Currently, digital tax reporting requirements come into force all around the world. There are plenty of e-Invoicing, SAF-T, and similar obligations in Europe. However, more and more interesting electronic tax obligations are also being introduced in Asia, for example in Vietnam and Indonesia.

In this article we present an overview of another Asian e-tax obligation, which is the e-Invoicing system in Thailand.

The Thai e-Invoicing model

Issuing invoices electronically is not mandatory in Thailand. However, taxpayers who decide to exchange e-Invoices with customers need to report them to a central system, maintained by Thai tax authorities, called E-tax Invoice and Receipt.

The format of e-Invoices in Thailand is XML, PDF or any other electronic one. Importantly, each e-Invoice needs to be digitally signed using strictly defined certificates stored on the HSM (hardware security module) or USB token. Moreover, e-Invoices need to have an electronic time stamp indicating date of issuance.

The content of the e-Invoice should be considered standard, without any unusual specifics. It is required to provide basic information about the seller, the buyer, and transaction values (net, VAT rate, VAT amount).

It needs to be underlined that what is submitted to Thai tax authorities (ETDA) are data about e-Invoices issued by a particular taxpayer, whereas the e-Invoices themselves are submitted separately to customers. Therefore, the Thai system should not be considered as full clearance model, such as SdI in Italy or KSeF in Poland.

Thai businesses need to transmit to a tax office data about their issued invoices by the 15th day of the month following the month the invoice was issued. The required format is XML, which is most popular standard across digital tax reporting obligations.

There are three ways to submit electronic invoices to tax authorities:

- Web upload: upload of compressed (zip) files no bigger than 3 MB directly to Thai tax office website. This method is for dedicated companies that do not have a significant number of invoices.

- Host to host: this method requires the development of a direct connection between the taxpayer and the E-tax Invoice and receipt system and is intended for large taxpayers.

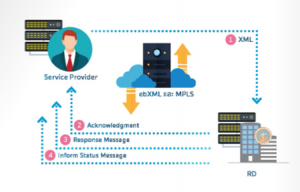

- Service provider: a method using a service provider that enables transmission of e-Invoices to the Thai national system. The service provider method is a beneficial option to for large taxpayers that do not want to invest time and money in the development of their own complex IT solutions, as required in the “host to host” scenario.

For the smallest taxpayers, with a yearly revenue below THB 30 million (approx. EUR 800,000), there is an alternative option allowing transmission of electronic invoices (in PDF format) via e-mail both to a customer and to a tax office. In fact, this exists as a parallel system called E-tax Invoice by E-mail.

Is it worth joining the E-tax Invoice and Receipt system?

The question above is a bit rhetorical. In practice, in many cases taxpayers will not be able to avoid using Thai central e-Invoice reporting system. Although issuing electronic invoices is not mandatory in Thailand, most medium-sized companies, and all large corporations rely on electronic invoices. Once a company starts issuing e-Invoices, it consequently needs to report them to a central E-tax Invoice and Receipt system.

It needs to be appreciated that the tax authorities of Thailand (ETDA) publish extensive and valuable documentation about their central e-Invoice system. It provides a number of guidelines, XML examples, and full technical details. Thanks to this approach, it is easier for taxpayers and developers to adapt to the E-tax Invoice and Receipt system.

Unfortunately, most of the publications are in Thai, whereas English translation is unavailable. It is worth appealing to tax authorities of countries that plan to introduce complex e-tax obligations to provide documentation in English, as many global corporations have their tax and IT functions centralized with limited local language resources.

Nevertheless, it can be clearly seen that electronic tax reporting requirements are spreading across the world. The E-tax Invoice and Receipt system is a first step in Thailand’s digital tax journey. What will be next step? No details are available yet, but current trends point to real-time invoicing (through a clearance model). Let’s observe Thailand carefully as it still has a lot to do when it comes to digital taxation.