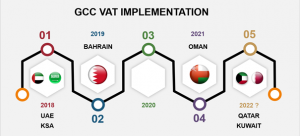

Back in June 2016, the Gulf Cooperation Council (GCC) took a critical step when it enforced regulations to launch the process of implementing its VAT regime across the six countries that form the GCC; namely, the United Arab Emirates (UAE), the Kingdom of Saudi Arabia, the Sultanate of Oman, Qatar, Kuwait, and the Kingdom of Bahrain. The implementation was based on the Common VAT Agreement signed by all six states.

Three years have already passed since the first implementation, and the process is still pending. The current state of play shows four countries having completed the implementation (the United Arab Emirates, Saudi Arabia, Bahrain, and Oman) and two still planning to get it done (Qatar and Kuwait). The expected dates of introduction for Qatar and Kuwait are still not finalized. Given the delays in other countries and the continued challenges of the Covid-19 pandemic, this may still take some time.

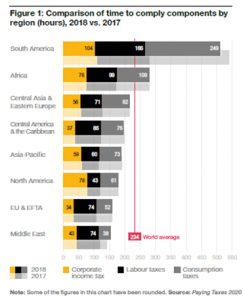

The current GCC outlook seems positive considering the extremely low standard VAT rate (5%) but also taking into account the compliance burden on taxpayers. As analyses have shown (for example, the Paying Taxes 2020 report by PwC), the Middle East region, including the GCC, has the lowest indicator of the time spent on tax (VAT compliance).

Estimated time spent on tax compliance (for consumption taxes) in the Middle East is around 40 hours, whereas the global average is 93 hours (based on data available for 2018). It is largely thanks to the high level of digitalization used in the overall compliance process (such as online registration, and VAT return preparation and submission). Additionally, it must be underlined that fairly simple VAT return layout (which emulates the rather simple models used in Dutch, British, and Irish templates) plays a vital role in making taxpayers’ lives much easier in the Middle East region and the GCC.

Below is a short snapshot across GCC jurisdictions from the perspective of the introduction of VAT.

THE UNITED ARAB EMIRATES

The UAE (together with Saudi Arabia) was one of the first countries to introduce VAT on 1 January 2018, marking the beginning of a completely new chapter in the history of VAT and the Middle East region.

The UAE implemented a 5% VAT rate and a range of (standard) exemptions for a selection of transactions (such as healthcare, education, financial services).

The main tax authority in the UAE is the central Federal Tax Authority (FTA), which governs VAT across all emirates. What is interesting is that VAT income is supposed to be shared proportionally between central and emirate-level administrations based on the defined place of supply (this information has to be disclosed in the VAT return). According to the UAE Ministry of Finance, VAT revenues are constantly rising, reaching AED 29 million in the first year (2018), followed by a 7% increase in 2019 (to AED 31 million). Between January and August 2020, the UAE collected AED 11.6 billion.

The UAE is also trying to catch up with global indirect tax trends and introduced, for example, a SAF-T-type report (to be presented on demand during tax audits) and more recently e-commerce regulations. On the other hand, there still seems to be little progress towards spreading the e-invoicing model (currently available only as an option).

THE KINGDOM OF SAUDI ARABIA

The Kingdom of Saudi Arabia decided to pave the way to VAT implementation in parallel with the UAE. As in the UAE, VAT was introduced on 1st January 2018 with standard rate of 5%. However, KSA decided last year that it would raise the standard rate to 15%, which is a pretty unprecedented move in the VAT world. While the introduction of 5% VAT already seems to be impacting the local economy (prices, consumers, and taxpayers), the hike of the rate to 15% will definitely have adverse consequences.

The Saudi government already announced (on 27th April 2021) that the 15% VAT rate is temporary, and that within a maximum of five years’ time it will be reduced to between 5% and 10%. The timeframe would largely depend on how fast the situation in KSA will stabilize after the Covid-19-induced downturn.

The KSA government recognized that fraud and the shadow economy are among biggest reasons for decreased tax revenue. Therefore, by the end of December 2021, the e-invoicing law in KSA will come into force. As of that date, all taxpayers who are resident in KSA will be obliged to issue electronic invoices, direct debits, and credits for all transactions and taxable deliveries.

BAHRAIN

As announced by the country’s Finance and National Economy Minister, Bahrain generated BD 250 million last year from VAT, which exceeded expectations by 150%. Although the numbers are quite impressive, this is the smallest GCC economy, and is continuously struggling with a mix of challenges, most recently the coronavirus pandemic and a fall in oil prices.

Bahrain took the third place (trailing the UAE and KSA) in the VAT implementation race. VAT regulations came into force on 1 January 2019 with a standard rate of 5%. However, the registration obligation was gradually extended during 2019, starting from the highest revenue entities and eventually including all businesses with an annual turnover of BD 37,500.

OMAN

On 16 April 2021, the fourth VAT jurisdiction was created in the GCC region, this time in Oman. Apart from the implementation of VAT, the Omani government introduced excise duty on sugar drinks and tobacco in 2019 (similarly to the UAE), and is planning to introduce personal income tax for wealthy individuals, which currently does not exist in any GCC country, from 2022.

QATAR AND KUWAIT

There is currently no official date of implementation for any of these countries. Some sources mention 2022 as the year these two countries might make VAT operational.

Conclusion

As we can see, the implementation of the VAT law in the GCC region is now well underway, and is much closer to reaching the objective of having all six GCC jurisdictions under a VAT regime. As of April 2021, the majority of the member states had implemented VAT. It is now hard to predict when the process will be completed as the unexpected Covid-19 situation is now top of the list of government priorities. On the other hand, the negative impact on the public budget may as well become a trigger for a speeding the implementation of this additional source of revenue.