The state of e-Invoicing in France

The French government and businesses across the country are already familiar with e-Invoicing requirements as there have been multiple regulations already introduced in this area. France took an important step by introducing obligatory e-Invoicing for B2G transactions back in 2017. In recent years the process has been completed, and since 2020 all businesses have been obliged to use B2G e-Invoicing in France when supplying goods and services to public entities via the dedicated e-invoicing portal Chorus Pro. The total number of the e-Invoices already exchanged via the Chorus Pro portal is currently close to 25 million.

The next step saw the French government enact amendments to the National Finance Act in November 2020. The upcoming change will be a major milestone in e-Taxation in France. According to these regulations, there will be an obligation to use e-Invoices in B2B trade for all domestic transactions. It will also become mandatory to report all transactions electronically (e-Reporting). The idea is to implement a unified and structured method of reporting tax data in order to enable quick and effective auditing.

The French e-Invoicing model

The main goals behind the recent amendments are pretty standard: simplification and the prevention of fraud.

It is worth noting that the simplification measures will not only increase the effectiveness of the invoicing process, but also ease the compliance burden through pre-filed VAT returns.

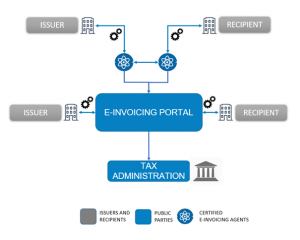

In terms of e-Invoicing models, France has chosen the tax clearance model, which is technically very similar to what Mexico has implemented. At the core of this model is the exchange of e-invoice data with the tax authorities. However, the taxpayer will not directly report the data to the government (as it does in, for example, the Italian SdI solution). The system will be supported by certified private agents who will first collect the data from taxpayers and then share it with the tax authorities.

The exchange of tax data between the supplier and the client will be useful in various scenarios, depending on whether the taxpayers engage the intermediary e-Invoicing provider (certified private platform). In particular, taxpayers may choose to send and receive e-Invoices without any involvement of the private platform.

The existing e-Invoicing portal provides three main options for submitting e-Invoices. Taxpayers can use EDI, an API connection, or a web service to upload the e-Invoices. In practice this means that there is also a possibility for small enterprises to manually enter the invoice details via the portal. This model is also called the ‘Y’ model, the main feature of which is being adapted to various billing circuits. On one hand, it leaves flexibility for businesses to use the public invoicing portal (or a partner paperless platform for issuing or receiving e-Invoices), while leaving the obligation to declare invoicing and payment data to the tax authorities.

Scheme 1: The ‘Y’ model for e-invoicing.

e-Invoicing Format

The French administration has already published the details of the structure (semantic model) of the e-Invoice, which will become obligatory from 2024. Detailed information can be downloaded at the official French tax administration webpage (https://www.impots.gouv.fr/portail/specifications-externes-b2b).

First of all, the French e-Invoice follows the EU standard norm (EN16931). According to the official guidelines, there will be three basic acceptable formats; namely, UBL 2.1 (Universal Business Language), CII (UNCEFACT XML CII 16B), and Factur-X (mixed model, readable by humans and machines).

There is also a CIUS extension, which enables the introduction of certain country-specific rules, which allows specific invoice fields to be added. In France this extension includes the additional information on the code of the administration, which receives the invoice and a sub-code of the purchase order number (an extra code used by very large organizations).

Additionally, it should be noted that the Chorus Pro portal enables the application of PEPPOL e-invoicing components, which allows the processing of e-Invoices issued by foreign suppliers.

The French e-reporting solution

An important element of the French e-Taxation revolution is the mandatory e-Reporting solution within which taxpayers will be requested to report standardized, transaction-related data. As a result, tax authorities will have a thorough insight into the details of the transactions and the ability to react instantly in case of any inconsistency or suspicion of fraud. The need for such an additional obligation arises from a number of local, tax-specific regulations for which the proper information cannot be extracted based on the harmonized e-Invoicing standard.

The e-reporting will particularly embrace three aspects: invoice payment information, B2C transactions, and foreign transactions (not including domestic supplies). This is mainly for sales, but certain purchase transactions can also be included.

As such, in France the standard tax (VAT) point for supplies of services is linked to the payment, unlike all other EU countries. Therefore, the tax authorities intend to have more insight into the taxpayers’ compliance. Under the e-Reporting requirement the following data will be disclosed: invoice number, date of payment, and the amount of payment by invoice.

Within the B2C reporting mandate, there is a special reporting requirement for B2C transactions, for which there is no obligation to issue an invoice. The following document data will be reported:

- the unique identification number of the taxable person (SIREN)

- date of payment

- amount of payment for all operations

- number of daily transactions

- period for which the transmission is made

- the words “option for the payment of the tax after debits” (if the taxable person has carried out this option)

- the total amount (excluding tax) and the amount of the corresponding tax (per tax rate)

- the total amount of tax payable, excluding any foreign VAT, stated in euros for transactions performed using foreign currency

- currency

The mechanism of e-Reporting assumes that the data needs to be reported to the tax authorities within a few days. The planned model follows the solution already implemented (the SII in Spain, for example).

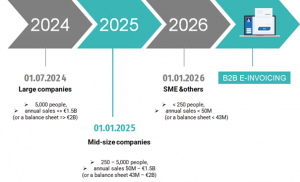

E-invoicing and e-Reporting implementation schedule

The schedule of implementation will be the same for the e-invoicing and the e-reporting obligations.

According to the most recent announcements the e-Invoicing requirement will be introduced on 1st July, 2024. The obligation will not apply immediately to all taxpayers, but will be introduced in phases. Initially, the obligation will embrace large companies, followed by mid-sized enterprises (from 1st January, 2025), before being extended to all businesses (from 1st January 2026).