be developed at a single jurisdiction level – the Core Invoice Usage Specifications (CIUS). In Germany X-Rechnung represents such a specification.

X-Rechnung – German e-invoice specification (CIUS)

The introduction of the X-Rechnung in Germany not only meets EU obligations with respect to B2G e-invoicing, but also creates a foundation for a fully digital, end-to-end e-invoicing process starting from the issuance of the invoice, through to its sending and processing, and ending with the payment. Interoperability of the German e-invoice (X-Rechnung) is possible owing to the EU e-invoice standard, which in the first place defines the core of the e-invoice (the set of basic data that must be included in the document). Among these critical elements are the invoice number, invoice date, information about the seller, purchaser, description of the transaction, supplier details etc. The aforementioned core elements are included in the semantic data model in a structured and logically linked manner.

However, on top of the EU standard there are certain elements that particular jurisdictions require to be included in an invoice – the German X-Rechnung extends the EU e-invoice standard with 21 additional business rules. As an example, based on the German Federal E-Invoicing Ordinance, an e-invoice must contain at least the following information, in addition to the invoice components under VAT law:

- route identification number (Route ID) – recipient’s identification number

- payment terms (due date or text description of the condition)

- bank details of the payee

- e-mail or De-Mail address of the biller

The currently binding version of the X-Rechnung is 1.2.2 and it will apply until 31st December 2020. As of 1st January 2021, the latest version (2.0) will apply.

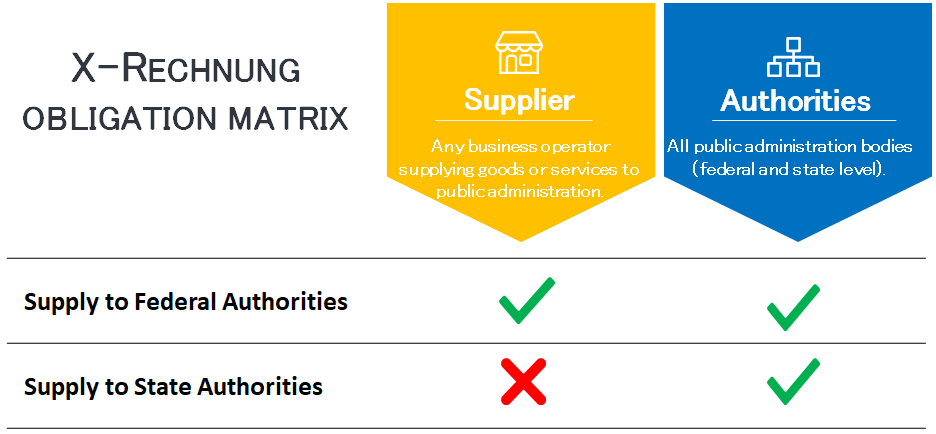

Who is obliged to comply with the X-Rechnung requirement?

The German landscape in terms of applicability of X-Rechnung is a bit complex due to its extensive administrative structure (consisting of federal and regional states). Therefore, there may appear specific differences regarding for example submission details, implementation deadlines, thresholds, or obligations to submit electronic invoices across particular regions or states.

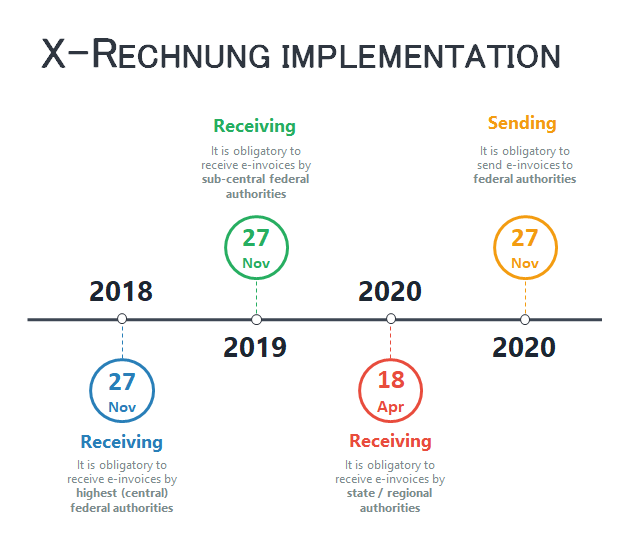

Between November 2018 and April 2020, the administrative authorities were obliged to meet the requirement for receiving e-invoices. As of 27th November 2020, the X-Rechnung obligation applies also to all suppliers (invoice senders) who fall under the German definition of the entrepreneur (§ 14 of the German Civil Code), and who interact with the public administration in Germany in the context of public contracts.

Additionally, there are some exceptional cases (defined by the law), in which the e-invoicing obligations can be waived (such as for small value orders under EUR 1,000, or if invoice data requires confidentiality).

How the X-Rechnung works?

The e-invoice must be prepared in a defined and structured XML format by the supplier right from the start. The X-Rechnung standard allows the inclusion of up to 200 attachments with a single e-invoice. In case of deliveries to federal state operators, there may still be an option to send paper invoices (or in other acceptable formats other than X-Rechnung, such as PDF files).

As regards the sending of the X-Rechnung to the administration operators, there are generally different ways of processing these e-invoices. The German government provides the two main platforms for the transmission of e-invoices to invoice recipients:

- ZRE – for electronic invoices to institutions of direct federal administration (e.g. ministries and federal authorities), and

- OZG-RE – for electronic invoices to institutions of indirect federal administration (e.g. independent institutions that have taken on federal tasks).

The invoice recipients will be informed via whichever platform they can be reached on. In order to be able to use an invoice receipt platform, the supplier will have to register (create a user account) and activate the desired transmission channels.

In addition to the above transmission solutions for e-invoicing, a self-service for the manual creation of e-invoices is also offered to enable meeting the requirement by the suppliers with few invoices and / or not having dedicated e-invoicing software.

The X- Rechnung implementation timeline is as follows:

Now it is high time for many business operators who have not yet adjusted their accounting systems to do this in order to comply with the X-Rechnung requirements.

In practice, in order to fulfil the German e-invoicing obligation the contractors (suppliers) must ensure that their ERP (invoicing software) is designed properly and enables the creation of the X-Rechnung in accordance with the existing standard (structured XML).