Published: December 2024

On November 5, 2024, the ECOFIN Council approved the long-anticipated “VAT in the Digital Age” (ViDA) reform package, marking a significant milestone in the modernization of the EU VAT system. Designed to streamline processes, reduce fraud, and align tax reporting with the digital economy, ViDA introduces transformative measures set to reshape how VAT is handled across the European Union.

ViDA represents a leap forward in establishing a more harmonized and digital VAT framework. Central to the reform are plans to mandate electronic invoicing for intra-EU transactions by 2030 and expand the One-Stop Shop (OSS) system, minimizing the need for businesses to hold multiple VAT registrations in EU member states. The reform also simplifies reporting obligations for the movement of goods across the EU under a single VAT registration

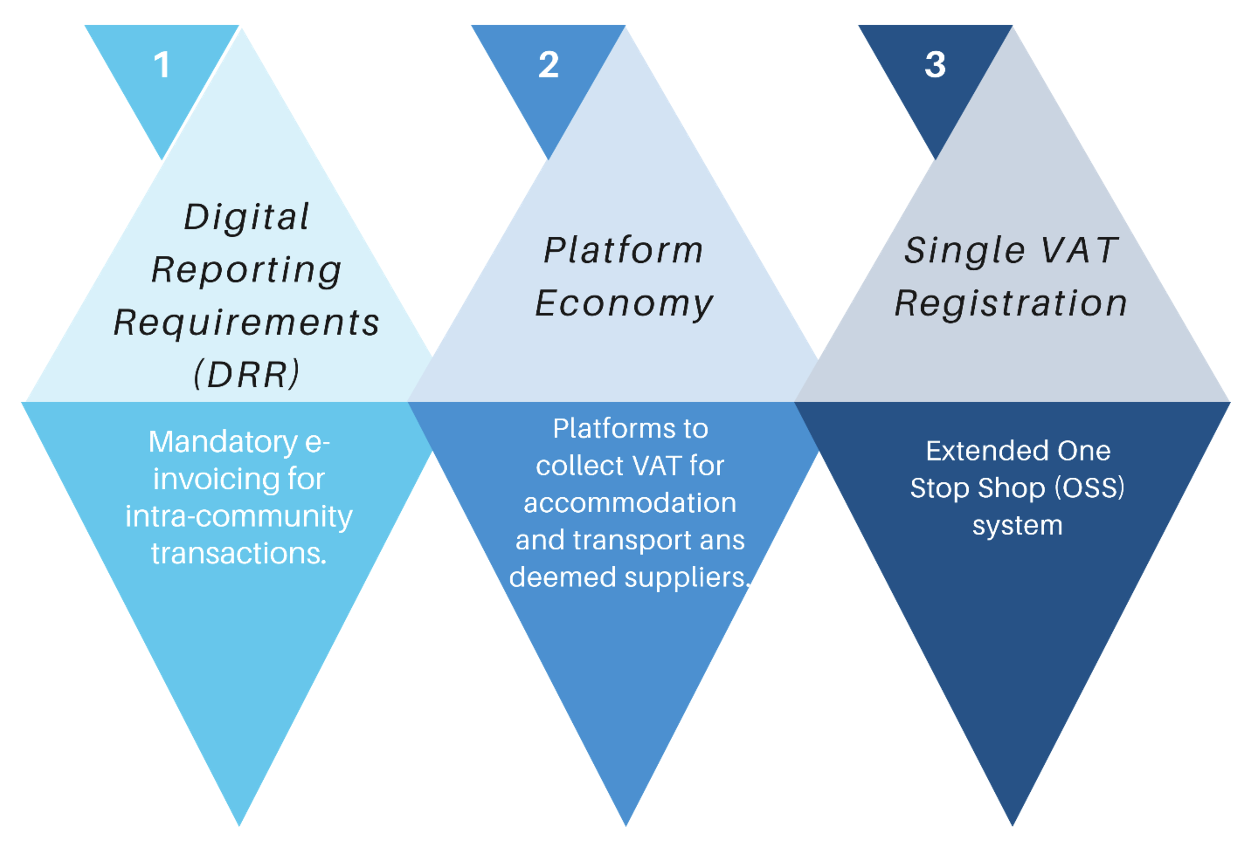

The core pillars of ViDA

The ViDA reform package is structured around three main pillars:

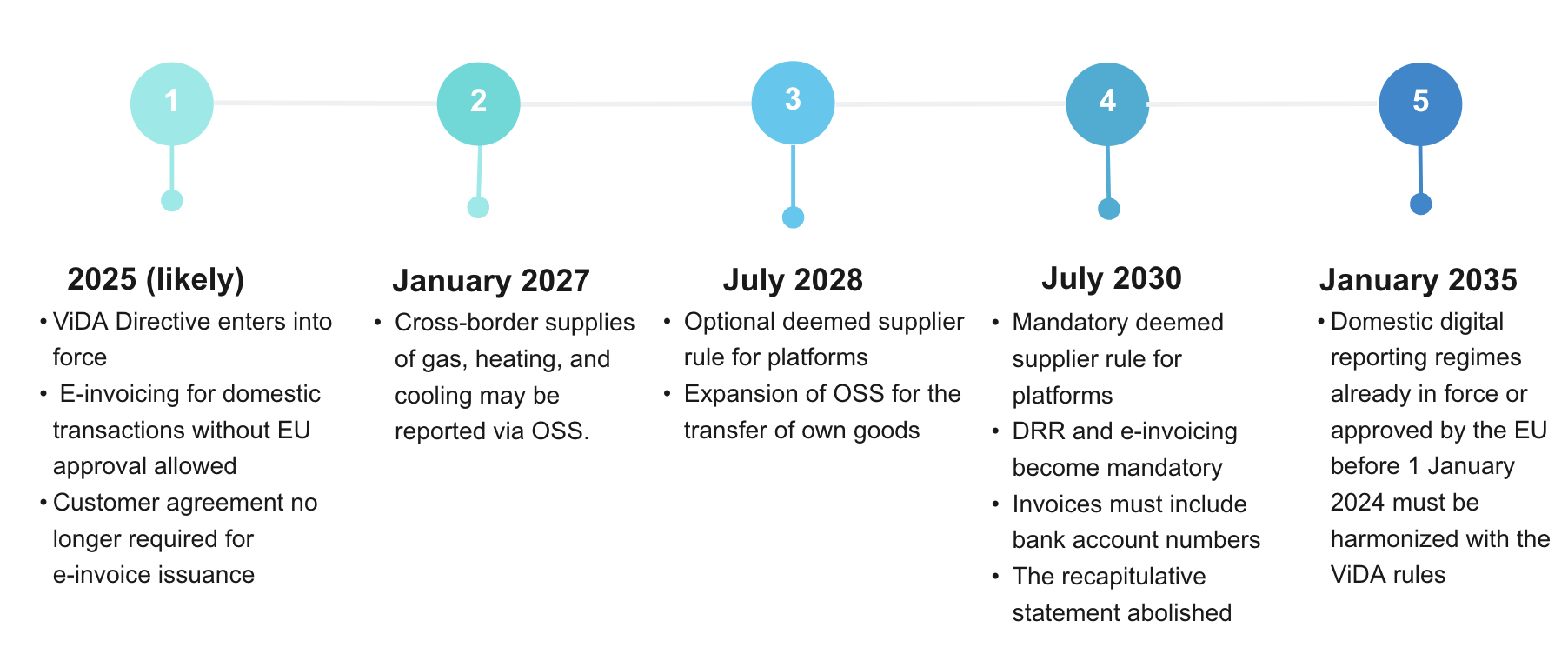

While agreements on the first and third pillars were reached earlier in May 2024, progress on the second pillar faced delays due to differing views among member states, notably Estonia’s reservations regarding the “Deemed Supplier” model for certain platforms. Originally planned for implementation between 2024 and 2028, the timeline has been revised, with full execution now anticipated between 2025 and 2035.

New digital reporting and e-invoicing rules

Starting July 1, 2030, all VAT-registered businesses within the EU will be required to issue structured e-invoices for two key types of transactions:

- Intra-Community supplies of goods.

- Supplies of goods and services subject to the reverse charge mechanism.

These invoices must adhere to the European standard for electronic invoicing (EN 16931) and be issued within 10 days of the chargeable event. Additional information, such as bank account details and sequential references for corrective invoices, will also be mandatory. Businesses will be allowed to issue summary invoices for all supplies made within a calendar month.

To align with these requirements, member states may implement mandatory domestic e-invoicing regimes for established businesses starting 20 days after ViDA is published in the Official Journal of the European Union, without needing prior approval from the European Commission.

The new digital reporting system will replace the current recapitulative statements, requiring businesses to report transaction details electronically on a case-by-case basis once the invoice is issued. For self-billing and acquisitions, an extended reporting deadline of five days will apply. By streamlining digital reporting and e-invoicing, the new system aims to harmonize processes for intra-EU trade.

However, until 2030, member states may continue to operate varying invoicing regimes for domestic supplies. Some may retain existing rules, adopt the EU e-invoicing standard, or rely on derogations under pre-existing arrangements. Full harmonization is expected by 2035, ensuring all member states align with the EU’s unified standard.

Addressing the platform economy

The deemed supplier concept, already applied to e-commerce marketplaces for VAT collection, is set to be expanded under ViDA. Building on this existing framework, ViDA will extend the deemed supplier model to platforms operating in the passenger transport and short-term accommodation rental sectors.

From January 1, 2030 (optionally from July 1, 2028), platforms in these sectors will be required to collect VAT on transactions where the underlying suppliers are either non-taxable persons or taxable persons using special schemes that exempt them from VAT collection. However, platforms will not be responsible for VAT if the underlying suppliers provide a valid VAT identification number and declare their intention to charge VAT.

This change clarifies VAT obligations for platform operators and ensures VAT is effectively collected in cases where suppliers might otherwise fall outside the scope of standard VAT rules. Additionally, ViDA introduces rules clarifying the place of supply for platform facilitation services, treating them as intermediary services for business-to-consumer (B2C) transactions. VAT on such services will be due in the jurisdiction where the underlying supply takes place.

By extending the deemed supplier concept, ViDA aims to create consistency in VAT collection across a broader range of platform-driven sectors, addressing gaps in compliance and reducing administrative complexity for tax authorities and businesses alike.

Simplifying VAT registration across the EU

A major focus of ViDA is reducing the administrative burden of VAT compliance through enhancements to the OSS system:

- The Union OSS Scheme will expand to cover domestic B2C supplies, goods with installation or assembly, and sales aboard ships, aircraft, or trains. It will also apply to certain energy supplies, such as electricity and gas.

- A new Special Scheme for Transfers of Own Goods will enable businesses to report such transfers through the OSS system, eliminating the need for VAT registration in both the origin and destination countries.

A digital future for VAT

The ViDA package underscores the EU’s commitment to reducing the VAT gap and combating fraud while adapting to the realities of a digital economy. For businesses, the reform represents a significant shift in VAT compliance, necessitating updates to existing invoicing, reporting, and VAT management systems. Adopting integrated technologies, such as ERP and billing tools, will be essential to meet the new requirements.

ViDA is not just a regulatory update—it’s a transformation of the EU VAT landscape, paving the way for a more efficient, transparent, and unified tax system in the years to come