Slovakia was one of very first countries to introduce detailed electronic VAT reporting. In 2014, the kontrolný výkaz (control statement) requirement came into force. This is a local, XML-based sales and purchase listing report. A similar requirement was introduced in the Czech Republic two years later in 2016.

Therefore, it is no surprise that Slovakia is following current trends in digital taxation and is already imposing new obligations in 2022; namely, mandatory B2G, G2G, and G2B e-invoicing, as well as requiring that payments only be made to bank accounts registered in the special list provided by the tax administration.

Slovak e-invoicing system: Deadlines

Slovakia has decided to introduce a central e-invoicing system called Informačný Systém Elektronickej Fakturácie (IS EFA). The pilot phase is already in place, whereas the process of “going live” is divided into two parts:

- From January 2022, e-invoicing through IS EFA becomes mandatory in B2G, G2G, and G2B

- From January 2023, e-invoicing through IS EFA becomes mandatory for all other transaction types, including B2B

IS EFA: Technical outline

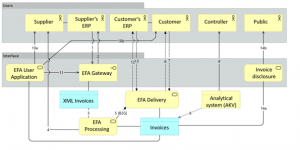

The Slovak national e-invoicing framework consists of the following modules presented in the diagram below:

- EFA Gateway: responsible for communication with the taxpayer ERP system, in particular to allow receipt of supplier invoices.

- EFA Processing: responsible for processing electronic invoices.

- EFA Delivery: responsible for delivery of invoices to customers.

- Analytical System: responsible for performing checks on reported invoices.

- EFA User Application: responsible for generating electronic invoices and managing them.

- Invoice disclosure: responsible for invoice disclosure for B2G and G2G scenarios.

There are two main methods of entering invoices in the IS EFA system:

- Automatic upload directly from taxpayer ERP (points 1 – * in the diagram above) dedicated to medium and large taxpayers.

- Manual upload using EFA User Application (points 11 – * in the diagram above) dedicated to small taxpayers.

Many of technical details are well-known from similar e-invoicing developments in other countries. In particular, the Slovak system relies on XML-format invoices in the UBL 2.1. standard, which is also in place in Serbia, for example. Communication between different modules of the IS EFA is facilitated by dedicated API.

The “White List” of bank accounts

Slovakia had decided to introduce another requirement aimed to reduce tax fraud, which works similarly to the White List Poland obligation, providing a white list of taxpayers and bank accounts.

Starting from January 2022, the tax administration of Slovakia (Finančná správa) is to publish an updated list of all bank account numbers disclosed by companies every day. By the end of November 2021, Slovak VAT-registered taxpayers already had to provide tax authorities with all bank accounts that they use in their economic activities.

Most importantly, payment for an invoice must be made only to the supplier’s bank account as stated on the list published by tax authorities. Otherwise, a customer becomes jointly responsible for supplier’s VAT liability. The only way of avoiding joint responsibility when making payment to the account not registered at the White List is to use a split-payment method.

It is possible to verify the bank account number of a company directly on the tax office website. What needs to be provided is the VAT ID number of the taxpayer. As a result, there is a list of bank accounts that are used by this company. Another method is to download a “flat file” (in XML format) containing a list of all taxpayers and their respective bank accounts.

However, the third method of verifying taxpayers’ bank account numbers seems to be the most convenient, especially for large companies that make a lot of payments daily and need to verify large numbers of accounts. There is a special API published by the tax authorities called OpenAPI. As well as verifying bank account numbers, this API allows users to check other Slovak tax databases. For example, it is possible to verify whether a particular Slovak VAT ID is valid one.

Process changes are unavoidable

Companies operating in Slovakia need to prepare for the requirements outlined above. Businesses operating in public procurement should already have an e-invoicing solution in place. However, other companies should already be preparing for the e-invoicing implementation. In practice, the introduction of national e-invoicing IS EFA system will impact most business processes, in particular AP and AR.

The requirement of verifying bank account numbers before making payments also needs to be reflected in company processes. Additional procedures will probably need to be designed and followed. Although there is a possibility to avoid joint and several liability by using the split-payment method, this cannot be considered a “workaround” solution. Split payment also has significant disadvantages. In particular it has negative cash-flow impact and is also more complex from a technical perspective.

To sum up, meeting new digital tax requirements, such as Slovak ones, requires the cooperation of multiple stakeholders and cannot be successfully implemented in a “silos” model. IT developers need to closely cooperate with finance departments (AP, AR, tax, and internal control), which also need to understand each other to make the required changes happen.