At the moment, businesses operating in the United Kingdom have a lot of VAT work to get through because of Brexit. There are significant changes on the horizon, especially in transactions in goods. We are going to publish a series of articles about the VAT consequences of Brexit in early 2021. Please stay tuned.

However, besides Brexit it is worth mentioning what is going to change in HMRC’s Making Tax Digital (MTD) requirement, which came into force in the UK in 2019.

From the reporting periods starting on or after April 2021, taxpayers will need to have in place digital links for any kind of VAT data transfer.

What is a digital link?

As the name suggests, MTD UK is about the digitalization of taxes. VAT taxpayers have to keep their records digitally and submit their returns to HMRC electronically using MTD software.

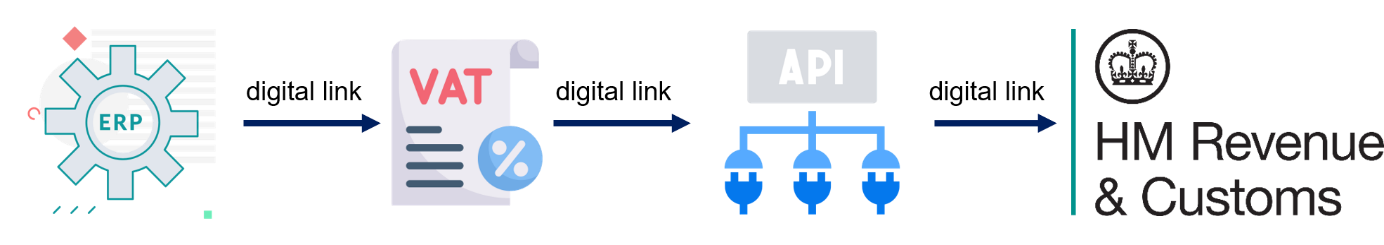

The data required for VAT reporting come from different sources. Often, more than one application may be used in the compliance process. HMRC MTD requires that any transfer or exchange of data between programs, products, or applications has to be electronic or digital. That is the definition of a digital link.

It is common that VAT data are transferred between programs or applications using the “copy-and-paste” method. However, it needs to be underlined, that this practice, as well as that of manual transposition, does not constitute a digital link. Exchanging VAT data in this way will be allowed only until the end of the so-called soft-landing period, on 31 March 2021.

Examples of digital links.

MTD HMRC guidance provides a number of examples of digital links. The simplest one, which might be considered a digital link, is a formula in a spreadsheet. An example would be a formula linking values between two separate spreadsheets.

Additionally, the following examples are also recognized as digital links:

- XML, CSV import and export, and download and upload of files;

- Automated data transfer;

- API transfer.

VAT calculation is a complex process and there are sometimes values that cannot be retrieved directly from the system because of, for example, a capital goods scheme adjustment. HMRC recognizes such scenarios and permits deviation from the digital link requirement in such cases. It might even be possible to input data by hand, but such situations are exceptional.

VAT reporting with digital links in place.

VAT reporting processes may differ between each particular taxpayer. However, the general scenario includes three main steps:

- Extraction of VAT data from the ERP system;

- Preparation of VAT returns values ready to be reported;

- Submission of VAT returns to tax authorities (HMRC in the UK).

As of reporting the periods starting in April 2021, all three above steps will have to be linked with each other using digital links. Therefore, manual intervention (or the “copy-and-paste” method) will be forbidden.

In order to prepare VAT reporting in line with MTD requirements (including the digital links obligation), it is recommended to use functional compatible software. HMRC provides a set of three requirements, which VAT software will be relied upon to enable. These are:

- Recording and archiving digital records. In other words, taxpayers have to record and archive their VAT data digitally;

- Providing to HMRC information and VAT returns from data held in digital records by using the API provided by HMRC;

- Receiving information from HMRC using the API.

It is worth underlining that functional compatible software might be a single application or a set of applications, which as a whole are recognized as functional, compatible software. However, each data transfer between these applications will have to be performed using digital links.

Digital links challenges.

It seems that the biggest challenge related to the introduction of digital links from the April 2021 reporting period is likely to be the submission of VAT return figures to HMRC without any manual intervention.

During the soft-landing period, a lot of business have decided to use so-called MTD bridging software. This can be an external application that enables the submission of VAT returns using API provided by HMRC. Until April 2021 it is allowed (and indeed will remain quite common) to calculate final VAT data for example in a spreadsheet and using the “copy-and-paste” method, for example, transferred to a separate piece of bridging software for the submission of VAT returns to HMRC.

As of April 2021, such practices will no longer be permitted. However, it seems it will still will be possible to use bridging software. But VAT data transferred to the bridging software for MTD will have to be transferred using a digital link.

Considering the above issues, it is worth preparing to meet the new digital links requirements right now. The fewer applications used for VAT reporting, the better. A single solution (for example the ERP add-on) in line with all MTD requirements (including digital links) seems to be a perfect approach for VAT reporting in the UK starting in the April 2021 reporting period.