Digital tax requirements are spreading across the globe. Most European Union countries already have some e-Tax reporting obligations in place, such as e-Invoicing, SAF-T, and real-time reporting. There are many developments outside Europe as well, especially in e-Invoicing. It is worth mentioning the recent introduction of e-Invoicing in thje US, Indonesia, Vietnam, Egypt, and Australia. We’ve published our analysis of these requirements as articles on LinkedIn.

Until recently, one of the few countries without a comprehensive B2B e-Tax requirement was Belgium. However, that is changing as Belgium is set to introduce mandatory B2B e-Invoicing in 2023.

Background

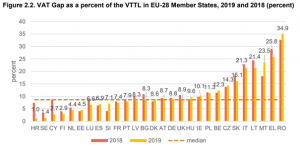

Unfortunately, there is not much information about Belgian e-Invoicing available yet, and no official legislation update has been published. However, the background of the upcoming change is known and is based on the same objectives as the introduction of similar e-Tax requirements in other countries. One of these aims is narrowing Belgium’s VAT gap, which stands at 12.3% according to the latest EU Commission report, one of the highest VAT gap ratios in the EU.

Therefore, to reduce VAT frauds, Belgian Deputy Prime Minister and Minister of Finance Vincent Van Peteghem announced in October 2021 a plan to implement mandatory e-Invoicing in B2B transactions.

E-invoicing entry schedule

As mentioned, there is no e-Invoicing legislation in place yet. It is expected to be published in 2022. However, based on unofficial sources, Belgium will introduce mandatory B2B e-Invoicing in three phases, each covering a different scale of taxpayer:

- For large companies in July 2023

- For medium-sized companies in October 2023

- For small companies in 2024

Belgian B2B e-Invoicing based on PEPPOL framework?

The technical outline of B2B e-Invoicing in Belgium is also not yet known. However, it is expected that it will somehow be based on PEPPOL standard, which is already a B2G e-Invoicing solution in Belgium.

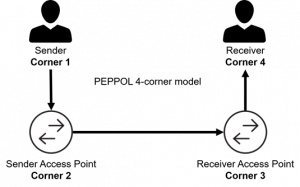

If Belgium decides to introduce B2B e-Invoicing in line with PEPPOL, it is worth recalling how this framework works. PEPPOL follows a four-corner model, in which a sender (the supplier) and a receiver (the buyer) have their own access points. Once a sender issues an e-Invoice, its transmission is made through the PEPPOL network using sender and receiver access points. Finally, a receiver collects an invoice from his own access point.

Clearance model as a next step?

Conceptually, PEPPOL-based e-Invoicing is not a clearance model, in which an invoice is supplied to tax authorities before it is shared with a recipient (for example in Italy’s SdI). However, it can be assumed that in the future Belgium will decide to follow the clearance model, especially given current national e-Invoicing system Mercurius, which is being used by public bodies for exchanging invoices in B2G scenarios. To put it simply, Mercurius is a PEPPOL access point for governmental organisations.

Therefore, an extension of Mercurius features might be on the cards. However, currently there is no sufficient piece of information to predict details of Belgian B2B e-Invoicing. We are constantly monitoring news about digital tax updates and will share with you more info about Belgian e-Invoicing as soon as it is published.