Is electronic invoice mandatory in Portugal? (H2)

Currently, only electronic invoicing is mandatory for large companies in public procurement transactions. Large suppliers must issue and send invoices to all Portuguese public entities only in electronic form. Throughout 2021, the obligation will expand to the medium, small, micro enterprises and public entities.

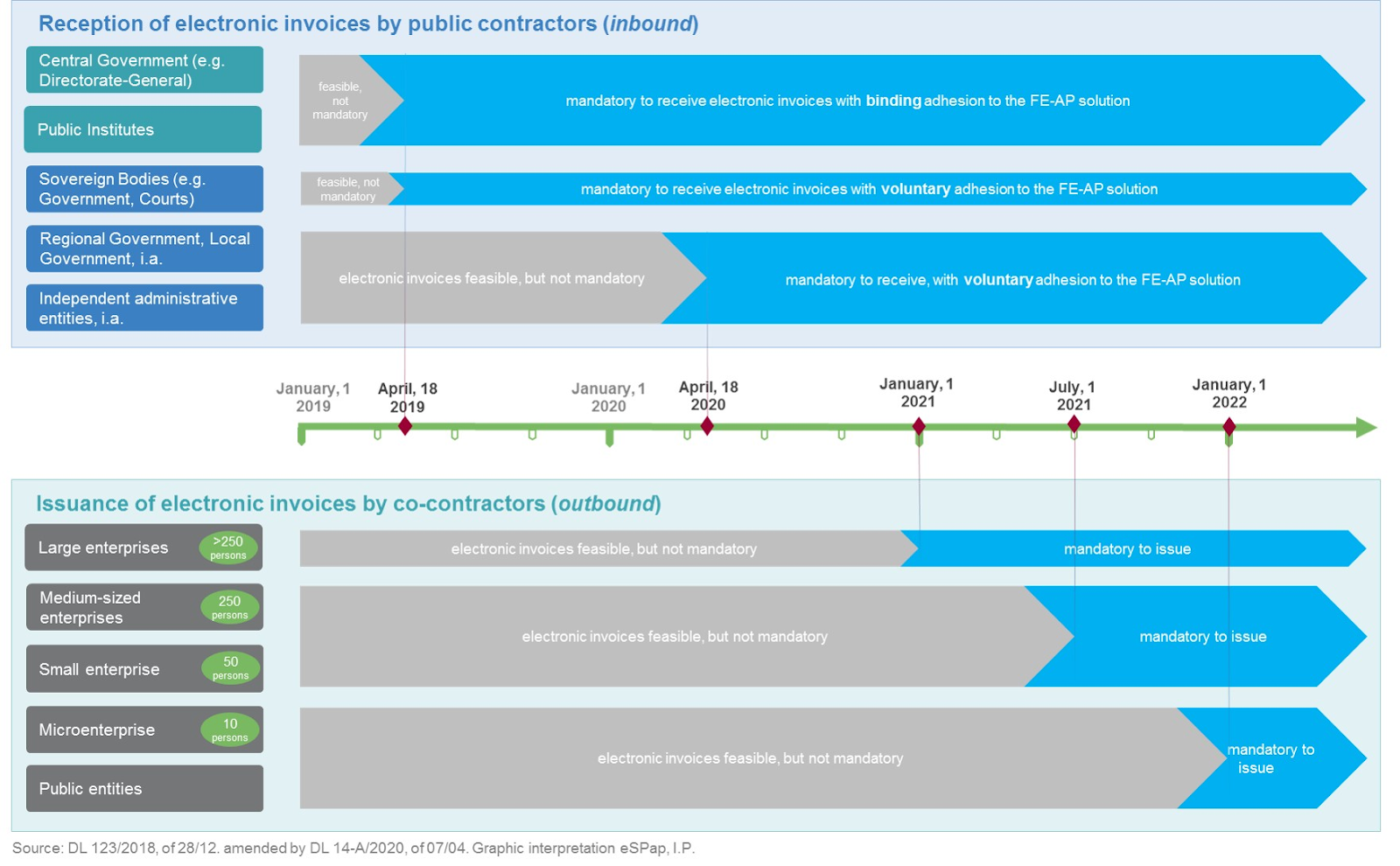

The deadlines for the B2G e-invoicing mandate in Portugal (H2)

- For large enterprises, B2G electronic invoicing in Portugal is mandatory as of 1 January 2021.

- For medium and small sized companies, the deadline date is 30 June 2022

- For non established businesses, Portugal mandatory B2G e-invoicing has been postponed to 1 July 2021.

- And finally from 30 June 2022, micro enterprises and public entities will be obliged to issue e-invoices in public transactions.

SOURCE: ESPAP

Who is eligible for e-invoice in Portugal? (H2)

From April 2020, all the EU public entities must accept e-invoices from their vendors. This means every vendor can invoice a public entity electronically if they wish to do so. We have also published an article on B2G e-invoicing mandate in EU.

Moreover, although there is no obligation, sending B2B invoices in Portugal could be done electronically if the recipient gives consent.

Who is responsible for e-invoice in Portugal?

“Entidade de Serviços Partilhados da Administração Pública I.P.” or “eSPap” is the government authority responsible for setup and maintenance of the public procurement e-invoicing system. It is also responsible for publishing technical and functional requirements.

How do I create an electronic invoice in Portugal?(H2)

PDF invoices are not electronic invoices. Official data format is XML (extensible markup language) which is both human and machine readable. Only e-invoices in CIUS PT, UBL 2.1 or other European Norm-compatible formats (upon agreement with the Public Authority) will be accepted. An e-invoicing software is required in order to comply with the requirements. For instance, Portugal e-invoice SAP software creates electronic invoices by automatically extracting your invoice data from SAP modules.

How to transfer Electronic invoice with eSPap?

In order to transfer and receive e-invoices, suppliers and entities will connect to the eSPap’s portal FE-AP, the gateway of the state to financial documents. The documents will be transferred through a secure online connection (web-service). Thus, sending via e-mail is not possible. eSPap supports users in the registration, test and go-live processes. Furthermore, the B2AP portal is designed to support suppliers in monitoring the status of e-invoices sent to the FE-AP solution.

Which public institutions have to work with eSPAP? (H2)

Public entities linked to the use of the FE-AP solution provided by eSPap are:

- Direct State Administration Bodies, for example, Directorates-General, Regional Directorates, General Secretariats, DGEstE, ASAE, AT, IGF among others;

- Public Institutes, for example, IAPMEI, INEM, IPDJ, ISS, eSPap itself among others.

Who can use B2G platform FE-AP?(H2)

All public bodies can voluntarily use the FE-AP solution provided by eSPap. However, in the adhesion process they are subject to the project planning carried out by eSPap.

Is QR Code mandatory for e-invoice in Portugal? Is ATCUD mandatory?

No. We previously published that ATCUD has been postponed to 1 January 2023 from 1 January 2022. Recently, the government applied the same postponement to the QR code regulation. According to the 2021 Portugal State Budget Law, it will be mandatory to put QR code and ATCUD (Sequential number and validation code) on all invoices and other fiscal documents as of 1 January 2022. The aim is to control transactions more strictly.

Is e-invoice mandatory for exports in Portugal? (H2)

No, invoices used in export transactions can be in paper or pdf format. E-invoicing is optional.

Is e-invoice mandatory for B2C in Portugal? (H2)

No, and B2C and B2B e-invoicing are not expected to be mandatory any time soon.

Why is e-invoicing needed in Portugal? Advantages of e-invoicing in Portugal (H2)

Portugal Government applies electronic invoicing as a tax clearance model. This model enables continuous transaction controls (CTC). It provides real-time digital control of transactions which helps tax authorities prevent tax evasion and reduce VAT gap.

Furthermore it has solid benefits to the organizations: Use of paper decreases, routine processes become automated and complex tasks become easier. Consequently e-invoicing significantly reduces the time and money spent for business processes.