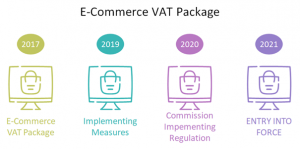

The long-awaited e-Commerce revolution finally became a reality on 1 July 2021. The first plans were made back in 2017, when the EU Council adopted the VAT e-Commerce Package (Directive & Regulation). Two years later, implementing measures were approved and enacted. Finally, in 2020, the detailed regulations were finally adopted. However, due to the practical difficulties triggered by the onset of the coronavirus pandemic, the final entry into force of the VAT e-Commerce Package was postponed to 1 July 2021.

VAT e-Commerce Package – the general concept

The general aim is to simplify the e-Commerce trade on one hand, but also to eliminate fraudulent activities and increase VAT revenue across EU Member States on the other. One of the most important goals has been to create a framework under which the VAT applies in the country of delivery of goods (i.e., in the jurisdiction of consumption). The steps undertaken focus on the supplies of goods for individuals in various capacities.

There are several areas which the VAT e-Commerce Package affects, including:

- existing MOSS regime (improvement)

- supplies of goods through online marketplaces (electronic interfaces) (new obligation)

- supplies of services (other than TBE) to individuals (B2C) (significant change of rules)

- distance sales transactions (significant change of rules)

- distance sales of imported low-value goods (22 EUR) (exemption removal)

VAT c-Commerce simplification regulations

Although the challenge for all the stakeholders of the e-Commerce supply chain is immense and requires significant effort to meet the new requirements, it is worth mentioning and highlighting all the simplifications introduced in the VAT c-Commerce Package.

Below is a short outlook on the 4 main pillars of the VAT e-Commerce Package.

VAT e-Commerce simplification pillars

Reconstruction of the VAT distance sale rules (OSS regime)

The main element of the package is the combination of the unification of the distance sale threshold and the extension of the One-Stop Shop concept to B2C EU distance supplies of goods. In effect, this will bring smooth VAT compliance for online sellers while ensuring maximalization of VAT revenue across EU jurisdictions.

The liquidation of the country-specific thresholds seems to be a very good step toward harmonization of the VAT application for B2C transactions. The online sellers were struggling to comply with the VAT obligations, as the thresholds were spread between 35k EUR to 100k EUR and required separate tracking of sales for each country.

As of July 2021, the unified threshold for distance sale in the amount of 10,000 EUR applies. Most importantly, the threshold applies for all EU jurisdictions, and total sales to all EU consumers shall be counted in order to monitor the threshold. In practice, this would mean that the sellers would fall into the destination country VAT obligations more quickly. As a result, the requirement for VAT registration would be unavoidable, except for micro sellers.

This is where the second element of the distance sale rules reconstruction comes into play. In order to make online sellers’ lives easier, the One-Stop Shop concept was implemented. It is an established concept introduced back in 2015 for selected services (telecommunication, broadcasting and electronic), which, following its success, has now been extended to supplies of goods in the B2C sector. The major simplification of VAT compliance under this new regime is the possibility to account for VAT in a single jurisdiction and in a single VAT return. As a consequence, it must significantly cut down on VAT requirements for online sellers, even if at the initial stage customization of the business, administration and finance procedures will require a great deal of effort and create several challenges.

Closing the low-value consignments loophole (iOSS regime)

Low-value goods have stood for the major VAT avoidance phenomenon in the recent decade (costing the EU approx. EUR 500M each year). The VAT Expert Group (an advisory body to the European Commission) first called for the removal of the low-value consignment exemption (22 EUR) due to the fact that it was discriminatory against EU retailers. What is more, with fast-paced e-Commerce expansion the relief has been massively exploited and abused, i.e. without regard for value parcels have regularly been declared within the exemption threshold, avoiding payment of VAT on import.

Finally, this loophole has been closed under the VAT e-Commerce Package implemented on 1 July 2021. The EUR 22 limit was removed, and thus all imported goods shall be subject to VAT. To simplify the process, the new e-Commerce VAT scheme provides for a simplified import VAT procedure called iOSS (Import One-Stop Shop) for consignments with a maximum value of 150 EUR. This single point of import VAT allows declaration of VAT in the seller’s country of registration. This is again a simplification measure that should enable smooth processing of VAT settlements on importation.

Marketplace – the new taxpayer in the e-Commerce supply chain

The marketplaces have been placed in a new role since July 2021. For years when the e-Commerce sector grew with great dynamics, the marketplaces’ role has become more important as these were the only points where multiple online sellers have to be identified. Having this in mind the tax authorities had huge capacity issues in identifying and effectively audit VAT compliance by the online sellers. Therefore, the obligations have been partially put on the marketplaces. In the first place, following the increased push from the tax authorities, the marketplaces started to place a condition of VAT registration in order to open the retailer’s account.

As of 1 July 2021, the marketplaces (i.e., any online marketplaces facilitating the sale of goods) are liable to calculate and settle VAT for online sellers in case of particular transactions. All B2B and selected B2C supplies will be excluded from this obligation. In practice this would mean that the online seller will sell the goods first to the marketplace operator and the latter will sell it further to the consumer. The marketplace therefore becomes an active taxpayer in the e-Commerce supply chain, taking over the responsibility for VAT collection and VAT settlement.

This requirement would mainly apply to transactions (sales) realized by the online sellers established outside the EU and is aimed at increasing the effectiveness of VAT revenue collection in this sector.

The mentioned cornerstones of the VAT e-Commerce Package constitute a solid structure. This refreshes the VAT model for e-Commerce business. The new concept brings many simplification measures. However, it is expected such clear conclusions will be possible only after the transition period in which all stakeholders get used to the new regulations and their application.