Based on the special arrangement between the EU and the UK (the NI Protocol), until the end of 2024 Northern Ireland will be treated as a member of the EU for VAT purposes. This rule shall apply only to goods transactions (services will not be affected). Previous articles about VAT changes after Brexit, and goods and service transactions under post-Brexit rules provide additional information.

The specific status of Northern Ireland in a post-Brexit world brings a number of challenges across many business sectors. Although at first glance it is a matter of a simple switch between EU and export/import transactions, the list of issues that need to be taken into account is not as short as one might expect. At the same time, it should be noted that in some areas current practices will continue, and no major changes will apply.

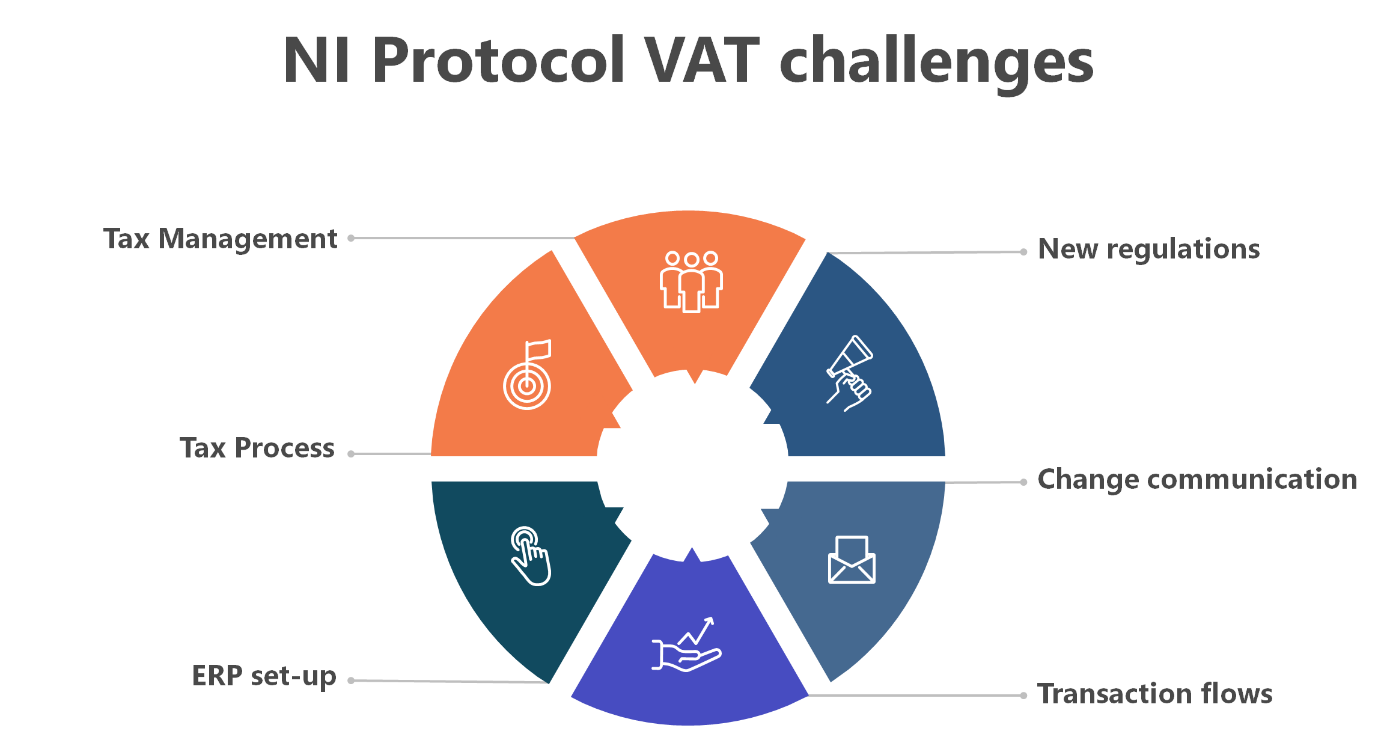

As the impact will be visible across various business domains, the issues fall into a few main categories: ERP related, tax process and risk management. Below is a brief overview of these challenges and of those areas that are not impacted and where businesses may continue to operate as they have in the past.

ERP setup

The first, obvious changes that come to mind when preparing for any tax (mainly VAT) changes are accounting software changes. Where ERP is complex, VAT treatment of transactions is usually defined in the form of a tax code. Therefore, the specific regime used for Northern Ireland businesses requires changes. However, because Northern Ireland shall operate as an EU territory, the changes to the tax code only apply to transactions with the rest of the UK.

The setup changes shall include the invoicing process, in which the VAT regime shall be properly assigned for transactions with the EU. Specifically, the VAT ID prefix shall be changed for invoices issued to EU customers.

From the perspective of EU-based companies there will be a need for a distinction to be made between counterparties located in Northern Ireland and those elsewhere in the UK. For example, if any invoicing solutions assign VAT treatment automatically based on the location of the customer, then it is necessary that for the UK such tools are able to distinguish between an address in Northern Ireland and one elsewhere in the UK (relying on the country level alone is not adequate).

Additionally, as the NI Protocol applies only to goods transactions, no changes are required for service transactions.

Tax process

It should be underlined that Northern Ireland will remain under the UK tax system. Specifically, HMRC shall be the relevant tax authority collecting VAT revenue. Similarly, VAT returns shall be unchanged, and both UK and Northern Ireland taxpayers shall be obliged to report their sales and purchase transactions on these returns.

As far as foreign VAT refunds are concerned, the EU VAT refund procedure (regulated by Directive 2008/9/EC) remains applicable for Northern Ireland.

Certain changes will have to be implemented for invoice processing as the verification of the location of a supplier/customer in Northern Ireland will be crucial to ensure proper VAT treatment.

Business transaction flows

There is some tax risk around the NI Protocol and its VAT consequences for business transaction flows. As the entirety of Brexit and the NI Protocol mainly impact goods transactions, the first area to be closely monitored should be the flow of goods and the Incoterms used. Specifically, where deliveries include the UK (other than Northern Ireland) additional obligations will pop up (customs duties, importation documentation, customs procedures, etc.)

As Northern Ireland will retain its EU status, a selection of VAT-specific regimes will apply there, whereas they will not apply to the rest of the UK. Among others, specific goods transactions such as those for call off stock and triangular chain supplies will continue to apply in Northern Ireland.

An interesting matter is the VAT group regime, which, as explained by HMRC, will still apply to members seated in the UK and Northern Ireland, but will now have different VAT consequences. The major change is that in the supply of goods between members of the VAT group, where the supply is between Northern Ireland and some other territory in the UK, VAT must be accounted for (whereas normally all supplies within the VAT group fall outside the scope of VAT). Therefore, companies that are part of such VAT groups shall verify internal supplies to properly assess the application of VAT.

A new area of complexity will be created around shipments of goods that pass through Northern Ireland or the UK on part of the route (e.g. goods shipped from GB through NI to ROI and from ROI through NI to GB). In order to properly perform these transactions, it may become necessary to make use of customs procedures such as onward supply relief or transit, in order to simplify VAT settlements.

It seems that a variety of issues will certainly accompany doing business across the EU, the UK and Northern Ireland due to the NI Protocol. It would seem that NI businesses will be impacted the most owing to the dual status of their location.