In the global e-invoicing landscape, Germany is one of the top performers, having implemented the e-invoicing model way before the directive 2014/55/EU was imposed.

German e-invoicing started back in 2014 by a dedicated working group (Electronic Invoice Germany Forum, or FeRD) and comprises the inputs and efforts of both federal and local authorities, as well as various organizations and associations. From that date, the ZUGFeRD (ver. 1.0) became a national format of e-invoicing, available for any organization to use.

It is worth noting that the idea behind the implementation was not only to provide generic functionality of e-invoicing, but rather to create a solution that will be easily implemented across businesses, irrespective of their size, to enable all taxpayers to exchange the invoices in a simple and effective manner, including the micro entrepreneurs, who might not be equipped with advanced software solutions. By using the so-called hybrid model even in case of invoices issued to entrepreneurs whose systems do not handle xml e-invoice format may disregard the xml format and post the invoice manually based on visual PDF format.

Most recent developments

In March 2019 the ZUGFeRD 2.0 version was published in order to meet EU standards (EN 16931). At the same time the X-Rechnung standard was introduced (developed by the Federal Ministry of Interior and Coordination Office for IT Standards) as a minimum standard to be used for e-invoicing. Both ZUGFeRD 2.0 and the X-Rechnung are compatible with the EU standard and are both used as a Core Invoice User Specification (CIUS). However, state authorities can also accept formats other than X-Rechnung. Germany may also make use of the PEPPOL CIUS.

On 24th March 2020 the upgrade of the ZUGFeRD to version 2.1 was announced together with the Factur-X 1.0, which are identical hybrid formats allowing for full compliance in e-invoicing between Germany and France, including the B2B and B2G segments.

Now the time has come for Germany to finalize implementation of obligatory e-invoicing for B2G transactions. The obligation is expected to come into force by 18th April, 2020. Based on the last communication of FeRD, by this date all levels of public administration including states and municipalities will be obliged to guarantee the reception of electronic invoices. In November 2020, the process is set to be completed, when all the contractors are obliged to use e-invoicing when selling to public authorities in Germany.

Since 27th November, 2018, the mandate was limited to top federal state authorities, but has been available to subordinate institutions at federal level since 27th November 2019. The respective local authorities are obliged to transpose the VAT directive regulation into their supplementary state legislation.

An e-invoice hybrid

The most important feature of the German e-invoice standard is that in a single file it carries both an XML-based structure and a visual PDF/A-3 standard, which allows users to read it in a friendly format. Therefore, it is irrelevant whether customers use specific e-invoicing software or not, as they may choose to work with a visual format (like PDF), and can manage the document manually.

The ZUGFeRD XML format is based on the international standard UN-CEFACT and is therefore not only compatible across the EU, but also internationally.

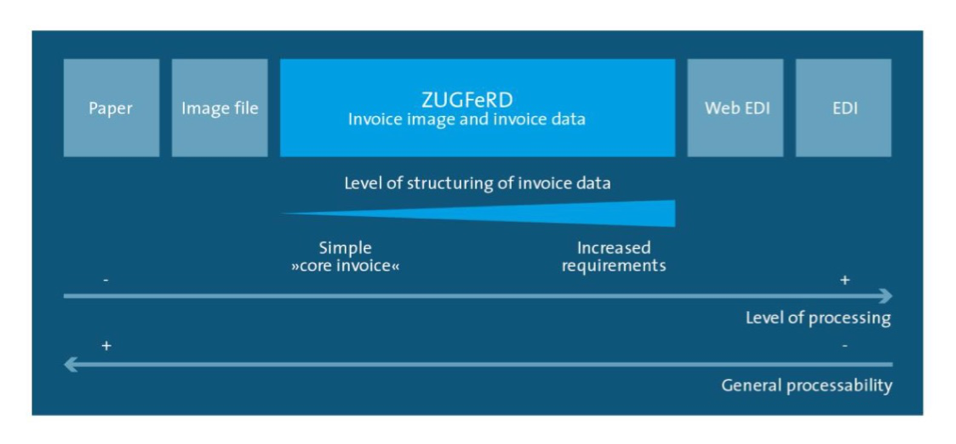

Following the ZUGFeRD specification document, the idea is to fill the gap between the EDI (massive invoicing solution) and small-scale entrepreneurs (some of whom even use paper invoicing as a preferred format).

Available profiles

The widespread use of the ZUGFeRD e-invoice format is underpinned by three available profiles: basic, comfort, and extended.

The profiles differ in terms of complexity and the amount of structured information included in the document. The basic model may be used for simple invoices where only basic invoice data are required (any additional data may be added in a free text mode). On the other end there is an extended profile that enables more extractable, sector-specific data. What is important under ZUGFeRD 2.0 is that all the profiles are compatible with EU standards.

The profiles also differ in terms of the documents that are served. Basic profiles support only commercial invoices, notifications, and credit notes. Comfort profile additionally supports debit and credit notes related to financial adjustments, while under the extended profile, self-billing documents are served.

The added value of ZUGFeRD

Apart from standard advantages that can be listed for each e-invoicing solution – i.e. cost savings (paperless process) and digitalization of accounting process – the ZUGFeRD brings real added value to the world of e-invoicing. This is mainly owing to its key feature: the hybrid character of the document.

Firstly, the hybrid format helps spread the use of this model thanks to its readability, which prevails over only xml-based standards. Thus, businesses that are not yet ready to install the fully-fledged EDI-based e-invoicing technology may still rely on the visual format of ZUGFeRD. It definitely makes their embrace of technology less disruptive.

Another simplification is the audit feasibility. The visual form enables effective verification of the invoice content, which must meet the same legal (VAT) requirements as any other invoice, no matter the format.

Last but not least, the PDF/A-3 format is ideal for archiving.

Finally, its gratuitous character, including a free validation tool, increases the universal appeal of the ZUGFeRD standard.

The measure of the quality of the German e-invoicing model can be perceived from the perspective of a recent announcement of the Swiss authorities recommending the implementation of the ZUGFeRD/X-Rechnung hybrid model. Although Switzerland already has a 20-year history of applying e-invoicing, it is missing out on the advantages of the hybrid e-invoice format. Seems like ZUGFeRD has the potential to become a global standard.