All large Egyptian companies need to join the country’s e-invoicing system before July 2021.

The timeliness of Egyptian e-invoicing

Mandatory e-invoicing in Egypt is being introduced in stages. The first phase, from November 2020, covered 134 companies. In February 2021 an additional 347 businesses joined the system. From July 2021 all large Egyptian taxpayers will need to start using e-invoicing. By 2022 implementation of e-invoicing is still continue with the target companies operating in Egypt.

It is also worth underlining that any businesses working with the government (B2G model) need to start using e-invoicing as of July 2021 at the latest, regardless of their size. Otherwise, they will no longer be allowed to trade with public bodies.

The concept of Egyptian e-invoicing

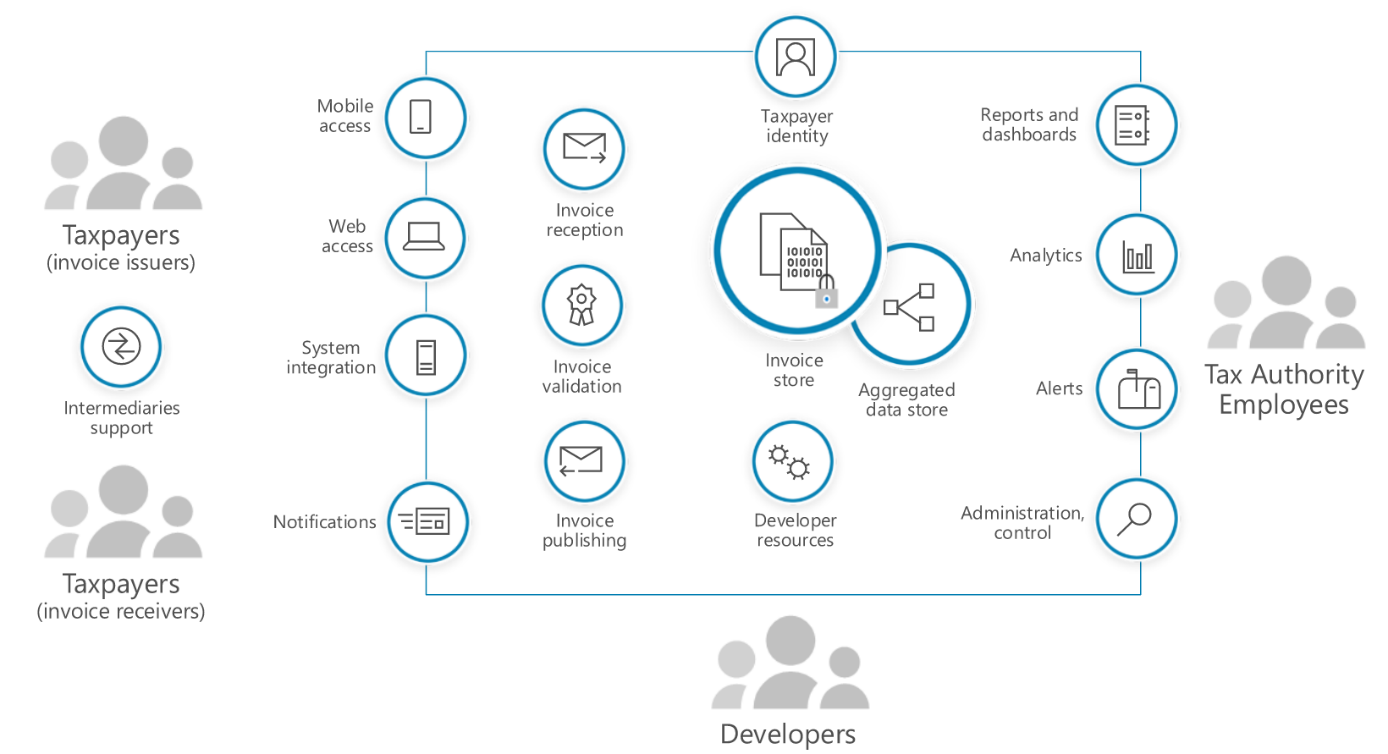

The model that Egyptian e-invoicing is based on is commonly known as the clearance model. This means that each invoice must be validated and approved by the tax authorities before it is sent to the customer.

From a technical perspective the Egyptian e-invoice is a structured file in XML or JSON format. That is quite unusual but very welcome, as other similar developments rely solely either on XML (most often) or JSON.

The transmission of XML/JSON invoices is done via the dedicated Application Programming Interface (API). API is an interface that facilitates communication between different pieces of software. For example, using so-called ‘calls’ it is possible to integrate taxpayer ERP with the government e-invoicing system.

Particularly noteworthy is a technical aspect of electronic signature. Each Egyptian e-invoice has to be electronically signed using either a physical HSM (Hardware Security Model) device, or a USB token.

The structure of Egyptian e-invoicing

Apart from a standard set of information (such as seller and buyer data), Egyptian e-invoices need to contain the special product classification in line with Global Product Classification (GPC), which follows Global Standards 1 (GS1) definitions. While GPC codes are dedicated to goods only, it is also possible to use EGS standards to validate both goods and services.

Taxpayers need to map internal commodity codes used in ERP to GPC. Importantly, tax authorities need to be informed no later than 15 days before a taxpayer uses a new code.

Each issued and accepted invoice has a special UUID (Unique ID) number, which is assigned by the tax authorities and different from the internal invoice number. Reference to the UUID of the original invoice needs to be made in case of credit or debit note issuance.

Selected nuances of Egyptian e-invoicing

Although the following selected issues may not seem crucial from a development perspective, they need to be considered and agreed upon order to properly set-up relevant IT e-invoicing solutions.

Primarily, it needs to be underlined that Egyptian e-invoices contain a lot of different codes and classifications. Apart from the aforementioned GPC/GS1 product classification, it is required to precisely define the tax type and subtype shown in a particular invoice, for example. There are 20 codes describing types of tax. For instance, T1 stands for VAT, T7 for entertainment tax, and T14 for stamping tax. Moreover, there are more than 50 tax subtype codes, including 9 subtypes valid only for T1 (VAT), including V001 for export, and V006 for exempt supplies to defence and national security bodies, for example.

Such a detailed level of classification requires a lot of data mapping, from the ERP system to the e-invoice format. Mappings need to be preceded with a number of in-depth analysis performed by the taxpayer.

Last but not least, Egyptian e-invoicing introduces an extremely high precision standard in showing values. Most of the fields in the Egyptian e-invoice are precise to five decimals. Usually, taxpayer ERP does not rely on such a high level of detail. Appropriate rounding needs to be discussed when transferring numbers from the ERP to required Egyptian e-invoicing standards.