INTRODUCTION

E-invoicing regulations have existed in Russian legislation since 2012. However, there was no significant development of electronic invoice reporting until July 2021. It seems the government expected that the optional e-Invoicing would gain popularity with time as digitalization expands internationally. However, it is worth noting that in 2017, an important step towards digitalization was taken in Russia. As of January 2017, it has been obligatory to provide e-accounting data (invoice listings) to allows tax authorities to cross-check data between different taxpayers. This process includes a requirement to provide scanned, digitally signed invoices, which will probably be replaced by the structured e-Invoicing model.

Following the recent trend of e-Invoicing mandates gaining appeal across Europe, the Russian government has also taken steps to create an environment to implement a B2B electronic invoicing obligation.

The new regulation included in the Federal Law No. 371-FZ, which became binding in July 2021, should be considered another milestone on the road to widespread digitalization of Russian business. Currently, the reform is expected to be completed by 2024.

According to this regulation, B2B e-Invoicing remains voluntary, except for taxpayers who are part of the traceability system, which is used for certain goods transactions and is meant to monitor trade in the territory of the Russian Federation.

TRACEABILITY SYSTEM

The traceability system became obligatory in July 2021. It was also active before that, but only voluntarily and as part of a trial. The aim of this model is to oversee trade at all stages within the territory of the Eurasian Economic Union (EAEU) from the moment of import of certain goods, through distribution and retail, and ending with the B2C delivery.

The traceability system creates an obligation to monitor the movement of certain types of goods, which include the following groups:

- refrigeration and freezing equipment

- industrial vehicles

- washing and drying machines

- construction equipment

- monitors and projectors

- electronic integrated circuits and elements

- baby strollers and child safety seats

The traceability system is strongly linked to electronic invoicing as the law requires that for any transactions falling under traceability, the counterparties must accept the e-Invoices, except for export transactions and sales to non-taxable private individuals (B2C).

E-INVOICING IN RUSSIA

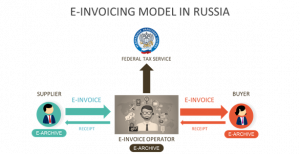

The e-Invoicing regulations have been in place for almost 10 years in the Russian Federation, and follow the clearance model, which gives tax authorities immediate insight into transactions. The tax clearance model and the post-audit model and the two major options for introduction of transactional control. The model selected by the Russian government seems to be more advanced and much more demanding in terms of technology. One of the main requirements in this model is mandatory e-Invoicing. Nevertheless, the destination (tax clearance) model was for a long time not possible in the Russian Federation due to interoperability issues and operators not being able to develop a centralized structure to enable the successful exchange of e-Invoices.

Like other electronic invoicing models, the Russian concept is based on unified document structure (XML), which is to be exchanged with the use of certified service providers. All e-Invoices require that taxpayers use a digital signature, which can be generated either via encryption software or with support from certified e-Invoice agents (electronic document exchange operators, or EDEOs). Currently the list of the authorized e-Invoice operators includes approximately 50 agents.

Each electronic invoice is to be considered a legally valid invoice, as long as it contains all the data prescribed by the law. Each invoice must also be registered in ledgers and purchase and sales books, as well as stored electronically for four years. The exchange of the e-Invoices may be subject to an audit by Russian tax authorities and the transaction parties must be able to prove business relations.

E-INVOICING & TRACEABILITY REGIME

Until July 2021, e-Invoicing existed across Russia as a voluntary regime. However, the first group of taxpayers had to implement mandatory e-Invoicing starting in July 2021. What is specific about the Russian model is that, apart from being obliged to issue e-Invoices in a defined format, there are additional requirements related to monitoring of trade across Russian territory.

Because the e-Invoicing mandate is part of the traceability system, there are specific requirements related to the content of electronic invoices. These will have to include the batch registration number (RNPT). Apart from this information, the sales invoices should also provide information about measurement units and the actual quantity of goods covered by the traceability system to enable proper monitoring of certain commodities. What is important is that additional information will also be visible in the shipping documentation, as well as recorded in the VAT reports. Such a model would enable FTS to run cross-checks and request the taxpayer to present and explain the relevant documentation in case of discrepancies.

Despite the obligation to issue e-Invoices, some exceptions may apply, in which case a paper invoice may be issued. This would apply if the buyer is either self-employed or an individual purchasing goods for personal needs (B2C supply), as well as in the case of exports (or re-exports) from the territory of the Russian Federation.

The expected e-Invoicing flow will include the following steps:

- the supplier issues an e-Invoice and signs it using a digital certificate

- the supplier sends it to the certified operator

- the certified operator verifies the document and the validity of the digital signature

- the certified operator sends the e-Invoice to the buyer

- the relevant confirmations are exchanged between operator and the counterparties

At this stage, the real-time exchange of the e-Invoice data between the operator and the tax administration is not in place. However, the e-Invoice data will still be subject to e-Reporting based on separate regulations (post-audit model).

FUTURE PLANS

The expected date for the launch of the fully fledged tax clearance model is 2023. From that date it will be required that the e-Invoicing operators submit the e-Invoices in real-time to the Federal Tax Service. At this point, business transactions will become fully transparent enabling quick and effective control.

Considering that the e-Invoicing regulations have been in force since 2012, the most recent developments show that significant progress has already been achieved. The Russian government also aims to have above 90% of invoices in electronic form by the end of 2024. In the coming years there will be more changes in Russian legislation, and the Russian Federation will definitely keep up the pace of other e-Invoicing leaders.