The Hungarian Ministry for National Economy has introduced a tax audit report, called Adóhatósági Ellenőrzési Adatszolgáltatás (data export for tax authority review), through Decree 23/2014. The common name is RFHUAUDIT, derived from the SAP audit report product for Hungary.

RFHUAUDIT Audit Report is to be generated in XML file format and submitted to the State Tax and Customs Administration on request. The pilot program has already started for large businesses and technology providers. The new SAF-T requirements are scheduled for 2022.

Technical outline of the Tax Audit Report

The main content of the invoice includes data on the export stock of invoices, invoice headers, account issuer details, account recipient details, representative details, and product and service item details.

- Details of invoice header, including account serial number, account type, invoice date, and date of completion;

- Details of account issuer, including tax number, public tax ID number, and issuer’s personal information (name, address, etc);

- Details of account recipient, including recipient tax number, public tax ID number, and recipient’s personal information (name, address, etc)

- Details of representative, including tax number, name, and address;

- Details of product and services item sold, including name, quantity, unit price, and commodity code (based on SZJ classification).

How can the SNI SAP solution help you with RFHUAUDIT?

At SNI, our primary objective is to be the global partner to help our customers remain compliant in this new digital world.

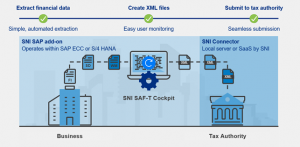

The SNI SAP solution enables the smooth and automated extraction of financial data.

- Firstly, businesses must locate and extract all financial transactions data.

- This data is then formatted as XML files, which are submitted to the tax authority.

- Users can monitor this process easily through the SNI Cockpit.

- Finally, the XML files are submitted to the tax authority.

With SNI’s add on, you can meet your tax obligations with ease and stay compliant in this new digital world.

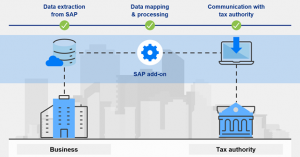

SNI covers all three main layers for digital tax reporting and regulatory compliance.

- Data extraction from SAP

- Data mapping and processing

- Communication with tax authorities

All three steps are contained within a single SAP solution, eliminating the need for any external or third-party systems or services.

Benefits for SAP users

For SAP user companies, SNI provides easily integrated solutions maximised for your existing systems and infrastructure.

- Our solutions can be easily integrated without requiring the installation of SAP OSS notes.

- There’s no need to employ a third-party SAP consultant, saving time and money.

- SNI’s solution is compatible with most SAP versions, meaning you won’t need to upgrade your systems.

- All SNI solutions are certified by SAP, so you can trust that they will run smoothly and reliably.

Support

We are dedicated to providing rounded and continuous support to our customers. After the initial implementation, training, and documentation is provided, we

- Help our customers in their transition with ongoing advice and assistance.

- Take care of maintenance and regulatory updates,

- Liaise with relevant tax authorities in order to keep you informed of any regulatory changes or developments.