Brexit – a new VAT chapter in EU trade

Although Brexit formally took place on 1 February 2020, it is the date of 1st January 2021 that marks a brand-new chapter in EU trade in the context of VAT. Between 1 February 2020 and 31 December 2020, a transitional period was in force, when EU regulations over taxation were still applicable to the UK and its taxpayers. However, from the beginning of 2021, customs borders between the EU and the UK have been removed. As a result, the transactions between the UK and EU countries now have a different VAT treatment.

Definitely the major impact will be visible in goods transactions mainly because of physical customs frontiers. Below is just a quick review of how goods and service transactions will be taxable under post-Brexit rules (as of 1 January 2021).

It should be noted that the rules presented below do not fully apply to transactions taking place between the EU and the taxpayers from the territory of Northern Ireland. This subject will be separately addressed in Chapter 3 of the SNI Brexit Series.

Goods transactions

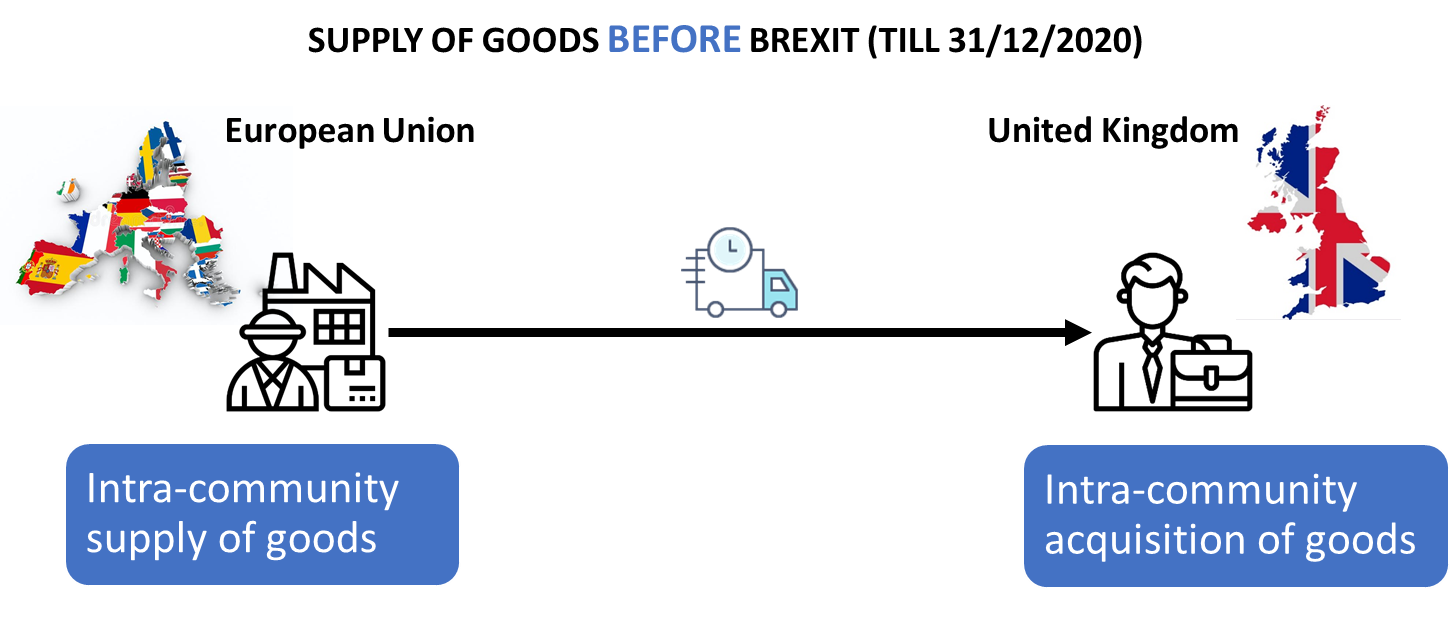

Before Brexit

Until the end of 2020, the supply of goods between the EU and the UK has been considered an intra-community supply/acquisition of goods, which was subject to a 0% VAT rate in the country of dispatch, and subject to reverse-charge VAT in the country of delivery.

SCHEME1

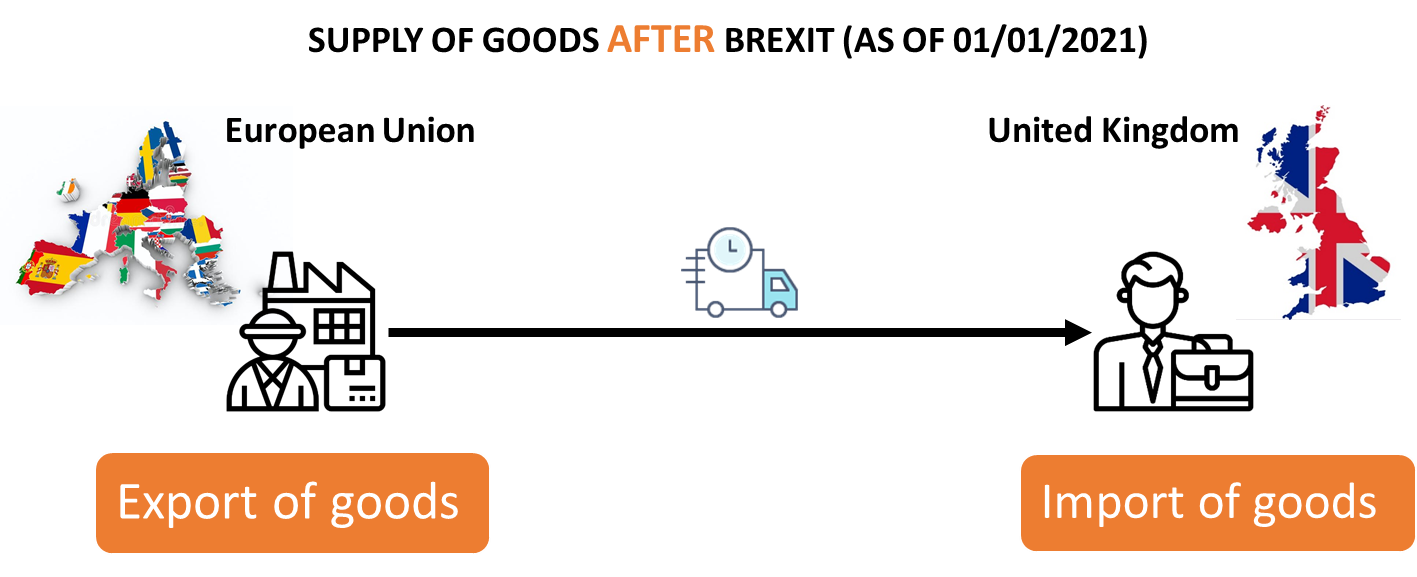

After Brexit

As of 2021 these supplies will be recognized as exports and imports of goods, respectively. In terms of VAT calculations, the effect will eventually be the same (i.e. export of goods subject to 0% VAT, including in the UK after Brexit), while the import of goods will end up with neutral VAT calculations. The VAT neutrality on the import of goods may sometimes be impacted negatively by the cash-flow issue, which appears in jurisdictions where it will not be possible to use a simplified import VAT scheme (the so-called postponed VAT regime). In the UK there will be an option to settle import VAT in the VAT return from 1 January 2021. However, in some EU countries it may still be necessary to physically pay import VAT at the border, and later claim a refund of such VAT from the relevant EU state.

SCHEME2

Service transactions

In the case of service transactions for services, different rules apply because VAT is not dependent on the place of delivery. As a result, VAT taxation is not impacted by the existence of physical borders. Consequently the changes brought by Brexit are not as significant in this area.

Before Brexit

Services are taxable in the country where the customer it registered, excluding five exceptions (real estate, passenger transport, short-term vehicle rental, event admission, and catering services).

After Brexit

The rule remains the same following Brexit, and will be applied in the same way both ways (EU to UK, and UK to EU). However, there will be one small change in this respect: the supply or acquisition of services to/from UK will be reported from the pre-Brexit period.

In particular, the supply of services to EU and non-EU customers are reported differently. More specifically, it may appear in different boxes in the local VAT return. It is also common across the EU that EU services are reported separately (in the EC Sales List). In practice, this means that the accounting software/ERP VAT determination code will be changed from ‘EU service supply/purchase’ to ‘non-EU service supply/purchase’.

Brexit’s impact and tax challenges

Looking into the economic side of Brexit it should be noted that, as a rule, the above changes to VAT treatment will not adversely impact the VAT position of taxpayers. Different treatment for goods and service transactions will finally lead to a neutral VAT position in B2B transactions. However, there may be some negative cash-flow consequences depending on the mode of import VAT settlement in particular countries.

Definitely, taxpayers will bear more cost and effort in redesigning tax procedures, which include not only accounting/ERP software updates, but also documentation processes (especially for import/export transactions) and invoicing rules.

When addressing these challenges, it should also be noted that it is worth reviewing the goods transaction flows and delivery/shipment arrangements, which are usually reflected in the use of particular Incoterms. A closer look into EXW and DDP supplies is recommended, as these may significantly change the way a particular transaction is recognized for VAT purposes. In the worst-case scenario, this could end with an obligation to register for VAT in the UK or an EU country.

The new chapter of EU trade has been opened, and in order to assess the real impact of these changes on taxation (especially VAT), we need to wait at least a few months, and probably longer.