Standard Audit File for Tax (SAF-T)

What is the Standard Audit File for Tax (SAF-T)?

SAF-T is an international standard created by the OECD in 2005 for the electronic exchange of accounting data between businesses and tax authorities. A revised Version 2.0 was released in 2010 to accommodate more complex financial reporting. Its main objective is to enable digital tax audits by harmonizing how accounting data is transmitted.

It is important to note that not all OECD countries use SAF-T. For example, the United Kingdom chose a different approach with its Making Tax Digital (MTD) initiative, focusing on digital VAT submissions rather than comprehensive audit files.

SAF-T also goes beyond VAT. Depending on local legislation, the file may include general ledger records, accounts receivable and payable, inventory information, and even payroll data. This flexibility makes SAF-T a versatile tool that can support a wide range of tax and compliance needs.

What is VAT Reporting?

VAT reporting is a summary of a business’s transactional records, including sales and purchases, taxable amounts, and VAT information. It is usually submitted monthly or quarterly, depending on a country’s legislation. The most common formats in the EU are VAT declarations (VAT returns) and SAF-T files. In many countries, the electronic audit file (SAF-T) is expected to gradually replace traditional VAT returns.

VAT reporting is central to EU tax compliance because Value Added Tax is one of the largest sources of revenue for member states, yet it is also one of the most vulnerable to fraud. The so-called “VAT gap” — the difference between expected VAT revenue and what is actually collected — remains significant across Europe. By digitalizing VAT reporting, tax authorities can detect discrepancies faster, minimize fraud schemes such as carousel fraud, and ensure more accurate, transparent collection.

Traditional VAT Returns vs. SAF-T

Traditional VAT returns provided only an aggregated picture of tax obligations. Businesses would submit manual forms or online templates summarizing total sales, purchases, and VAT payable. While useful, these reports lacked transaction-level detail and made it difficult for authorities to verify accuracy.

By contrast, SAF-T requires structured XML files containing granular records of invoices, ledgers, and customer data. This shift enables automated cross-checks between buyers and suppliers, real-time identification of irregularities, and a much stronger defense against VAT fraud. Put simply, VAT returns answer “How much tax is due?”, while SAF-T explains “Which transactions generated that tax?”

SAF-T Format and Technical Structure

The SAF-T format is based on XML to ensure consistency, machine readability, and cross-border compatibility.

- Core OECD Structure: Elements such as <Customer>, <Supplier>, <Invoice>, and <TaxTable> define universal building blocks.

- Local Adaptations: Each jurisdiction customizes the schema. For example, Portugal’s SAF-T (PT) requires additional fields for cash registers, while Poland’s JPK structure integrates VAT return data into the XML file.

SAF-T Schema

Although SAF-T in different countries has a similar format based on OECD SAF-T SCHEMA VERSION 2.0, every country’s legislation defines the mandatory fields to be filled in the report differently. So a business has to consider the specific rules and standards of the country in which it has reporting obligations.

Because of this dual system — OECD baseline plus national adaptation — companies must configure their ERP or accounting software to generate the correct file. This often involves custom mapping of accounts, adjusting tax codes, or modifying currency and language formats.

What is the SAF-T Line?

A SAF-T line represents a single transaction, whether it is an invoice line, a journal entry, or a ledger posting. Each line contains detailed fields such as transaction date, taxable amount, VAT rate, and VAT amount.

This level of granularity allows auditors to trace transactions from source documents to VAT declarations, ensuring accuracy and reducing opportunities for fraud.

What is the SAF-T Process?

The SAF-T process generally follows four main steps:

- Data Extraction – Accounting and transactional data is pulled from ERP systems such as SAP, Oracle, or Microsoft Dynamics. This includes invoices, ledgers, and customer data.

- Mapping to Local Schema – Extracted data is aligned with the national SAF-T format. For example, companies in Poland must map their chart of accounts to the JPK_V7 structure, while Portugal requires mapping for specific invoice categories.

- File Validation – The generated XML file must be tested for errors. Tax authorities often provide online validators: Portugal has the e-fatura portal, while Poland offers a JPK test environment.

- Submission – The validated file is submitted to the tax authority. Submission may be done manually via a government web portal or automatically through API integration, depending on national requirements.

This process ensures both technical accuracy and legal compliance.

How to Insert a SAF-T?

A SAF-T file is typically generated using ERP or accounting software, such as the SNI SAF-T solution. Once the file is created, companies can choose between:

- Manual Uploads – Suitable for smaller businesses but prone to errors or delays.

- Automated Submissions via API – Preferred by larger enterprises to ensure timely and consistent reporting.

Best practices include performing regular reconciliations between SAF-T data and VAT returns, running test submissions ahead of deadlines, and maintaining strict internal controls to avoid discrepancies.

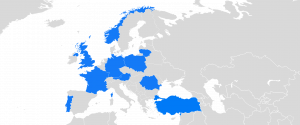

SAF-T Reporting Requirements in Europe

SAF-T has been adopted across multiple European countries, with varying scope and frequency:

- Portugal: Monthly submission of SAF-T (PT) files is mandatory for invoices and ledgers.

- Poland: Since 2020, the JPK_V7 file combines VAT return and transaction-level data into one submission.

- Norway: SAF-T mandatory since 2020, but only required upon request.

- Austria: SAF-T files are requested during audits but not submitted periodically.

- France : SAF-T is required primarily for audits, with gradual alignment towards digital reporting.

- Romania: Submission of SAF-T (RO) files is mandatory as of 2022. Three different types of SAFT report are covered by Romanian regulation: standard monthly, annual asset and on request stock reports.

The overall trend is clear: countries are moving from “on request” audit files toward regular, periodic, and even real-time reporting.

Benefits of SAF-T

For Tax Authorities:

- Enables faster and more targeted audits.

- Enhances fraud detection and reduces the VAT gap.

- Promotes cross-border cooperation thanks to a common standard.

For Businesses:

- Automates data preparation, reducing manual workload.

- Ensures compliance with national rules within a global framework.

- Improves financial data management through structured reporting.

- Reduces administrative costs and audit disruptions.

What are the benefits of SAF-T?

It makes tax audit much simpler and less costly for tax authorities. The ultimate goal is to reduce the VAT fraud and VAT gap. On the other hand, automated reporting of VAT data simplifies the reporting process for companies.

The SNI SAP solution enables smooth and automated extraction of financial data. These data are then processed and converted into XML files. Users can monitor this process easily through the SNI SAF-T Cockpit. Finally, the XML files are submitted to the tax authority through an SNI Connector.

Conclusion

VAT returns have traditionally formed the backbone of tax reporting, but they are no longer sufficient in an increasingly digital economy. The Standard Audit File for Tax (SAF-T) provides a more detailed, standardized, and transparent system, benefiting both businesses and tax authorities.

As Europe moves forward with the VAT in the Digital Age (ViDA) initiative, SAF-T is expected to converge further with e-invoicing and real-time reporting frameworks. This evolution signals a future where digital compliance is not just about submitting totals, but about delivering complete, verifiable transaction histories in standardized formats.