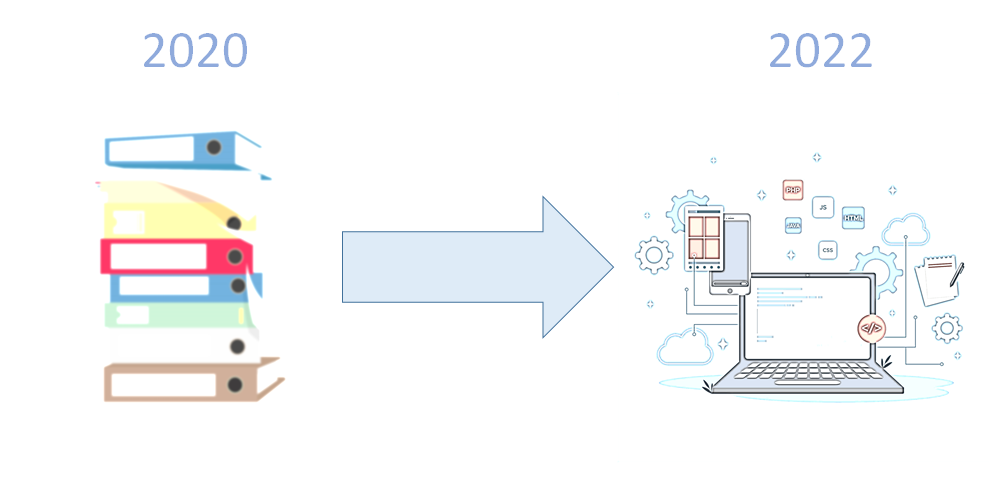

The Vietnamese e-invoicing mandate has just been officially postponed from 1st November 2020 until 1st July 2022. Taxpayers will therefore remain in the transitional period, during which they are still allowed to use paper invoices and current invoicing rules .

At the same time, the General Department of Taxation (GDT) encourages taxpayers who are ready to switch to e-invoicing before the extended deadline to do so. For that purpose, a number of regulations have been released, including those governing technology and infrastructure details.

The current system, which is paper-based, is extremely fraud-prone but at the same time creates a huge burden for tax administrations. For this reason, the GDT not only encourages businesses to adopt with e-invoicing earlier, but also obliges selected organizations to implement e-invoicing before the new deadline (a separate individual notice will be sent to these organizations).

So, what are the requirements that must be met for e-invoicing to be valid? Below are a few selected remarks on Vietnamese e-invoicing requirements.

VIETNAMESE E-INVOICING TECHNICALITIES

In terms of technical requirements, the Decree No. 119 /2018 / ND-CP (Decree 119) elaborates widely on this aspect. In particular, the Decree 119 indicates the basic infrastructure requirements in art. 32 point 1 let. d), by stating that the equipment and technical infrastructure must ensure:

- uninterrupted provision of e-invoicing service and ensure a secure connection with the web portal of General Department of Taxation around the clock (excluding maintenance periods).

- data protection: the capacity and ability to detect, warn, and prevent illegal access and attacks on the network environment to ensure confidentiality and integrity of data exchanged.

- the procedures for data backup: online data backup, data restore, and data recovery from the time of failure of the electronic data exchange system.

- storage of all electronic documents and their accessibility at all times,

- that connection standards of the Ministry of Finance are met.

The above requirements should in particular be observed by service providers who intend to deliver e-invoicing services in Vietnam. Apart from technical requirements, there are number of conditions that should be met by such providers. These include among others the prerequisites regarding the providers profile, finance, human resources, and contract provisions.

E-invoice format is based on XML text format language. The format of an e-invoice consists of two components: the component containing the data of the e-invoice (invoice content elements) and the component containing digital signature data. Additionally, in case of an electronic invoice with the code of the tax authority, there is an additional element containing data related to the code of the tax authority.

VIETNAMESE E-INVOICE CONTENT

The requirements regarding e-invoicing have been included in Decree 119. However, these provisions have been detailed in the Circular No. 68/2019/TT-BTC (Circular 68), which took effect from 14th November 2019. According to Vietnamese regulations, the contents of an e-invoice include all the items that are required for paper invoices (identification data of the parties, invoice identification data, etc.), as well as some additional data that are specific to e-invoice:

– the digital signature and electronic signature of the seller and buyer

– time of issuing e-invoice (specified date format)

– the tax authority’s code (in case of electronic invoice with the code of the tax authority)

– fees and charges that are payable to the state.

According to the Circular 68, in certain cases (sales in selected sectors) a waiver may be applied in terms of e-invoicing requirements (e.g. supermarkets, shopping malls, the oil and gas sector, construction and installation, stamps, and tickers).

VIETNAMESE E-INVOICE CORRECTIONS

In case of mistakes or errors made in an e-invoice it will not always be necessary to re-issue the e-invoice, but the exact consequences will depend on the type of the error.

If a mistake is made exclusively in the buyer’s name and/or address (while other information is correct), there is no obligation to re-issue the e-invoice. The seller should send a notice to the tax authorities and inform the buyer about the mistake.

In case of mistakes related to the tax code, invoice amount, tax rate, tax amount, or description of goods, a new e-invoice must be issued.

VIETNAM IS ON THE PATH TO E-INVOICING

At this point in time it could be stated that Vietnam is ready for e-invoicing in that regulatory affairs have adopted a number of legal acts (decrees, circulars) regarding implementation of e-invoicing. However, due to the revolutionary nature of the change, not all businesses have been able to adapt to the new requirements, which has triggered a postponement of the entry-into-force date. Hopefully we will be observing the e-invoicing transformation progressing in Vietnam over the coming 20 months.