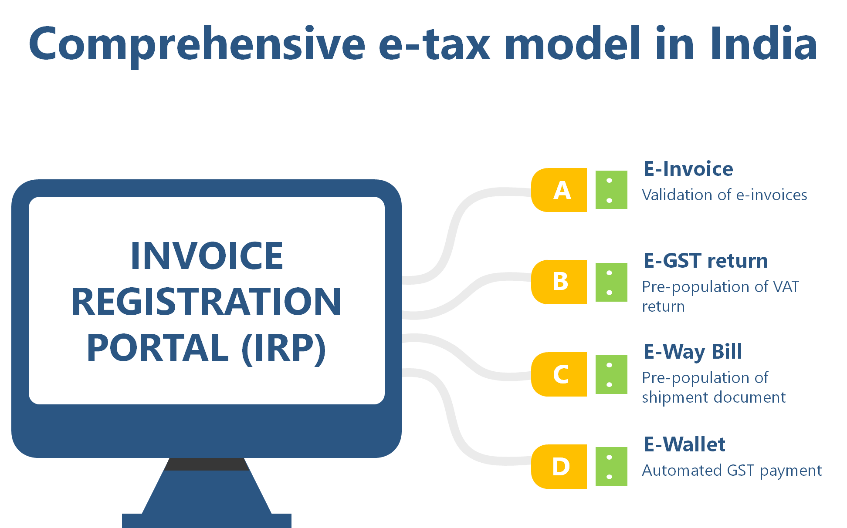

Indian e-invoicing model qualifies as a high-standard e-invoicing solution under which an integration has been achieved between e-invoicing, VAT return and transport documentation. In the e-invoicing world the Indian model shall be considered as one of the most advanced concepts which has already (in force as of October 2020) enabled a cross functional digitalisation of tax related compliance. Let’s have a quick look on how the system applies across these 3 functionalities: e-invoicing, GSTR (VAT reporting) and E-Way Bill (consignment documentation).

E-INVOICE

The Central Board of Indirect Taxes and Customs (CBIC) has notified the updated version of e-invoice schema/format (Version 1.1) on 30th of July 2020.

According to the released update Indian e-invoice schema consists of total of 138 fields which are enumerated under 12 sections and 6 annexures, out of which 30 fields are marked as mandatory. The following sections are considered as obligatory and must be included in the e-invoices uploaded into the Invoice Registration Portal (IRP):

- basic details,

- supplier’s information,

- recipient’s information,

- invoice item details,

- document total,

- invoice item details,

- document total details.

Indian e-invoice schema (INV-01) is based on Universal Business Language (UBL) / PEPPOL standard with certain customisations which aim to adjust it to Indian business practices and other local requirements (e.g. e-way bill). It means that the Indian e-invoice follows the global leading standard and would be aligned with majority of e-invoicing models across the world.

The documents covered with the e-invoicing obligation include a regular invoice, credit note, debit note and some other documents which may be required by the GST law. It shall be possible to upload a bulk of invoices at a time. However, there will be no possibility to amend the invoice reported on IRP. In case a rectification is needed the e-invoice would need to be cancelled and re-issued.

A GST e-invoice will be valid only with a valid IRN (invoice Registration Number) which is issued during authentication on IRP portal. What is important IRN is not the invoice number, however invoice number is one of the elements of the generated IRN.

In terms of e-invoice registration (upload) it has been announced that there shall be multiple modes available for reporting an e-invoice and these would include in particular: API, mobile app, and also offline tool. The taxpayer may choose the most suitable option.

E-VAT RETURN (ANX1 ANX2)

Reporting of e-invoice data to GST could be seen as an incidental by-product of the e-invoicing concept, however it seems a natural step forward in digitalisation of taxes. One of the objectives of the tax administration within the frames of e-invoicing project is to enable the pre-population of GST returns with use of the reported data. As a result, it should reduce the administrative burden both on the taxpayer’s and tax office side. It shall also allow for an automated and almost instant verification of the business transactions.

The government of India in collaboration with the GST Council introduced the new filing system named as GST 2.0, under which the matching of invoices shall be the most important element. Under the new model the taxpayers will generally be obliged to fill in the following forms:

- GST RET 1 (main return)

- ANNEXURE 1 (supplies)

- ANNEXURE 2 (acquisitions)

Both GST ANX 1 and GST ANX 2 has been launched and officially implemented from October 2020. The trial run of the new GST filing system has already been started on July 2019.

So how will the e-invoicing system be integrated with GST Returns?

Once e-invoice is registered and authenticated by the IRP it shall be uploaded into the relevant GST return. Once the validation has been done, it will be visible to the recipient for viewing and editing (in the VAT return – GST ANX2).

The transactions reported by the suppliers in the GST ANX1 (sales report) shall automatically, in real time, appear in the buyers’ GST ANX2. The buyer will then have an option to accept, reject or defer particular invoices, depending on the results of the verification.

At the same time the data reported in the annexures shall be used to pre-populate the main return (GST RET1).

On an interesting note: in case of a nil return the GST RET1 form can even be filed via an SMS.

E-WAY BILL

The e-tax journey does not come to an end at the stage of pre-population of the VAT return. The next important puzzle is the E-Way Bill and a massive change is in place also in this area.

E-Way Bill has been the critical part of the India GST system since 2018, when it became mandatory for all shipments taking place within India territory – both intra-state and inter-state. E-Way Bill is a consignment document which is being carried by the transport provider during transportation. It is an obligatory document for shipments exceeding value of Rs. 50 000 and should be issued by the supplier of goods.

Up till the end of September 2020 the E-Way Bill was using the data uploaded by the suppliers. As of October 2020 this document will be partially pre-populated based on the e-invoice data uploaded and validated via IRP. The automation will cover the A-part of the E-Way Bill which includes the mainly the suppliers data and some other invoice details (HS code, invoice number, value of goods, etc.). The other part would still require data to be provided by the user separately.

CONCLUSIONS

The integration of the e-invoicing, VAT return and the consignment monitoring is now a fact in India. The test has just started and in the nearest future it is highly probable that taxpayers and tax administration will face a number of challenges. In a long run though it is rather expected that the tax compliance simplicity and effectiveness will become a main feature of the Indian e-tax model. However, India is still not done with digitalisation of taxes. Next year (April 2021) it is expected that E-Wallet solution would come into force which would enable payment of import GST with virtual currency and allow for a better cash-flow management for importers.

The comprehensive e-tax compliance solution would definitely boost India in the worldwide tax complexity rank to a higher position and is also likely to stay top of many European jurisdictions.