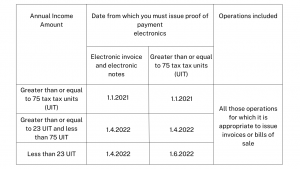

In Peru, both B2B and B2C e-Invoicing is already mandatory. According to Superintendence Resolution No. 279-2019/SUNAT, you can find the threshold values which are expanding gradually. By June 2022, the last group of taxpayers were included in the obligation and the country’s e-Invoicing system will be completed. Peru electronic invoice system is named Sistema de Emisión Electrónica(SEE). E-Invoices must be generated in UBL 2.1 format and must be digitally signed.

With the successful implementation of the electronic invoice system, the government announced the new transport document. In June 2022, the Peruvian tax authority (SUNAT) published a draft resolution. The new electronic transport document (GRE) will be effective from January 2023. It must be connected to invoices (comprobantes de pagos) and facilitate monitoring and track of goods under transportation. With the new resolution, the tax authority wants to eliminate the use of paper. QR code is required in the document and transmitted through the software provider (PSE – proveedores de servicios electrónicos) or directly to the SUNAT Portal.