Currently, most of Polish taxpayers are struggling with the so-called “Polish Deal” (Polski Ład), which is a huge, complex reform of tax regulations in Poland. Most of the changes are related to income taxation and social contributions. There are some amendments to VAT regulations as well. As of July 2022, Poland is introducing the VAT group concept.

However, it is also worth noting other changes to Polish VAT compliance, which are not part of the Polish Deal package, but are still important. Starting from the January 2022 reporting period, VAT reporting needs to be done using a new version of JPK_V7 (the so-called VDEK).

Background

In October 2020 Poland abandoned the standard VAT return form to introduce the JPK_V7. This is an XML-based VAT obligation covering data formerly reported in VAT returns and the JPK_VAT.

From the very beginning, there had been a lot of controversy about the JPK_V7. For example, companies had difficulties providing details about transactions, which were not easy to retrieve from ERP systems, such as the split-payment mechanism indicator or special classification codes for products (GTU codes).

The Polish Ministry of Finance decided to introduce the second version of the JPK_V7 JPK_V7M(2) and JPK_V7K(2) for monthly and quarterly reporting. New file structures will be in force from January 2022. Primarily, they reflect the latest VAT e-commerce changes. However, there are some other changes as well.

Changes to JPK_V7

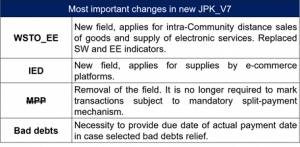

As mentioned, most of the amendments in JPK_V7 are triggered by the introduction of the new VAT rules for e-commerce at EU level. There are some new indicators that need to be marked for particular e-commerce transactions. WSTO_EE needs to be assigned for intra-community distance sales of goods and supply of electronic services. Additionally, the IED indicator should be marked in case of supplies made by e-commerce platforms.

There are some changes to JPK_V7 that have not resulted from the e-commerce package. It is important to highlight some of them. First, the obligation to mark transactions subject to the mandatory split-payment mechanism has been removed. As mentioned, this requirement has caused a lot of difficulties for taxpayers. Fortunately, there are no more MPP indicators, either on sales or on the purchase side of the new JPK_V7 file.

There is also a new field P_560, which needs to be ticked by taxpayers who are applying for a VAT refund within 40 days. That is a special period for taxpayers, who voluntary joined the structured e-invoicing (KSeF) system.

Other selected amendments include slight changes and clarifications of GTU codes and the need to provide a due date or actual payment date in case of some bad debt-relief scenarios.

It is worth mentioning that most of the aforementioned changes were introduced into tax regulations between July and December 2021. However, no new JPK_V7 structure has yet been published. Therefore, some transitional rules are still in place. For example, taxpayers were not obliged to enter “MPP”, although this field was part of first JPK_V7 version.

Poland moving towards real-time reporting

The changes to JPK_V7 are important and need to be immediately implemented by Polish VAT taxpayers. The deadline to begin reporting using the new version of JPK_V7 is 25 February 2022. Considering that the final version of the new structure was published on 27 December 2021, companies have not been granted much time to adapt their IT solutions to the change.

It is also worth mentioning another change in Polish VAT regulations; namely, the structured e-invoicing system (KSeF). This is a real-time reporting requirement, since electronic invoices are issued, received, and maintained by using the central e-invoicing system. Consequently, tax authorities have immediate access to information about taxpayer transactions. KSeF was introduced in Poland from 2022, but it is still an optional mechanism for now. It will become mandatory at earliest April 2023. The implementation of solutions for structured Polish e-invoicing is a much more complex project than the implementation of the new version of JPK_V7. Therefore, it is good to start preparing for the KSeF requirement now.

We have recently published an article about the Polish e-invoicing system (KSeF) here.