Published: July 2025

The future is digital, and governments worldwide are racing to adapt. One of the central pillars of this transformation is electronic invoicing (e-invoicing), a system that replaces traditional paper or PDF invoices with structured formats.

Across Latin America, Europe, and Asia, countries are implementing e-invoicing systems to modernize corporate operations, increase economic efficiency, and bolster tax enforcement. Whether through value-added tax (VAT) or goods and services tax (GST) systems, e-invoicing has become a critical tool for reducing fraud, closing tax gaps, and improving the overall transparency of public finance systems.

In contrast, the United States operates under a sales tax system, which is managed at the state and local levels rather than the federal level. This decentralized structure creates a complex and fragmented environment for invoicing standards and compliance. There is no single regulatory body overseeing invoicing practices; instead, guidance comes from a combination of the Internal Revenue Service (IRS), individual state tax authorities, and industry-specific norms.

Invoicing requirements in the U.S.

Invoicing practices in the U.S. differ significantly from those in countries with centralized VAT or GST systems. Since there is no national sales tax, businesses must comply with state-specific regulations in addition to any federal requirements.

While invoice formats can vary depending on industry norms or customer needs, a U.S. invoice typically includes:

- Business name and address

- Client name and address

- Invoice date

- Unique invoice number

- Payment terms and due date

- Description of goods or services

- Quantity and unit price

- Total amount due (in USD)

- Applicable sales tax (based on state law)

As a result, invoices have traditionally played a secondary role in the U.S. tax system compared to VAT or GST-based countries, where invoicing is central to tax reporting and compliance.

Decentralized tax system complicates e-Invoicing in the U.S.

The lack of a unified sales tax system in the U.S. presents a major barrier to implementing a consistent e-invoicing framework. Currently, there are no federal or state-level mandates requiring all businesses to adopt e-invoicing.

Each state defines its own tax rules, rates, and exemptions, making nationwide standardization difficult. While efforts like the Streamlined Sales Tax Project have encouraged greater consistency among participating states, progress remains limited.

Although not required by law, the federal government is systematically constructing a national e-invoicing system. The following initiatives show how the U.S. is gradually moving toward what could eventually become a mandatory digital invoicing framework:

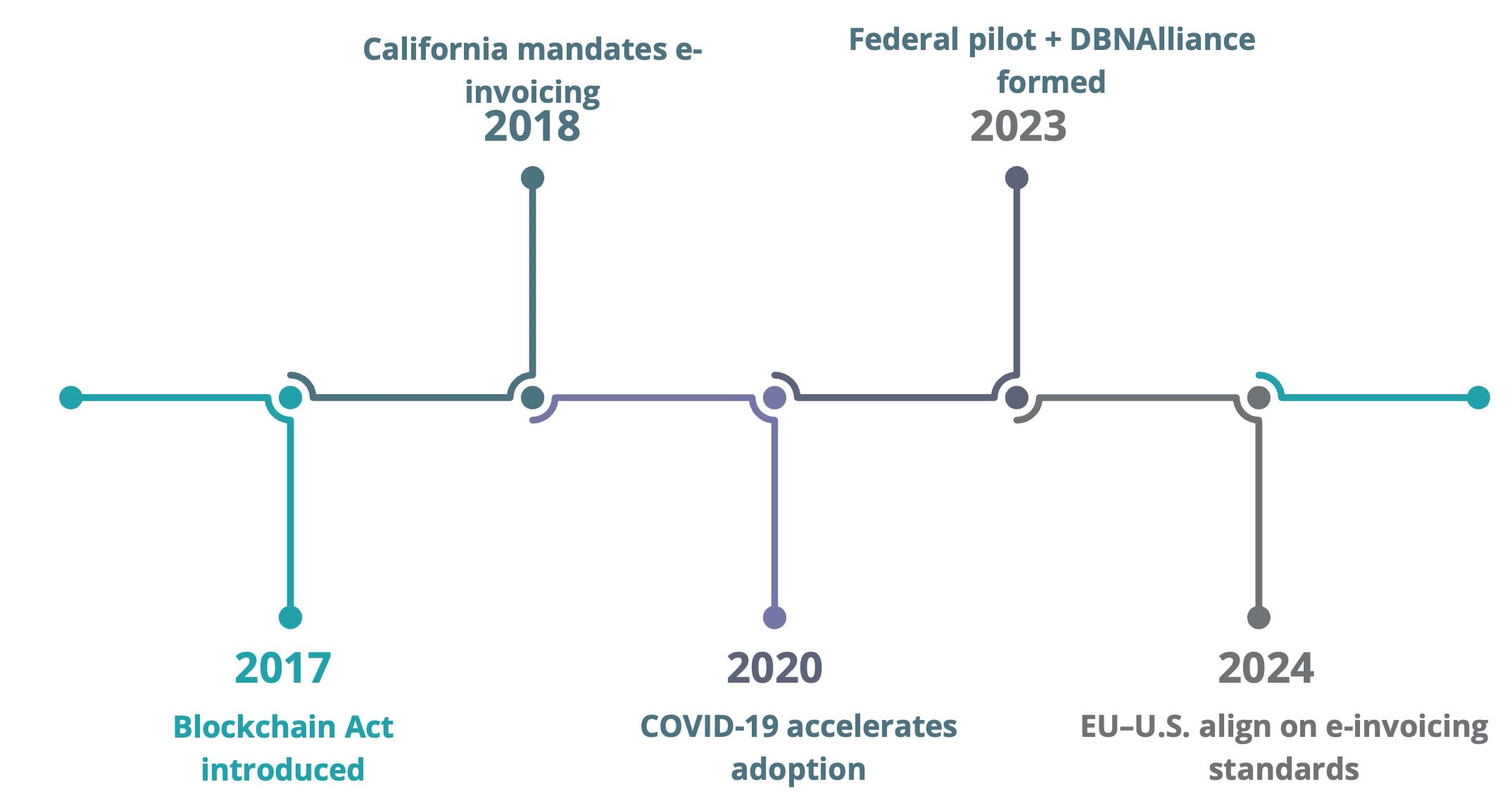

2017

The House introduced the “Promoting the Launch of Blockchain Applications for Smart Government Act”, exploring blockchain to improve processes like invoicing.

2018

California mandated all state contractors to submit e-invoices via its Cal eProcure system, as an early state-level move toward digital invoicing.

2020

COVID-19 accelerated e-invoicing adoption as businesses shifted away from manual, paper-based processes to support remote operations.

2023

The federal government launched a pilot e-invoicing program and established the Digital Business Networks Alliance (DBNAlliance) to oversee a national exchange framework, marking a major step toward future mandates.

2024

In April 2024, the EU and U.S. held the sixth Trade and Technology Council meeting, signaling their intent to harmonize cross-border e-invoicing and strengthen digital trade cooperation.

Both parties agreed upon several core principles to support the effective implementation of electronic invoicing: global access through a single connection, no fees for switching between access points (APs) and open exchanges that allow users to freely choose their preferred access point.

DBNAlliance network

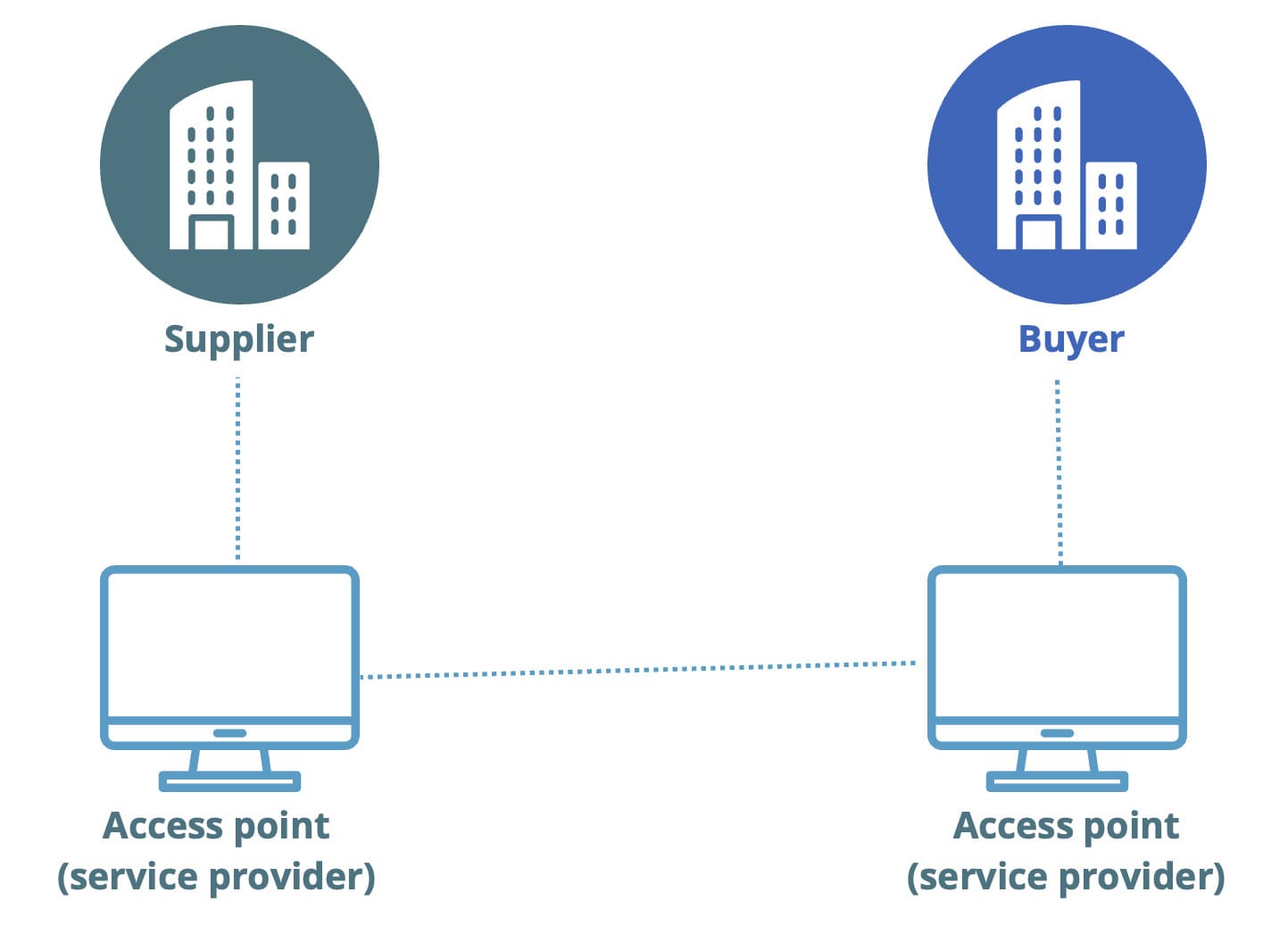

The DBNAlliance is based on a four-corner model, which is very similar to the Peppol framework, and enables the exchange of invoice data through open (non-proprietary) technical standards and a secure virtual network. It connects three key entities in the exchange process:

- Supplier

- Buyer

- Access Point service providers

The system uses AS2/AS4 communication protocols and supports real-time status updates and responses. The DBNAlliance adopts the UBL 2.X format, which supports structured files that can include attachments and electronic signatures. Key fields include:

- Supplier and customer data

- Delivery details

- Payment instructions, including banking or card information

- Charges, discounts, and taxes applied

- Descriptions of invoiced items

- Notes section

Why early E-Invoicing adoption matters

Although e-invoicing is not yet mandatory in the United States, government-led initiatives are gradually advancing the shift toward a digital future. Projects like the 2023 federal pilot and the creation of the DBNAlliance mark significant progress.

While adoption remains voluntary for now, the benefits are clear: faster processing, fewer errors, and simplified tax compliance.The likelihood of nationwide e-invoicing continues to grow. It’s no longer a question of if, but when. By planning ahead, businesses can stay compliant, efficient, and digitally ready.