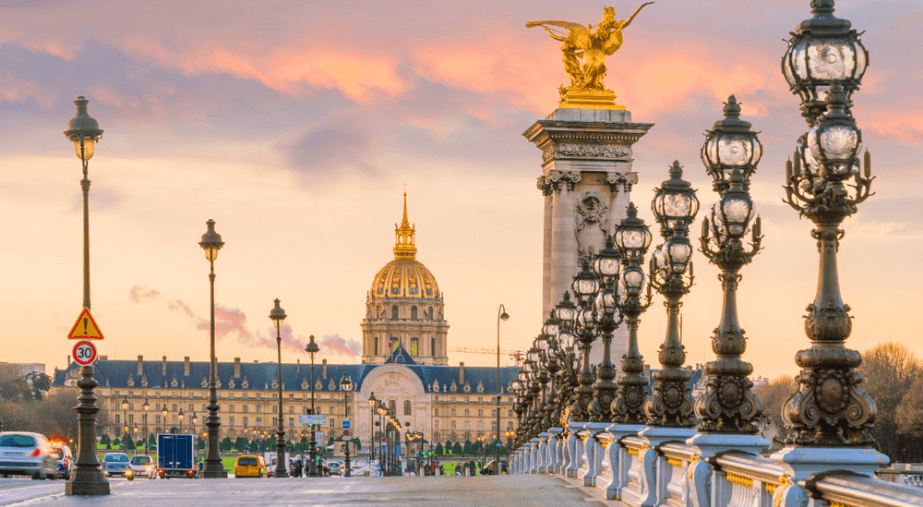

Prior to the beginning of mandatory e-Invoicing for large companies on July 1, 2024 France has announced a pilot program for e-Invoicing which will

SNI © 2025 All Rights Reserved.