Norway introduced SAF-T legislation in 2017. SAF-T reporting in Norway is mandatory from January 2020. Companies with less than 5 Million NOK in turnover and that have not published any data electronically are exempt from the requirement.

Only when the Tax Agency requests it, the taxpayer must submit to Norwegian SAF-T.

What is the Format of SAF-T Reporting in Norway?

The e-Format is XML machine readable format. It mainly contains transactional data.

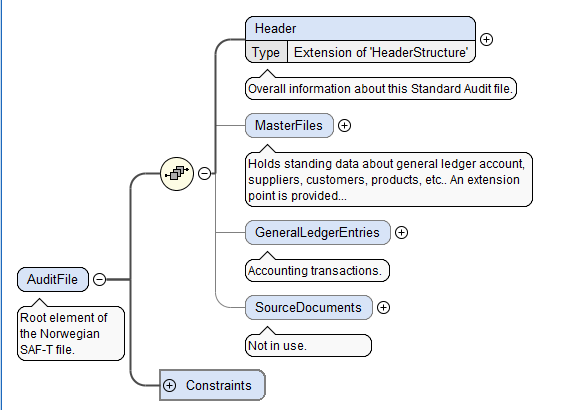

The schema of standard Audit File in Norway consists of:

SAF-T Norway Requirements

Header (Mandatory)

Holds general information about the file including the name of the software which produced it; the company on whose behalf the SAF-T is being submitted; and the selection criteria used. An extension point is provided to allow individual Revenue Bodies to specify further relevant information to be supplied.

MasterFiles (Mandatory)

Holds standing data about general ledger account, suppliers, customers, products, etc. An extension point is provided to allow Revenue Bodies to specify additional elements or structures such as tax rate tables.

Data under MasterFiles

Sometimes it might not be necessary to include all the accounts, codes, etc. available in the accounting system, but this depends upon the purpose of the file. If not all the accounts, codes, etc. are needed, then only the accounts in use in the data included, i.e. accounts with transactions or opening or closing balance are required. If the purpose of the file is to transfer the data between the system, then the entirety of the accounts, codes, etc. might be required. We recommend a choice for this during the export of the SAF-T file.

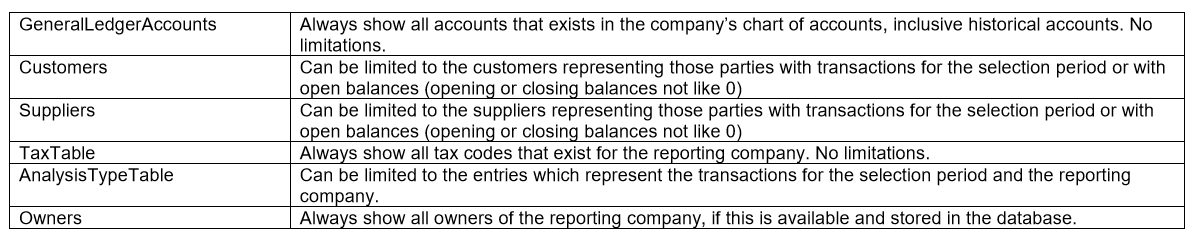

When transferring data to the Norwegian Tax Authority (Skatteetaten), as a general rule all the accounts, codes, etc must be included. However, the following limitations are valid:

GeneralLedgerAccounts (Mandatory)

The general ledger accounts of a company.

Customers (Optional)

The customers of a company.

Suppliers (Optional)

The suppliers of a company

TaxTable (Optional)

The current tax tables of a company.

AnalysisTypeTable (Optional)

Table with the analysis code identifiers. Used for further specification of transaction data. Example: cost unit, cost center, project, department, provider, journal type, employees, etc. Journal type (bilagsart) should always be used on all transactions.

Owners (Optional)

The owners of a company.

GeneralLedgerEntries (Mandatory)

Accounting transactions

How SNI Sap solution is helpful?

SNI solution will extract periodical accounting and VAT data from your SAP modules. It will issue an electronic SAF-T document within your SAP. As a result, it makes you stay compliant in case of an audit and your digital tax reporting process becomes a lot easier by our solution.