Published: January 2024

The European Commission has granted Romania a derogation on July 27th, 2023, allowing to proceed with mandatory electronic invoicing system for B2B transactions. Since July 1st, 2022, Romania has required the issuance of invoices through the RO e-factura system for B2B transactions involving products that are considered high-risk, such as alcoholic beverages, fuels, minerals, and agricultural goods. With the EU’s derogation, the plan is to extend the existing e-invoicing system to cover all supplies of goods and services delivered in Romania starting in January 2024.

Two phases of implementation

The rollout of the RO e-invoicing for all B2B transactions consists of two key phases: the first phase is near-real-time e-reporting, and the second phase is a clearance e-invoicing model.

First phase (e – reporting)

From January 1 to June 30, 2024, the following taxpayers are subject to new tax requirements:

- Entities with a registered seat in Romania.

- Foreign entities with a fixed establishment for VAT purposes in Romania.

- Foreign entities registered for VAT purposes in Romania.

These entities will be required to report all B2B invoices for supplies of goods or services taxable in Romania within the RO e-Invoice system, excluding invoices related to the export of goods and intra-Community supplies of goods departing from Romania.

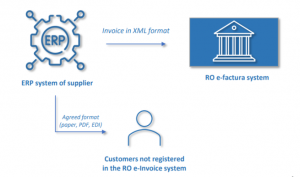

The requirement for the taxpayers is to generate invoices in XML format and file them through the RO e-invoice system using their Virtual Private Space (SPV) account, within five working days from the date of issue in ERP system. During this period, suppliers will continue to distribute invoices to their clients using existing methods, either on paper or via other electronic invoicing methods, unless both the supplier and the customer are registered in the RO e-Invoice system. If both parties are registered, an invoice is considered delivered to the recipient once it is successfully transmitted through the RO e-invoice system.

Second phase (clearance e-invoicing model)

Beginning in July 2024, a full clearance e-invoicing model will be implemented. Only electronic invoices issued in XML format and dispatched to customers via the RO e-Invoice system will be recognized for tax purposes. Invoices issued on paper or in the previous electronic formats will no longer be accepted.

Invoice transmission

The e-invoicing system in Romania will require the transmission of invoices through the RO e-Invoice system in the CIUS_RO format, which includes UBL 2.1 or CIN standards.

To access the e-invoicing system, companies must

- Have an account on the SPV (Virtual Private Space) platform.

- Be registered in the RO e-Invoice system.

Starting from next year, invoices can be submitted through the e-invoicing system either manually, by logging into the SPV, or automatically, by integrating your invoicing software with the e-invoicing system using an API.

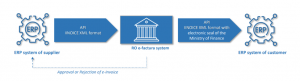

The e-invoice in XML format, when sent to RO e-factura, is verified for compliance with the proper structure. Upon confirmation of its compliance, the Ministry of Finance assigns its electronic seal, and the invoice is immediately transmitted to the recipient. If the submitted electronic invoice fails to confirm to the required structure, the sender is notified about the errors detected. Once these errors are corrected, the sender must resubmit the amended e-invoice via RO e-Factura. An e-invoice that carries the electronic seal from the Ministry of Finance and is transmitted through the RO e-Invoice system will be recognized as official one. Only such sealed invoices will be accepted for the purpose of exercising the right to deduct VAT.

The Romanian e-invoicing system does not provide the option for recipients to reject an invoice. In the case of an electronic invoice to which the recipient has objections, they need to notify the issuer of the electronic invoice. The issuer is then responsible for sending a corrected electronic invoice through the RO e-Factura system.

Penalties for non-compliance

In Romania, penalties for non-compliance with these upcoming e-invoicing requirements are stringent. Taxpayers who fail to comply will face penalties ranging from 1,000 to 10,000 lei, equivalent to up to EUR 2,000. These penalties will be enforceable from April 2024, following a three-month grace period.

Romania is one of the latest members of the European Union to introduce mandatory e-invoicing, a significant change for businesses operating within its borders. This move aligns with similar mandates across the EU, such as the one in Poland, which is also set to enforce mandatory e-invoicing in July 2024. For multinational companies with operations in both Poland and Romania, this period will be critical for ensuring that their invoicing systems comply with these new regulations. The challenges lie not only in adhering to the concept of e-invoicing but also in navigating the distinct technicalities required by each country. Unlike the overarching concept of e-invoicing which remains relatively constant, the technical specifications, particularly the XML schemes for e-invoices, differ significantly between countries. Consequently, businesses must undertake dedicated projects in each country to adapt their systems accordingly.