Norway is implementing major changes in VAT reporting. As of January 2022, VAT returns will have to be reported electronically, and directly from the ERP system. Most importantly, the new form will be in line with SAF-T codes.

VAT returns mapped to SAF-T codes

Since 2020 Norwegian taxpayers have needed to submit SAF-T reports upon request of tax authorities. SAF-T covers various areas relating to financing, accounting, and taxation.

In particular, the VAT treatment of sales and purchase transactions needs to be recognized by using a special SAF-T code provided by Skatteetaten (the Norwegian tax office). From January 2022 VAT returns will need to reflect SAF-T VAT codes as well.

There are 25 SAF-T VAT codes to be used in VAT return. For instance, code 1 refers to the purchase of goods and services following a standard rate (25%). Code 3 reflects sales of goods and services following a standard rate. VAT settlement of importation of goods by so-called postponed-accounting needs to be mapped to code 81.

The above picture presents a visualization of the new Norwegian VAT returns, which are an example of presenting VAT data conveniently. However, the output VAT return file to be submitted to the Norwegian tax office needs to be in XML format. Moreover, Skatteetaten requires XML files to be sent directly from the taxpayer ERP system.

API as a way of communication with Skatteetaten

Norwegian tax authorities prepared two Application Programming Interfaces (APIs) to allow submission and validation of new VAT returns.

Submission of XML files to Skatteetaten needs to be performed via Altinn3 API and requires the following steps:

1) Authentication

2) Validation

3) Data filling using the Altingn3-App

4) Complete data filling using the Altinn3-App

5) Complete submission using the Altinn3-App

6) Retrieve feedback using the Altinn3-App

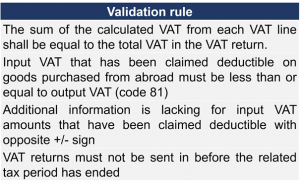

Validation of tax return is executed via Validation API. In particular, there are more than 50 controls of the content and composition of the elements in the VAT return that are performed by tax authorities automatically. Selected validation rules are presented in the table below.

More digital VAT developments in Norway

Aligning VAT returns with SAF-T is not the only new digital VAT initiative in Norway.

In particular, Norway has decided to modernize the VAT registration process. According to information provided by Skatteetaten it is expected that the “processing time for most registration cases will be reduced from weeks to minutes”. The whole process is fully online. Paper applications are no longer accepted.

Additionally, Norwegian tax authorities plan to implement a new VAT report: sales and purchase listing. The project is still at the proposal stage. However, the purpose of sales and purchase returns is to report VAT data on transactions electronically, usually in XML. Such obligations are in place in many countries. For example, Control Statement in the Czech Republic and Slovakia, or the sales and purchase part of Polish JPK_V7.

How to prepare for the new Norwegian VAT reporting?

VAT reporting in Norway is usually performed on a bi-monthly basis. First submissions of the new VAT returns will need to be done by April 10, 2022. Although there are still about 10 months until this deadline, it is worth starting preparation for the new requirement as soon as possible.

Firstly, meeting technical requirements requires IT development. Even though XML and APIs are currently popular and well-known standards, IT processes take time. All solutions need to be properly tested both from a technical and tax perspective. This is especially true if top quality is required, which is a case of developing tax solutions. It is also worth underlining that Norwegian authorities require VAT returns to be submitted directly from ERP systems. Therefore, it is not possible to generate the XML file from the ERP and then upload it manually, for example to a tax office website (as is possible in Poland, for example).

However, the implementation of digital tax standards requires more than core IT development. There is a lot of effort required to ensure that IT solutions will be in line with tax requirements. In particular, taxpayers need to analyze their VAT return data and map them with corresponding SAF-T codes.