Invoices issued by Portuguese taxpayers will soon have to include two additional elements: ATCUD codes and QR codes. Those long-awaited new requirements will become mandatory from January 2022 (QR Codes) and January 2023 (ATCUD).

ATCUD uniquely identifies an invoice

ATCUD (a menção do código único de document) is a unique document code that will need to be part of invoices in Portugal from 2023, and is separate from the internal taxpayer invoice number

ATCUD consists of two elements:

¾ The validation code – at least eight-digit code given by Portuguese tax authorities, based on the invoice series number provided directly by taxpayers to the tax office;

¾ A sequential number of an invoice within a series (internal taxpayer invoice number).

Both elements need to be separated by a hyphen (-).

By June 2021, taxpayers can start providing tax authorities with their invoice series to receive validation codes.

ATCUDs need to be stated on each page of an invoice, as well as above QR code. The unique document code is also contained within the QR code.

QR codes as a single point of reference for invoices

In parallel with the introduction of ATCUD there is another obligation to be imposed on Portuguese invoices in January 2022: QR codes. These two-dimensional bar codes, with a minimum size of 30mm x 30mm, will become a mandatory element of invoices.

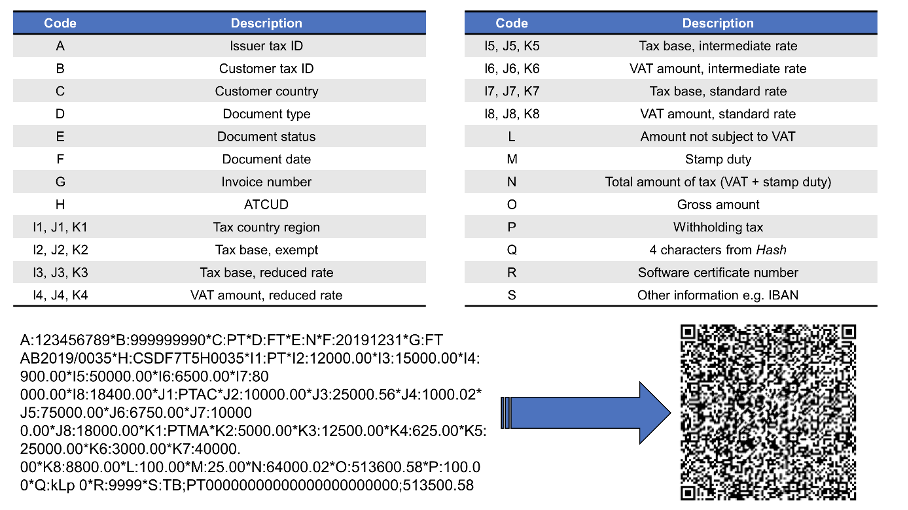

QR codes on Portuguese invoices (código QR nas faturas) contain all the data about a particular invoice coded in line with technical requirements provided by tax authorities. Codes A to S indicate particular document details. For example, code A indicates information about issuer tax ID (TIN). Information about ATCUD also has to be presented as a QR code (code H).

All available codes with their descriptions are presented below, as well as an example of a QR code message and its transformation into QR code.

Decoding the above example is as follows:

Issuer tax ID is 123456789 (A),

Customer tax ID is 999999990 (B),

Customer country is Portugal (PT) (C),

Document type is standard invoice (FT code, in line with SAF-T coding) (D),

Document status is normal (E),

Invoice issue date is 2019-12-31 (F),

Internal invoice number is FTAB2019/0035 (G),

ATCUD is CSDF7T5H-0035 (H),

I1 to K8 indicate relevant tax country regions (PT for mainland of Portugal, PT-MA for Madeira, PT-AC for Azores), tax bases and tax amounts following the exemption/applicable VAT rate (I-K),

Amount not subject to VAT is equal to EUR 100 (L),

Value of stamp duty is EUR 25 (M),

Total amount of taxes is EUR 64,000.02 (N),

Gross amount of the invoice is equal to EUR 513,600.58 (O),

Withholding tax is EUR 100 (P),

Hash value is Q:kLp (Q),

Certification id of billing software is 9999 (R),

In other information, IBAN and ATM values are provided (S).

QR codes are becoming more and more popular as they are able to include a lot of data using a compact graphic element. Most importantly, processing QR codes is easy. Often, it is sufficient to use camera in a smartphone: hold it over QR code and immediately receive a response (Quick Response).

One of the latest QR code applications helps to confirm that users have been vaccinated against COVID-19. It is expected European Union citizens will receive a unique QR code that includes details about COVID vaccination, which can be stored on their smartphones. Such QR codes can be easily read by airport staff at security controls, allowing quick identification of which passengers have been vaccinated.

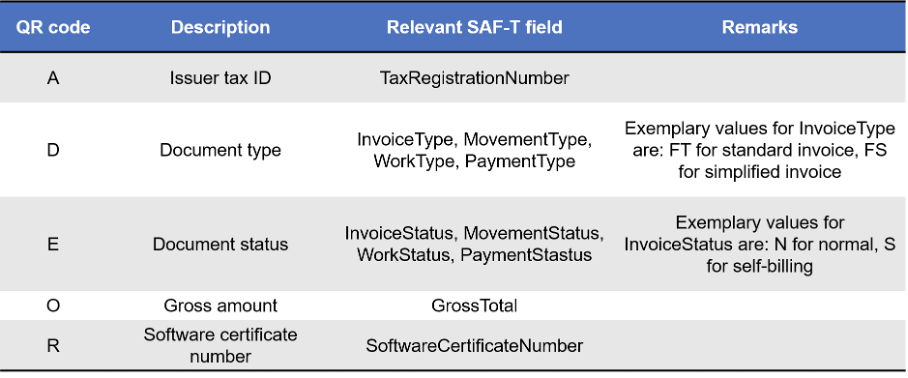

QR codes need to be mapped with SAF-T

Most QR code fields have to be created in line with Portugal SAF-T fields. In order to reflect SAF-T logic in QR codes, Portuguese taxpayers need to analyze their transactions, business models, availability of relevant data in the taxpayer IT system, and perform so-called ‘mapping’ between SAF-T and QR code obligations.

Selected examples of mapping of QR code fields to SAF-T are presented in the below table.

Portugal follows digital trends

Portugal has always been a trendsetter in VAT obligations. In 2008 Portugal introduced SAF-T, becoming the first country to do so. As well as ATCUD and QR codes, Portugal is working on a number of other developments in invoice digitalization.

Large taxpayers are already obliged to follow mandatory e-Invoicing in business-to-government (B2G) transactions. Small, medium-sized and micro companies will join obligatory Portugal B2G e-Invoicing in 30 June 2022. Taxpayers will have to use a billing software certified by Portuguese tax authorities. These requirement will apply to non-resident companies as well.

Considering above examples of digital tax initiatives, it is no surprise that Portugal, is pioneering the inclusion of QR codes on invoices. It is highly likely other countries will follow the Portuguese example and also consider the introduction of QR codes.