Japan is currently somewhere in the halfway of the process of developing and implementing the e-Invoicing mandate. For the purpose of the digitalization reform a dedicated body was established back in July 2020 – E-Invoice Promotion Association (EIPA). The main objective of the organization is to enable countrywide implementation of the e-Invoicing standard which could be used by all businesses. The e-Invoicing model forms part of the reform of the Japanese Consumption Tax system and is closely linked to the taxation regulations. The major tax change that is expected for the businesses is that the tax credit will be claimed exclusively based on the qualified electronic invoice.

Background

In the existing regulatory environment the businesses are to much extent still based on paper-based exchange of documents (in the past it would be the standard way of dealing with documents). The already available digitalization (EDI, invoices sent by email, etc.) has already brought some ease in this respect, however there is still a mix of analog and digital processes which does make the situation significantly efficient.

What is worth mentioning is that the e-Invoicing reform will completely redefine the meaning of a tax document (invoice). Historically, the invoice was not considered as a document which is formally required for tax deduction purposes (which is very uncommon across jurisdictions where VAT applies). It is expected that this will significantly impact the whole invoicing and tax compliance process for Japanese taxpayers.

Japanese e-Invoicing concept

The efficiency and productivity improvement itself are the cornerstones of the upcoming digital change in Japan. It is worth noting that EIPA in its activity is not only focused on digitalization of the invoices. The overall concept is wider and aims “to promote the “digitalization” of the entire back-office operations of business operators through the utilization and popularization of digital invoices (standardized and structured electronic invoices) in Japan.”

Japan Data Model based on PINT, Koichiro (Kay) Okamoto, November 29th, 2021

Digitalization model in Japan shall not only enable full connection of digital data between invoice issuance and payment process, but would go beyond and include the subsequent processes of accounting and taxation, such as reconciliation of deposits. It is also expected that such a comprehensive approach will inevitably result in the further digitalization of the related processes such as contracts and ordering.

PINT – Japanese e-Invoice specification

From the start the Japanese government and EIPA has considered the Peppol as a standard for e-Invoicing for Japanese businesses and from January 2021 they have been working together to develop a Japanese specification that will meet Japanese legal/business requirements. As a result EIPA/OpenPeppol agreed to use PINT (Peppol International Invoicing Model) as the starting point of Japanese specification. PINT is based on the BIS Billing 3.0, which is on one hand a compliant restriction (CIUS) of the EN 16931 but on the other hand is generalized to accommodate international needs and allows certain deviations.

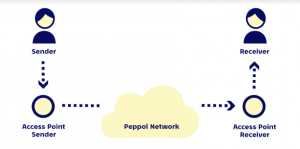

The Japan e-Invoicing shall be based on a so called “4 corner” model which means that

- the user (Sender) generates invoice data with its own machine system (billing management system, etc.),

- sends it through its own access point (Access Point Sender) via the Peppol network

- the generated invoice data is sent to the buyer’s access point (Access Point Receiver),

- The invoice data is further transferred to the buyer’s (Receiver) machine system (purchase management system, etc.).

Graph 1. Four corner model, Peppol, https://peppol.com/blog/what-is-peppol/

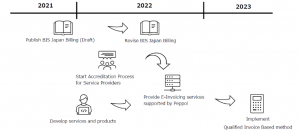

E-invoicing implementation timelines

According to the plan in October 2023 the final regulations shall become binding and the tax deduction for consumption tax will only be allowed based on the qualified e-Invoice, i.e. an electronic invoice issued according to a predefined standard. Before this will become reality Japanese businesses continue to use the Traditional Invoice Retention System which has been in operation since 2019.

To obtain certification, businesses are able to apply to the National Tax Agency as of 1st October 2021. The last date for application is 31 March 2023 to ensure the process is completed in time for 1st October 2023, post which the National Tax Agency will publish all registered operators, with their ID numbers.

The e-Invoice service providers as well as businesses would now be able to use and test Peppol e-Invoice model before final implementation will take place. EIPA would be encouraged to take this opportunity in order to take most of the preparation phase.

Graph 2: EIPA presentation: Current Initiative for E-Invoice in Japan; Hiroyuki Kato (Digital Agency, Government of Japan); 2021.11.30

Get ready for e-Invoicing

The current phase of e-Invoice implementation requires actions to be taken by the stakeholders in order to get prepared for the upcoming digitalization. Currently the e-Invoice service providers are obtaining relevant certifications whereas the businesses shall start preparations in terms of accounting systems and internal procedures.

Additionally, the businesses will need to be registered as a business issuing qualified invoices. This status will enable compliance with the regulations as of 1st October 2023. In order to obtain that status the businesses are required to submit an “Application for Registration of a Qualified Invoicing Business” by 31st March 2023. Before the go-live date the businesses will also have to adjust their systems so that they will be able to issue the electronic invoices in the prescribed format. In particular there will be a number of additional information that will constitute mandatory elements of the invoice (e.g. tax registration number, tax rate, tax amount, etc.)

The final transition to e-Invoicing in Japan should significantly improve the efficiency of business. Nevertheless, before the benefits become tangible, the transition means that business operators must do their homework now and prepare their IT infrastructure and internal processes to accommodate the digitalized transaction model.