Introduction

Digitalization is rapidly growing worldwide, significantly impacting the taxation sector. Tax authorities around the world are increasingly implementing more frequent and complex tax requirements. These requirements obligate business owners to electronically submit various documents and reports, including VAT Returns, EU Sales Lists, SAF-T, or invoices, in real-time or near-real-time. The challenge lies in the volume and complexity of electronic documents mandated by each country, coupled with various submission deadlines. This poses a significant challenge for companies operating on a global scale. Different regulatory demands in each country necessitate the integration of IT solutions for compliance with tax and legal norms. Often, this means setting up distinct applications in each country, provided by various vendors. Such a scenario poses significant challenges in efficiently managing the diverse requirements across different countries. SAP Document and Reporting Compliance (SAP DRC) is a solution that assists businesses in avoiding these challenges.

SAP Document and Reporting Compliance: A comprehensive solution hub

SAP Document and Reporting Compliance is a comprehensive global solution that facilitates the generation, processing, and monitoring of electronic documents and tax/ statutory reports. The solution caters VAT/ GST, e-invoicing and other taxes such as WHT, ESG.

SAP DRC complements your existing business systems, acting as a central hub, making compliance management easier across your organization. SAP DRC integrates seamlessly with your current systems (SAP ECC or S/4HANA), enabling smooth end-to-end processes from the creation to the submission of electronic documents and statutory reports. It eliminates the need for distinct solutions in different countries or for varying business scenarios, thereby making the compliance process more efficient. SAP DRC supports approximately 500 scenarios across 57 countries, including the latest updates in electronic invoicing for Poland, Romania, Slovakia, and Egypt.

The standard procedure for this process is outlined as follows:

- Initially, source documents such as SD Billing documents or Customer Invoices in FI are generated in SAP ECC or S/4HANA.

- Following this, eDocuments are created from these source documents.

- eDocuments are then transmitted to external systems e.g. tax authorities’ platform.

- The processing status of eDocuments is continuously monitored.

- Finally, the eDocument status is updated in the application, showing any changes based on information received from external systems.

End-to-End Processes with SAP DRC

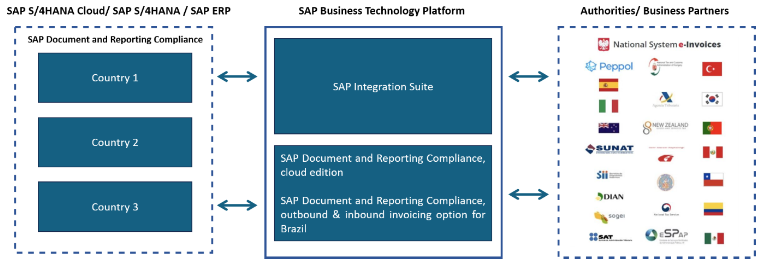

Depending on the country or region, different cloud services are integrated to complete the end-to-end process. The standard approach within the SAP DRC solution involves using either the SAP Integration Suite, or SAP Document and Reporting Compliance, cloud edition.

Whether using the SAP Document and Reporting Compliance or the SAP Integration Suite, the process involves:

- Generating electronic documents or reports in the appropriate format within your business systems,

- Forwarding them to the selected cloud service, and

- Facilitating interactions with external systems, such as tax authorities.

- SAP Document and Reporting Compliance, cloud edition – (SAP-managed cloud service in SAP BTP). The cloud edition handles the exchange of electronic documents and statutory reports for supported scenarios, as detailed on SAP help’s website.

- SAP Integration Suite (a customer-managed cloud service in the SAP BTP) offers integration packages tailored to particular business scenarios. These packages include pre-set integration flows for those scenarios. Once implemented, these flows enable the exchange of electronic documents with tax authorities’ platforms.

The full range of supported scenarios can be found on SAPHelp, where it’s also possible to check if integration with tax authorities’ platforms is available through SAP Document and Reporting Compliance, cloud edition, or SAP Integration Suite, or if manual submission is necessary. What is crucial to understand is that for each country scenario, only one solution is applicable – either the SAP Document and Reporting Compliance, cloud edition or the SAP Integration Suite. These solutions are not interchangeable, and therefore, no migration of current regulations is possible at this stage.

The SAP DRC Cloud Edition covers numerous scenarios, focused mainly on e-invoicing. The solution does not fully address all tax obligations currently. Specifically, for Spain’s SII, the end-to-end process still need to be supported by SAP Integration Suite. While future mandate, such as Spain B2B e-invoicing, is expected to be supported by the Cloud Edition.

Conclusion

In today’s fast-moving digital world, keeping up with complex and ever-changing tax rules is a big challenge for businesses everywhere. SAP Document and Reporting Compliance offers a practical solution. It gives companies a single system that makes it easier to handle tax documents and reports correctly, no matter where in the world they operate. This system works well with businesses’ existing SAP setups, helping to streamline the whole process from document creation to submission. Using SAP DRC means businesses can stay on top of their tax obligations without getting overwhelmed by the details. As technology and tax laws continue to evolve, having SAP DRC means companies can adapt quickly, ensuring they remain compliant and focused on their main goals. In short, SAP DRC is a key tool for any business looking to handle global tax compliance in a straightforward and effective way.