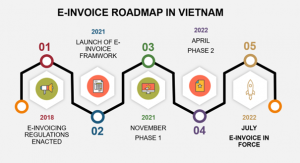

The extended deadline for the implementation of e-Invoicing in Vietnam finally came into force on 1st July 2022. Based on the Tax Administration Law No. 38/2019/QH14, all businesses are now obliged to issue invoices in electronic format. It was initially planned to be introduced as of 1st November 2020. However, due to pressure from various sectors it was postponed.

Implementation details

The e-Invoice model is based on the number of legal regulations that have been introduced since 2018. It is worth mentioning that, from a legal perspective, a number of the regulations will become void. In particular, very generic legal acts shall now be replaced by more detailed regulations, especially included in Decree 123/2020/ND-CP.

The Vietnamese government has defined a phased approach towards the final implementation of the e-Invoicing mandate. The first phase started in November 2021 and was finalized in March 2022. During this period, Vietnam e-Invoicing was introduced in 6 provinces. In the following 3 months (April to June), the range of the e-Invoicing mandate was extended to other regions of the country (57 provinces). Finally, as of 1st July 2022, all businesses are required to issue invoices in electronic form.

Importantly, the existing regulations foresee a certain exception rule and allow certain taxpayers to be relieved from the e-Invoicing obligation. Specifically, this refers to new enterprises (established between mid-September 2021 and the end of June 2022) and those failing to meet the requirements for information technology infrastructure to use e-Invoices as prescribed.

E-invoices: types of invoices

Pursuant to Article 5 of Decree 119/2018 the following 3 groups of documents can be defined as e-Invoices (or types of e-Invoices):

- Value-added tax invoice (VAT) – documents issued by the sellers of goods and services who declare VAT by the accrual method.

- Sales invoices – documents issued by the sellers of goods and services who declare VAT by the direct (value-added) method. It is worth noting that in Vietnam there is an option to pay tax calculated directly as a value added of goods or services.

- Other types of invoices include e-tickets, e-cards, e-stamps, e-receipts, and other defined electronic documents.

E-invoice: technical requirements

All the above-mentioned types of invoices must follow the e-Invoice format as prescribed by the Ministry of Finance. It means that these documents should include all the elements required, and must be issued in a prescribed format (XML) and include a secure digital signature.

It should be stressed that on top of the basic technical requirements there is an additional requirement that the e-Invoices include a special verification code from the General Department of Taxation. This specific code must be included in all e-Invoices by the majority of sellers. The following entities in particular are required to fulfil the said obligation: large businesses (threshold exceeding VND 10 billion), high tax-risk enterprises with a poor compliance record, as well as the self-employed. On the other hand, certain enterprises may be exempted from issuing e-Invoices with a verification code. Exemption covers companies operating in certain sectors, including electricity, petroleum, postal services, telecommunications, transportation, and entities carrying out transactions directly with the tax authorities or equipped with technology infrastructure, accounting, and e-Invoice software that complies with legal regulations. Despite not needing to use the verification code, it is still required that e-Invoice is sent to the tax authorities.

E-invoice: procedure

To become eligible for issuing the electronic invoices a particular entity should first register through the General Department of Taxation’s (GDT) website. During registration the applicant will provide multiple e-Invoicing information, such as the invoice form (with or without code), types of invoices to be issued, and a list of digital signatures.

Once the application is reviewed (usually within one day) the GDT will approve or reject the application. Based on the approval the company is ready to start issuing e-Invoices.

The next steps may look different depending on whether the entity is issuing the e-Invoice with or without the code, and whether the entity registers directly with GDT or uses a service provider. In case of entities obliged to use the authentication code, the issuance of the invoice will done through an account created during the registration. To issue the invoice, the document must first be created, then signed digitally, and sent to the tax authorities to get the code. If the entity is using a service provider, then the code is granted via the service provider (using their website or software).

For the e-Invoice with the tax authority’s code, the business units should note that the seller is responsible for sending the electronic invoice to the buyer. The method of sending and receiving is agreed directly between the parties. However, it must be consistent with the provisions of the law on electronic invoices.

To issue and invoice without the tax authorities’ code the entity must comply with specific requirements and should first receive the notification of acceptance from the tax authority.

Practical issues

One of the major issues when it comes to e-Invoicing is how to deal with the correction of the e-Invoice. The e-Invoicing legal regulations are pretty detailed in this respect. Depending on the type of the mistake, there may be different ways of rectification.

In case of mistakes that refer to the name or address of the buyer, the seller must inform the buyer and send a notice to the tax authority (Form No. 04/SS-HDDT Appendix IA). In such cases, not that it is not required to issue the e-Invoice again.

For e-Invoices with mistakes in the buyer’s tax code, invoice amount, tax rate, tax amount, or description of goods, the seller has two different options. The first option is the adjustment invoice, which includes the adjusted data and another option is that the seller would issue a new e-Invoice that will replace the incorrect e-Invoice.

It should also be noted that the law presumes that in certain situations the electronic invoices will be converted into paper documents. This would apply at the request of tax administration bodies for the purposes of tax audit or investigation.

The taxpayers will be aware that the law foresees penalties in case of misconduct in e-Invoicing. Depending on the type of violation the penalty could be as much as 20 million VND.

To deal with the pending issues and challenges around e-Invoicing, the Director General of the General Department of Taxation has requested that all the e-Invoicing units, from the central government to the local tax departments, will remain on duty 24/7 to promptly handle and resolve problems as they arise.

As reported by Deputy General Director of General Department of Taxation on 1st June 2022, nearly 92.6% of total enterprises have registered to convert e-Invoices. This seems to be very promising in terms of progressing with e-Invoicing mandate. This is also an important step in the digital transformation of the Ministry of Finance, a priority set by the government for the period of 2020-2025.