Published: February 2024

SAP Document and Reporting Compliance is an advanced solution that facilitates the seamless creation, processing, and electronic transmission of documents and legal reports. The advancement of technology and digitalization require global businesses to develop a comprehensive understanding of compliance for electronic documents and reports.

Tax authorities worldwide are increasingly introducing more complex and frequent obligations. Companies are now required to submit documents such as VAT returns, EU Sales Lists, SAF-T files, or e-invoices in real-time or near real-time. The challenge arises from the variety of formats and submission deadlines across countries, creating significant complexity for businesses operating globally. Instead of maintaining multiple applications in each country, having a single integrated solution becomes critical for efficiency.

This comprehensive system covers a spectrum of reporting types, including e-Invoices, VAT returns, and EC sales lists, with further options. By leveraging this platform, users can effortlessly generate valid documents while tracking and fulfilling their legal obligations.

SAP Document and Reporting Compliance not only streamlines document creation but also provides a reliable mechanism for reporting various transactions, and empowering organizations to meet their reporting requirements efficiently and in compliance with relevant regulations.

Electronic reporting regulations are gradually widening in many countries.The business world is far too familiar with the limitations of paper-based systems. Today, more than 80% of all documents are executed electronically through digital data storage devices, and this trend is gaining momentum.

If you are a business owner, a taxpayer, an accountant, or an IT executive, read on to understand why e-Invoice and e-document compliance are essential, and explore the main benefits of the SAP Document and Reporting Compliance framework that we support, including:

- No additional subscription needed

- Single vendor globally

- Comprehensive end-to-end solutions

- Expertise supporting various ERP systems

- Regulatory updates

- Fast processing times

What is an electronic document?

An eDocument is any transaction document that is exchanged between businesses in electronic format.

The main aim of using eDocument is to eliminate paper, which leads to time savings, higher efficiency and productivity, and the promotion of sustainable business practices.

What is the SAP Document and Reporting Compliance?

The SAP DRC solution is used to create electronic documents, including invoices, waybills, debit and credit notes, VAT returns, and EC sales lists, and to archive transactional data created in the SAP ECC or S/4HANA system into predefined exchange formats. These are then transferred electronically to external entities like legal or tax authorities.

SAP Document and Reporting Compliance currently supports around 500 scenarios across 57 countries, including the most recent e-invoicing mandates in Poland, Romania, Slovakia, and Egypt. This broad coverage allows companies to manage diverse electronic reporting and invoicing obligations from one central solution.

Generally, the SAP DRC is managed by the government. It often contains special fields and values that require specific information (such as VAT numbers, tax amounts, product prices, time periods etc.). The module allows you to create these documents with the specific values and fields required by the government, and to store and manage them in accordance with each country’s laws and regulations, thereby saving you time and effort.

How does SAP Document and Reporting Compliance work?

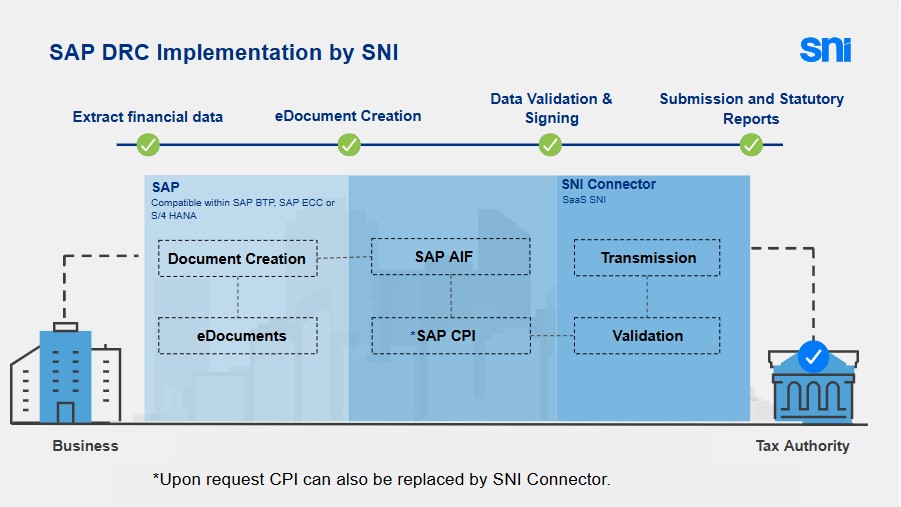

SAP provides a country-specific document format for each new legal requirement, based on the SAP Document and Reporting Compliance Framework. It uses two other major SAP Components:

- The SAP DRC Framework generates electronic documents created by source applications in SAP ECC and S/4HANA. This is an open framework, where currently SAP customers and partners create and provide compliance-related solutions.

- The SAP Application Interface Framework (AIF) is used to map transactional data to the prescribed format (such as XML) and enables SAP Document and Reporting Compliance to interface between source applications and SAP Cloud Platform Integration.

- The SAP Cloud Platform Integration (CPI) is used to communicate with external systems using web services. Pre-built, end-to-end integration packages enable validations and authentication (digital signature), sending eDocuments to the tax authorities or other public administration, and receiving responses to the back-end system.

The SAP DRC process starts with the creation of source documents in SAP ECC or S/4HANA. From these, eDocuments are generated and converted into the required formats before being transmitted to the tax authority’s platform. Each document’s processing status is continuously monitored, and updates are reflected in the application, enabling full end-to-end visibility.

For each country-specific scenario, SAP DRC operates through one of two services: the SAP Document and Reporting Compliance, cloud edition (SAP-managed) or the SAP Integration Suite (customer-managed). Only one of these applies per country, and they are not interchangeable. This ensures a clear, reliable approach to meeting local compliance requirements.

How can you integrate SAP ECC and SAP S/4HANA with SNI?

Whether you are an SAP or non-SAP user, SNI provides integration platform options for any preferred installation.

Addressing all these processes, SNI provides an SAP Document and Reporting Compliance platform, which covers all three steps that are necessary for digital tax reporting and e-Invoicing:

- Data retrieval from SAP ECC and SAP S/4HANA

- Data mapping and processing (creation of XML file)

- Communication with tax authorities and archiving

Businesses must first extract the relevant invoice data from core modules (SD, MM, FI) to use these solutions. Those using the SAP Document and Reporting Compliance Framework can later view this data on the SAP monitor. For businesses that do not want to subscribe to SAP integration packages (CPI), SNI offers a solution service package that will convert source data into the stipulated file format and submit it to the tax office in accordance with legislation.

SNI’s SAP DRC integration package prepares a file that will be submitted to the tax office in accordance with regulations by converting the source data into the mandatory file format. Then, depending on the legislation, it performs the necessary steps before submission (certification, digital signatures, schema controls), before submitting the electronic invoice to the relevant tax authority. These steps can be done through the customer’s in-house server or SNI cloud server.

The main benefits of using SNI’s solution for the SAP Document and Reporting Compliance Framework:

- The required regulatory compliance is provided with the standard SAP Document and Reporting Compliance Framework without the need for an additional license or subscription.

- It does not require the installation of SAP OSS Notes, thus providing convenience in the integration process.

- Ensuring compatibility is extremely important. Our commitment includes actively liaising with tax authorities to ensure you are continually informed about changes that may impact your operations.

- There is absolutely no need to use a third-party SAP consultant when using the SNI solution, thus saving you time and money.

- SNI’s solutions are highly compatible with most SAP versions (ECC 4.7 and Higher R3 Versions, S/4HANA), so there is absolutely no need to upgrade your systems.

- Maintenance and support for your system is diligently handled, with any arising issues addressed promptly within the defined standard SLA (Service Level Agreement) periods. This commitment ensures that your operations continue smoothly, and concerns are resolved in a timely manner.

How can SNI help you?

SNI provides the End-to-End DRC Implementation Package, a turnkey DRC implementation that covers all tax and regulation requirements, and submits documents in line with tax authorities’ requirements and global regulations. As such, you will not need an external tax or SAP consultant.

We also provide ongoing support and regulatory updates. We keep track of all regulation updates on your behalf and provide necessary technical solutions as they are needed, so there is no need to follow and implement OSS notes with consultants. SNI’s DRC solutions are at your disposal.

SNI does not require additional licenses for DRC implementation. It provides an easily integrated SAP DRC solution with its network of experienced experts and business partners. The solution is compatible with most SAP versions (such as SAP ECC, S4/HANA, or any ERP system) and there is no need to upgrade your systems. You will not need to enlist a third-party SAP consultant when utilizing the SNI solution, which also eliminates the need to install SAP OSS Notes, making for a more convenient integration process. Gain a strong global partner with an all-in-one solution for e-Invoicing and tax reporting.

The benefits we provide include affiliation, end-to-end package, affordable pricing, and being the sole vendor globally.

Our most significant contributions are:

- End-to-end SAP DRC implementation Package

- No need for external tax or SAP consultants.

- Includes all tax and regulation requirements

- Document submission in line with tax authorities globally

- Eliminates the need for multiple vendors in different countries

- No unexpected costs for regulative updates

- Easily scalable for other countries

- Global coverage (EMEA, APAC, LATAM)

- Regulatory Updates: We track regulatory updates and notify you, taking necessary actions.

- Support Maintenance: With our extensive support team, we swiftly provide all kinds of support efficiently.

- Tax Authority Communication: We handle communication with tax authorities.

We offer a single package in the most crucial four steps, becoming your sole vendor throughout the entire process, including for global accounts. We are here to save you time and money.