Egyptian VAT has just turned four years old. In September 2016, VAT replaced GST. Despite its short history, the Egyptian VAT system follows the latest world trends and is introducing mandatory e-Invoicing as of mid-November 2020.

The requirement will follow the clearance model (in place for example in Italy). This means that issued invoices will have to be pre-approved by Egyptian tax authorities, before being sent on to customers.

These are the pertinent details of Egypt electronic invoicing obligation.

Egypt e-Invoicing: legal background

The introduction of mandatory electronic invoicing is a part of a long-term Egyptian strategy, named Egypt Vision 2030, and aimed in particular at the digital transformation of government services.

The e-Invoicing obligation is based on the two following legal acts:

- Egyptian Ministry of Finance Resolution no. 188 will set up a general framework for mandatory e-Invoicing relating to the VAT clearance model;

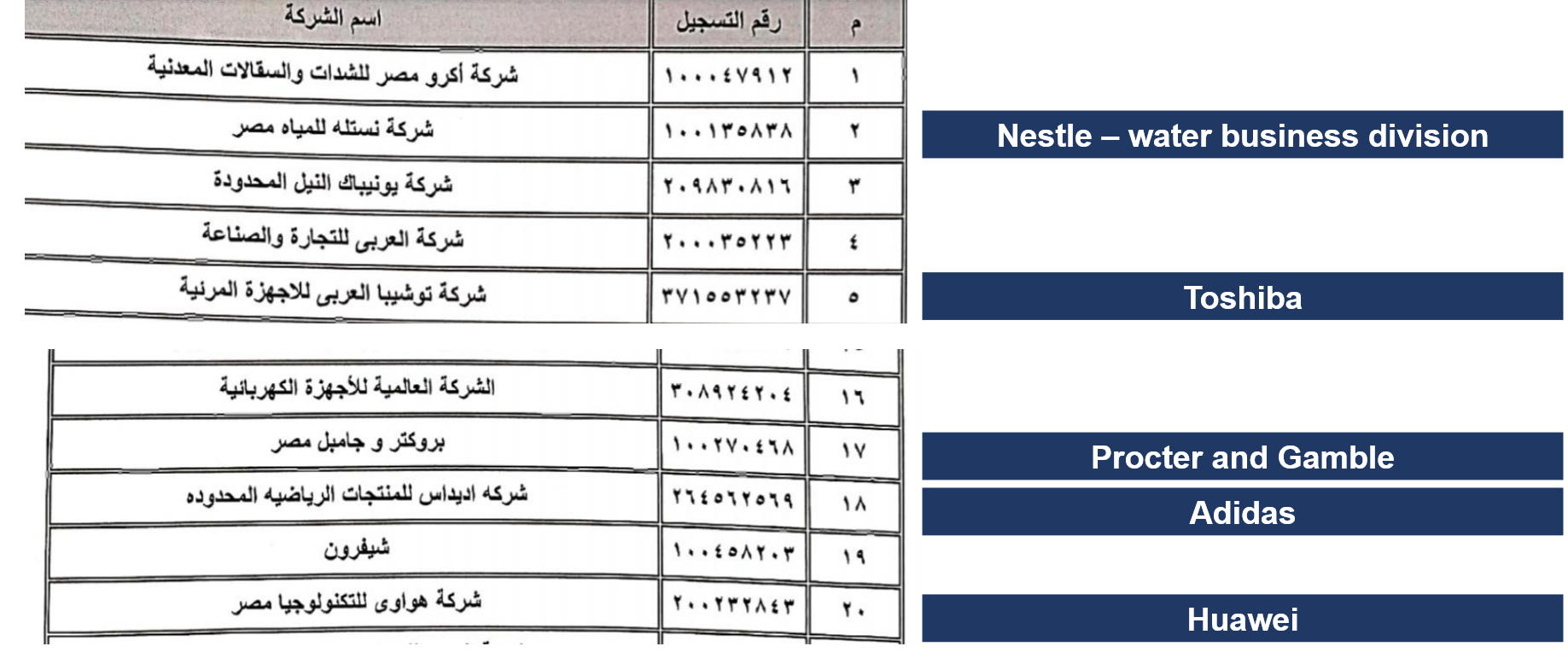

- Decision no 386 of the Egyptian Tax Authorities imposes requirements for the issuing of e-Invoices for 134 companies operating in Egypt.

Firstly, as mentioned, the selected 134 companies will be obliged to issue e-Invoices as of 15 November 2020.

The aforementioned list of 134 companies mostly includes the biggest companies operating in Egypt. Among others, the following global corporations are covered by the mandatory e-Invoicing requirement as of 15 November 2020: Adidas, Huawei, Samsung, Procter and Gamble, Nestle, Philips, and LG.

Egypt e-Invoicing: technical outline

Egypt electronic invoicing follows the tax clearance model. In other words, issued invoices need to be sent to the tax authorities, before sending it to a customer. It means that the Egyptian tax authorities will have information about taxpayer invoices in real-time.

The integration between taxpayer ERP and the government e-Invoicing system is based on various available APIs (Application Programming Interfaces). Both APIs and the entire e-Invoicing system has been developed by global IT giant, Microsoft.

Worth noting is the fact that the Egyptian tax office has also provided the so-called SDK (Software Development Kit), which is great support for developers working on e-Invoicing solutions.

The required format of Egyptian invoices is JSON or XML. Issued invoices also have to be digitally signed. The Egyptian model emphasizes the security of the system, as invoices need to be signed using the so-called HSM (Hardware Security Model). This physical device ensures that crucial cryptographic data (e.g. keys) are not stored online in the cloud, but are stored in HSM, offline, where they are secure.

Egypt e-Invoicing: invoice data structure

When it comes to the invoice’s content, most required data are standard (e.g. information about a seller, purchaser, values).

However, information about products (items) supplied have to be in line with the Global Product Classification (GPC), as defined by the Global Standards 1 (GS1) organization. Taxpayers need to map their internal commodity codes used in ERP for the GPC. What is also very important is that tax authorities need to be informed by a taxpayer no later than 15 days before using new code.

The current version of the Egyptian e-Invoice data structure is 1.1. What is also important is that there are separate schemes provided both for a credit note and a debit note, which is quite unusual. The distinction between document types need to be reflected in documentType field (“i” for an invoice, “c” for a credit note, “d” for a debit note).

Credit and debit notes also have to include reference to the original document, which is amended. The reference is made by providing a UUID (Unique ID) of the original invoice registered in the e-Invoicing system.

Egypt e-Invoicing: the ERP integration process

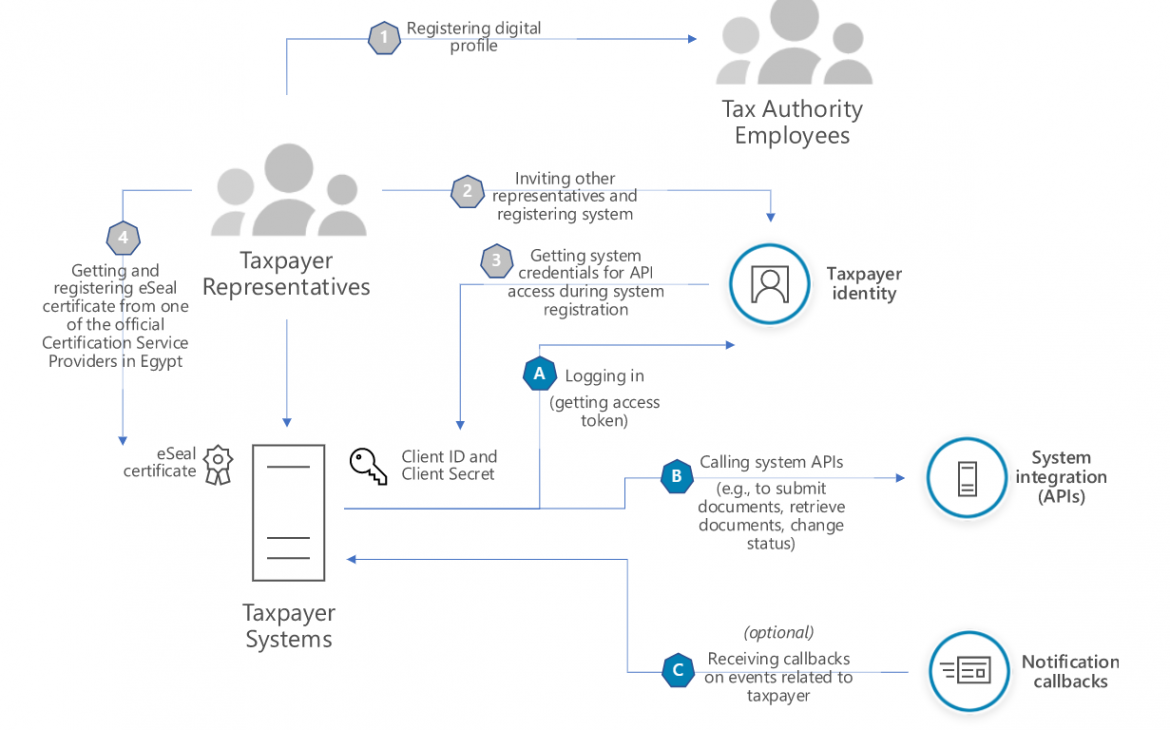

Egyptian tax authorities have published a useful overview of the steps required to integrate the taxpayer ERP system with the e-Invoicing system. The below image shows the required steps for integration.

Steps 1 to 4 are one-off activities and are related mostly to registering taxpayer profiles in the system, acquiring required digital certifications and API credentials.

Steps A, B, and C describe daily interactions between the taxpayer ERP and the e-Invoicing system. A – a taxpayer authorizes himself to call other API functions, B – actual API calling (e.g. in order to submit or retrieve invoice), C – receiving notifications from the system (e.g. invoice validated, rejected etc).

Instant notifications mentioned in point C will be shared via different means (e.g. invoice portal, SMS, e-mail, or other mobile applications).

Egypt e-Invoicing: this is just a first phase

As of 15 November, 134 selected Egyptian taxpayers will have to start using the e-Invoicing system. However, this is just a trial run. Based on the feedback from system participants, some potential changes in the system will be made before the obligation covers other taxpayers.

The above approach seems to be praiseworthy. What is more, selected taxpayers have attended workshops (as well as in weekly calls) organized by the Egyptian Tax Authorities to help understand technical nuances (SDK, API).

What is clear, and which we have already discussed in one of our recent articles, is that mandatory e-Invoicing and in particular, the clearance model, seems to be unavoidable. More and more countries are introducing this type of obligation. Egypt is merely the latest.