A few months ago, I published an overview of Hungarian e-Tax Story: From VAT Ledger to Real-Time Invoicing (RTIR 2.0). The real-time reporting requirement is the hottest tax topic in Hungary. However, there are additional Hungarian e-Tax obligations in place.

In this article, I’d like to provide you with details about the invoice disclosure requirement in force in Hungary since 2016. In the SAP world it is known as RFHUAUDIT – Audit Report for Hungary.

RFHUAUDIT Audit Report legal background: 23/2014 Decree

Decree 23/2014, by the Ministry for National Economy, sets up invoicing regulations in Hungary. The aforementioned regulation also imposes special requirements on taxpayer invoicing software, for instance SAP.

More precisely, an invoicing program needs to have a special function, officially called adóhatósági ellenőrzési adatszolgáltatás – invoice data disclosure for tax audit.

It is worth underlining that the above requirement is mandatory both for businesses established in Hungary and foreign companies registered in Hungary for VAT purposes.

RFHUAUDIT Audit Report: scope of reporting – invoice details

The Hungarian Audit Report is similar to that of Polish SAF-T structures – Invoices (JPK Faktury). It is required, at tax authorities’ request, to provide detailed information (item level) about taxpayer sales invoices including:

- Details of product sold, i.e. name, commodity code (based on SZJ classification), quantity, unit price;

- Details of customer, i.e. full name and address, VAT ID;

- Details of invoice: invoice format, invoice type, invoice number (including number of original invoice in case of credit note), net amount, VAT amount, currency, VAT rate;

- Special indicators, e.g. invoice subject to reverse charge settlement, self-billing invoicing, VAT exemption, cash-accounting, margin scheme.

Above are only examples of data required to be reported. It should be noted that the Audit Report requires detailed pieces of information, also covering specific VAT trading of means of transport (it is required to provide vehicle engine capacity).

RFHUAUDIT Audit Report: technical outline

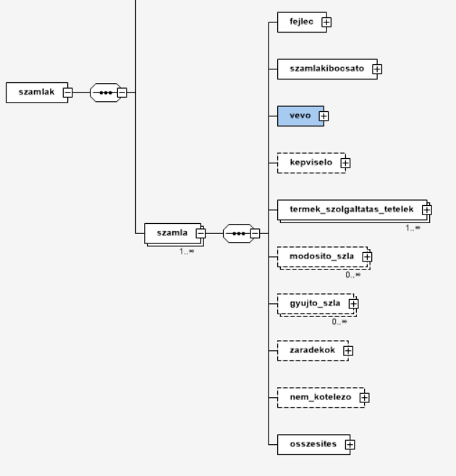

Hungarian Audit Report disclosing invoice details need to be provided in XML format, the most common for e-Tax reporting requirements. The generated file has to be in line with the XSD structure provided by Hungarian Tax Authorities (NAV): 23-2014_szamlasema.xsd

The invoicing program should enable exporting an Audit Report covering a selected range of invoices issued in a particular period.

Hungary moving towards SAF-T

Hungary has a number of e-Tax reporting requirements in place including a real-time reporting requirement (RTIR 2.0). These obligations exist in parallel. For example, although RTIR 2.0. reporting it is still required to generate Audit Report, described above.

It has already been communicated that Hungary will become the next country with obligatory SAF-T reporting, as of 2021. This OECD-based obligation is already in place in many EU countries and also in Norway (non-EU). It is expected that SAF-T will replace the Audit Report whereas RTIR 2.0. will exist and not be affected by SAF-T introduction.