Australia and New Zealand (hereinafter referred to as: A-NZ) have been making good progress in e-invoicing implementation over the last two years. Currently, having decided on the standard to be followed (PEPPOL BIS 3.0) and the generic e-invoicing documentation (extensions/specifications) the A-NZ governments are running the accreditation processes.

Let’s have a quick look into the standard itself and how the process of implementing it has been managed so far, while also taking a closer look at how it matches local country specifics.

What is PEPPOL?

PEPPOL is an international association that represents a global interoperability solution, which enables the exchange of documents between parties irrespective of their jurisdiction or different business status, be it private (B2B) or public (B2G). The key to the wide-spread popularity of PEPPOL is the international network of technology operators using common document structure and specification (eDelivery Network).

PEPPOL is based on three major pillars:

- The PEPPOL network (PEPPOL eDelivery Network);

- the document specifications (PEPPOL Business Interoperability Specifications or BIS); and

- the legal framework that defines the network governance (PEPPOL Transport Infrastructure Agreements).

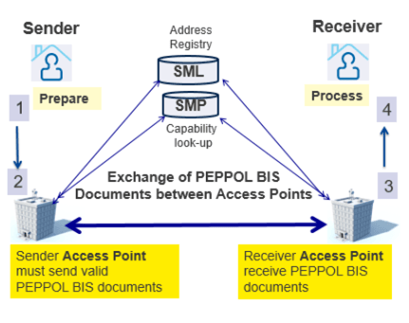

PEPPOL eDelivery Network overview:

Source: https://peppol.eu/what-is-peppol/peppol-transport-infrastructure/

In the recent years PEPPOL has become a first-choice solution for e-invoicing by creating a truly flexible solution. It is therefore not surprising that Australia and New Zealand have chosen PEPPOL to be a driver of their e-invoicing transformation.

PEPPOL e-invoicing – A-NZ’s journey

Australia and New Zealand (A-NZ) have not yet got far in the implementation of e-invoicing. However, there are some milestones that have already been passed.

- The Trans-Tasman Agreement (2018)

On 25 October 2018, the Australian and New Zealand governments took a decision to work together on the development of the e-invoicing model. The government representatives signed the Trans-Tasman Electronic Invoicing Arrangement, pledging to create and maintain a common Australia and New Zealand e‑invoicing approach to improve productivity and reduce the costs of doing business for both government and industry through an interoperable, single, digital economic market.

- PEPPOL announced (2019)

In February 2019 A-NZ’s Prime Ministers announced that both countries chose the PEPPOL interoperability framework for the implementation of e-invoicing. This is a global standard that gets lots of interest, not only within the EU. And as the A-NZ example shows, it may be adapted in countries operating under different invoicing and tax regulations.

- PEPPOL authorities established (2019)

As a next step, both governments formed their PEPPOL authorities in 2019: the Australian Taxation Office (ATO), and the New Zealand Ministry of Business, Innovation and Employment (MBIE). As a result of their effort the foundations of local e-invoicing were built, including e-invoice specification details and accreditation requirements and processes.

- PEPPOL accreditations (2019/2020)

By 2019 the accreditation process had been launched, and until the end of 2020 more than 20 providers in Australia and almost 30 in New Zealand have gone through the procedure successfully. The majority of providers registered as both access points, and service metadata publishers to provide comprehensive e-invoicing services to their customers.

PEPPOL e-invoicing – A-NZ extension

In recent weeks a number of changes and updates have been published with respect to e-invoice specifications and validation documents, which partially follow the updates of the EU’s e-invoicing norms, as well as PEPPOL BIS’s new releases (hotfixes). The most recent updates include updated EAS and ICD code lists, and minor corrections to the ISO currency code list, as well as adding some new validation rules.

PEPPOL is a common international standard on one hand, but also allows for the integration of specific local requirements. Therefore, it usually takes the form of a BIS (Business Interoperability Specification) extension to embrace local legal and business rules. Although the Australia and New Zealand e-invoicing mandate has not yet been finalized, a number of documents have been released in the context of localization adjustments of the PEPPOL standard. Among others, the invoice specification document and industry practice statement are worth noting to properly manage e-invoicing for both jurisdictions. Additionally, validation artefacts have been released that allow the verification of the specification.

A-NZ’s e-invoice specification

The A-NZ Invoice Specification document (released on 17 November 2020) presents the BIS Billing 3.0 Australian and New Zealand Extension for e-invoicing. This document provides details regarding the elements of the PEPPOL standard, which requires adjustment due to local requirements.

An example of such local discrepancies is the Payment Means Code, which is defined under PEPPOL and does not include some of the frequently used payment methods in A-NZ (such as BPAY). Therefore, there is a special guidance note published by the A-NZ authorities on how to manage payment methods that are not covered by the PEPPOL standard.

Another good illustration of the local specification is the tax element of the invoices. Whereas the sub-sections of the PEPPOL standard refer to VAT (Value Added Tax) information, the A-NZ extension replaces the term VAT with TAX, as VAT does not exist in Australia or New Zealand. (These jurisdictions implemented GST, which is a different form of indirect taxation that does not follow the mechanism of value added tax). For the same reason, a number of standard PEPPOL invoice rules referring to reverse charges will be deleted from the A-NZ extension, whereas some others are newly added rules, such as obligations for including business numbers (ABN and NZBN) on the invoice.

A-NZ Industry Practice Statement

Beside the A-NZ e-invoicing extension, the governments issued (on 24 November 2020) another important document: the A-NZ Industry Practice Statement, which aims to provide more guidance on the application of the e-invoice elements defined in the PEPPOL as optional. This is the area where some business-specific rules and business practices come into play. However, it should be noted that many such requirements are also intended to streamline the procurement, invoicing, and payment processes.

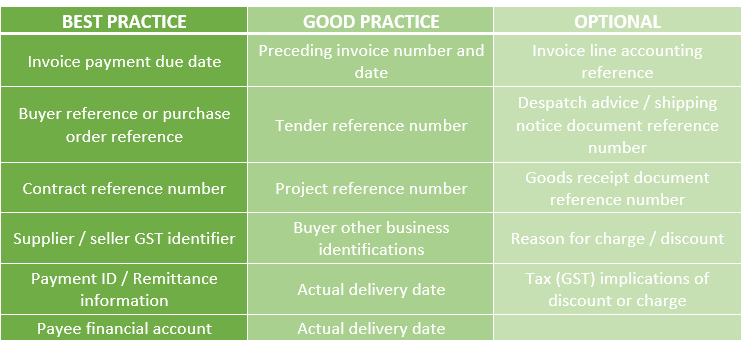

As a result of the efforts of the working group, which included the representatives of A-NZ service providers, the optional business terms of the PEPPOL standard were reviewed and classified into three groups (best practice, good practice and optional) depending on whether the lack of the particular business term may increase the probability of its rejection by the recipient. The document takes also into account industry-specific requirements.

Particularly, business terms marked as ‘best practice’ are the ones in common use and are recommended to ensure the effectiveness of the e-invoicing process. Examples of different categories of the business terms are presented in the table below.

A full overview of the document (A-NZ Industry Practice Statements) and a complete list of these business terms and their classification are available.

The journey of A-NZ towards the digitalisation of invoicing is on the right track and fundamental milestones have already been completed. In the near future we expect e-invoicing to spread across Australian and New Zealand businesses, followed eventually by a mandate that will bring significant benefits both for governments and business.