Recent global International Tax Competitiveness Index 2020 – a ranking published by Tax Foundation – placed Switzerland in fourth position overall, and at first position in consumption taxes (VAT). It underlined that VAT compliance costs in Switzerland are very low.

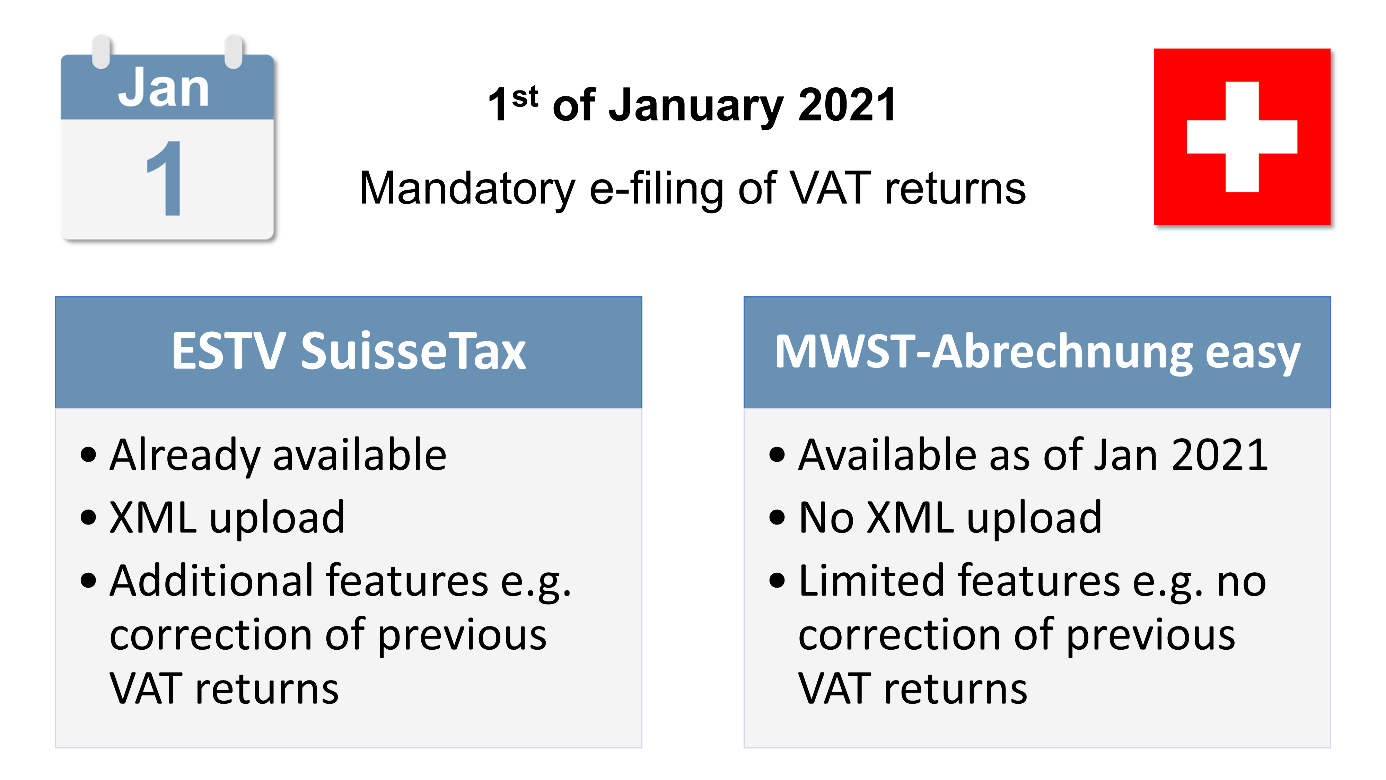

It may be that Swiss taxpayers will face an increase in compliance costs, because as of January 2021 electronic submission of VAT returns in Switzerland becomes mandatory. Hopefully, that would be a one-off additional cost, while in the long-term scenario VAT reporting costs are even likely to decrease thanks to upcoming changes.

Two e-Filing options: ESTV SuisseTax and MWST-Abrechnung Easy

Although e-Filing of VAT returns is not yet mandatory in Switzerland, it is already an option. The Swiss tax authority (ESTV) runs an e-Filing system called ESTV SuisseTax. This tool allows the submission of returns through the manual filing of relevant VAT return values on the SuisseTax platform.

However, SuisseTax is a more advanced system and provides taxpayers with a number of additional functionalities. Most importantly, it allows the uploading of data from XML files, which can be generated directly through the ERP system.

There is a second e-Filing option: MWST-Abrechnung Easy. Its introduction is expected in January 2021. However, due to the COVID-19 pandemic delays are possible. The new tool will be a simple one, enabling manual typing of VAT return figures. Unfortunately, XML uploading will not be a built-in feature of MWST-Abrechnung Easy.

It is worth underlining that the main advantage of MWST-Abrechnung Easy is straightforward access, without requiring registration or the creation of a dedicated account or profile. To log in, a taxpayer will have to provide a token code, sent by SMS to a mobile phone number.

Global turnover to be reported in Swiss VAT return

A lot of Swiss companies operate the so-called “principal model”. In a nutshell, this means that a company based in Switzerland (a principal) remains an owner of goods that are located in different countries (jurisdictions). Therefore, most often Swiss principals are VAT registered in multiple countries. Consequently, they have to prepare country-specific VAT reports reflecting the fact that transactions need to be reported in a particular jurisdiction.

However, numbers reported at country level in VAT returns also have to be included in the Swiss VAT return of any principal. This is a uniquely Swiss obligation, mandating that taxpayers have to report their global turnover in their Swiss VAT returns.

Taking into consideration upcoming mandatory e-Filing, the above requirement should be carefully analysed. It seems that generating an XML file directly from the taxpayer’s ERP system may increase the accuracy of VAT reporting in reflecting global turnover. Once all transactions (at a global level) are properly mapped on the Swiss VAT return, it will not be necessary to manually re-type values from local (country) VAT returns into the Swiss return, for example. That could also help reduce time spent on VAT reporting.

Switzerland follows global electronic VAT compliance

The VAT return is, in practice, the only VAT report that taxpayers have to submit in Switzerland. There is no ECSL & Intrastat reporting because Switzerland is not a member of the European Union. SAF-T, or similar electronic obligations, has not yet been introduced in Switzerland

However, by imposing mandatory e-Filing of VAT returns from January 2021, Switzerland is following the current global VAT reporting direction. Obligatory electronic submission of VAT returns is a first step. More and more countries are introducing comprehensive e-Tax reporting requirements, such as SAF-T, real-time reporting, the tax clearance model, and mandatory e-Invoicing. It is yet to be seen whether Switzerland decides to extend its electronic tax (VAT) obligations.