Denmark has some interesting VAT regulations in place. For example, it is allowed to treat selected environmental and energy taxes similarly, to input VAT and decrease business liability to tax authorities.

Danish VAT reporting obligations may be considered straightforward. In particular, there is no specific Digital Reporting Requirement (DRR) imposed in Denmark yet. However, this status will change in the near future because of the introduction of digital bookkeeping requirements also covering mandatory e-Invoicing. It is expected that the new obligations will come into force in January 2024.

Digital bookkeeping systems

A new Danish bookkeeping act enforcing an obligation to use digital bookkeeping systems has been formally in force since July 2022. However, the majority of main obligations resulting from new law are expected to be effective January 2024 at the earliest.

General requirements for digital bookkeeping systems are laid down in Article 15 (chapter 5) of new bookkeeping act (no. 700 of May 24, 2022):

- Digital bookkeeping systems must “support ongoing recording of the company’s transactions with an indication of receipts for each record and secure storage of records and receipts for 5 years”.

- Digital bookkeeping systems must “meet recognised standards for IT security, including user and access management, and ensure automatic backup of records and receipts”.

- Digital bookkeeping systems must “support the automation of administrative processes, including automatic distribution and receipt of e-invoices and option of accounting in accordance with a public standard chart of accounts in registered bookkeeping systems”.

Suppliers of digital bookkeeping systems (in practice: ERP systems) need to certify their products. The institution which validates and approves digital bookkeeping systems is the Danish Business Authority. Expected deadline for certification of accounting systems is July 2023.

Effective dates – calendar

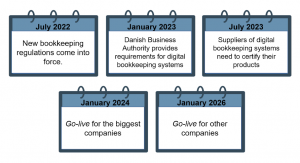

As mentioned, although the relevant law regarding digital bookkeeping is already approved, implementation of particular requirements is divided into phases. Currently, the most probable schedule is as presented below.

- July 2022: regulations introducing digital bookkeeping enter into force;

- January 2023: Danish Business Authority will provide requirements which need to be met by digital bookkeeping systems;

- July 2023: suppliers of digital bookkeeping systems must certify their solutions in Danish Business Authority;

- January 2024: go-live date for the biggest companies;

- January 2026: go-live date for other taxpayers.

What about e-Invoicing?

Most companies already run their accounting books digitally. Therefore, it seems the upcoming changes are not revolutionary. Still, adopting ERP systems to specific rules will be required.

However, new bookkeeping regulations established the obligation that digital bookkeeping systems have to support automatic distribution and receipt of e-invoices. It might be interpreted as the introduction of mandatory e-Invoicing obligation. Unfortunately, there are no details regarding e-Invoicing provided yet. In particular, there are no technical specifics (such as format of e-invoice) available.

Hopefully, the Danish authorities will present further information about their e-Invoicing model very soon.

Broader context – VAT in Digital Age

In March 2022, EU Commission published a report titled VAT in the Digital Age studying various Digital Reporting Requirements (DRR) introduced in EU Member States such as SAF-T, real-time reporting obligation,and the e-Invoicing clearance model.

Unfortunately, only 12 EU countries have introduced any DRR. According to the EU Commission, it is an “insufficient degree of fight against VAT fraud”. Therefore, it is suggested to introduce DRR at EU level. It is assessed that “an e-Invoicing solution ranks first”.

The report triggered a proposal of amendment to the EU VAT Directive published a few days ago (December 8, 2022). Among others, most important change includes new version of Article 218 of EU VAT Directive, to which point 2 is added:

“2. Member States may impose the obligation to issue electronic invoices. (…) The issuance of electronic invoices by taxable persons and their transmission shall not be subject to a prior mandatory authorisation or verification by the tax authorities (…)”.

An explanatory note to the proposal states that thanks to the new version of Article 218, “electronic invoicing will be the default system for the issuance of invoices”.

Moreover, it is proposed that Article 232 be deleted. This regulation required that issuance of electronic invoices be subject to acceptance of the recipient. Both changes are expected to come into force from January 2024.

Aforementioned changes are significant steps towards digitalization of VAT obligations, initiated by the EU. Currently, introduction of mandatory e-Invoicing (especially clearance model) is subject to EU approval (derogation). If the proposal of EU VAT Directive amendment is accepted, we may expect more EU countries to develop comprehensive e-Invoicing systems.