In March 2022, the European Commission published a report titled VAT in the Digital Age (ViDA), which is one of the most important VAT-related publications issued in 2022. Moreover, the ViDA report proposed significant amendments to the EU’s main VAT policy, the EU VAT Directive.

The biggest change imposes mandatory e-invoicing in each EU member state from 2028. However, from January 2024 EU countries will already be able to enforce such obligations without additional approval.

ViDA report: background

The main purpose of the ViDA report was to assess the EU’s current situation in the three following domains:

- Digital Reporting Requirements (DRRs)

- The VAT Treatment of the Platform Economy

- The Single Place of VAT Registration and Import One Stop Shop (IOSS)

The first volume of the ViDA report covers the DRRs study only. The remaining two areas will be presented in future updates of the ViDA report.

The ViDA report introduces a new term: Digital Reporting Requirement (DRR), which is defined as:

“Any obligation for VAT-taxable persons to periodically or continuously submit data in a digital way on all (or most of) their transactions, including by means of mandatory e-invoicing, to the tax authority”

The DRR obligation is focused on transactional reporting. Therefore, most new electronic VAT reporting requirements are already covered by the DRR concept, in particular SAF-T and structured e-invoicing. However, electronic submission of VAT returns should not be classified as DRR, as VAT returns are reported on aggregated values, not transactional ones.

ViDA report: conclusions

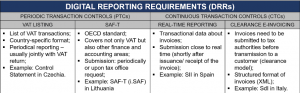

The ViDA study presents multiple classifications of Digital Reporting Requirements. In particular, DRRs might be divided into following categories:

- Periodic Transaction Controls (PTCs): detailed, transactional VAT data are submitted to tax authorities regularly, in line with VAT returns

- Continuous Transaction Controls (CTCs): detailed, transactional VAT data are submitted to tax authorities in real time or almost real time.

PTC and CTC Digital Reporting Requirements can be grouped into sub-categories presented in the table below.

In PTCs, the main difference between VAT listings and SAF-T is the required format. SAF-T (Standard Audit File for Tax) is based on OECD standards, whereas VAT listing DRR is fully based on national formats.

CTC obligations need to be fulfilled in real time or almost real time. In the case of “real-time reporting” DRRs (such as Spain SII and RTiR Hungary), taxpayers need to report data about invoices. However, invoices themselves may still be issued in almost any electronic format. On the other hand, the clearance (or structured) e-invoicing model (like SdI in Italy) imposes an obligation to issue e-invoices in a strictly defined format, usually XML. Moreover, e-invoices need to be transmitted to tax authorities before sharing e-invoices with customers.

As underlined in the ViDA report, in September 2021 only 12 EU member states had introduced Digital Reporting Requirements. The EU Commission concluded that it represented an “insufficient degree of fight against VAT fraud”, and recommended the introduction of DRR at European Union (EU DRR) level and e-invoicing solutions.

What is next?

A follow-up to the VAT in the Digital Age report was a proposal to amend the EU VAT Directive (2006/112/EC), issued by the European Commission on December 8, 2022. The proposal introduces many significant changes reflecting the conclusions of the VAT in the Digital Age report. It also introduces interesting concepts related to platform economy, as well as the idea of Single VAT Registration.

Most importantly, the EU VAT Directive proposal introduces e-invoicing as a general rule for the issuance of invoices. This may be done by relevant changes to Article 218 and the removal of Article 232, which required that issuance of electronic invoices be subject to recipient approval.

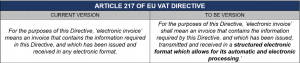

Moreover, there is an important change to Article 217 that defines electronic invoices as follows:

The key word in the above new definition is structured, which means issuing e-invoices in a strictly defined format (usually XML) that can then be automatically processed. It is worth noting that the widely-used PDF format is considered an unstructured format.

The concept of structured e-invoices is already in place at national level, including in the Polish e-invoicing requirement (Krajowy System e-Faktur, or KSeF). KSeF regulations introduced the new, structured e-invoice type (locally known as faktura ustrukturyzowana).

It is expected that mandatory e-invoicing will come into force in all EU Member States in 2018. However, since January 2024 member states have been able to impose such obligations without additional approval.

The proposal also introduces the EU Digital Reporting Requirement. It is expected that current recapitulative statements will be replaced by the new obligation from 2018. Taxpayers will need to report transactional data on cross-border supplies. That obligation might be compared to VAT listings but limited to cross-border supplies. Cross-border data will have to be reported within two days of issuing the invoice. Accordingly, the deadline for the issuance of invoices on intra-community supplies will also be reduced to two days.

It is important to note that the EU DRR will have a common format in each EU member state. Thanks to such standardization, EU countries’ tax authorities will easily be able to exchange data about cross-border transactions and perform more efficient cross-checks. It is expected that such a model will help reduce the VAT gap, which remains a big problem in the European Union.

In summary, it is clear that the European Commission is taking the conclusions of the VAT in Digital Age report seriously. The proposal for changes in the EU VAT Directive was issued within a few months of the publication of the ViDA report. The planned changes are really significant and should be considered as a big step towards digital taxation. The coming years will definitely not be boring for VAT payers!