Egypt Business-to-Business Electronic invoicing

Is e-Invoicing mandatory in Egypt?

e-Invoicing in Egypt has become mandatory for a list of companies.

The Egyptian Tax Authority (ETA) is obliging 134 large businesses to submit electronic invoices to the online portal of ETA as of 15 November 2020. ETA is responsible for the setup and control of the e-Invoicing clearance system. It defines e-Invoice as a digital document proving transactions of sale of goods and provision of services.

The e-Invoicing obligation for Egyptian companies will gradually extend to other taxpayers after January 2021. It is part of the government’s plan for full digitalization of its services.

Four main properties of e-Invoices listed by ETA:

- They have specific components and characteristics,

- They are prepared and signed electronically,

- They are sent and received by the taxpayer through the system, and

- They are reviewed and verified by the tax authority,

This means ETA will first validate and approve the supplier invoices before they are sent to the customers.

How does the new e-Invoicing system in Egypt work?

Companies compelled to use the new electronic invoicing system in Egypt will be required to register with the system by contacting ETA. After successful registration, the client information will be provided to transmit invoices and receipts in XML or JSON data format. The system will allow cancellation and rejection of invoices that have been issued incorrectly. Information such as tax identification number, national ID number, name, and domicile of the vendor are required in the purchase invoice. VAT declaration will be automatically filled via invoices.

Each invoice is digitally signed by a HSM (hardware security model) device and receives a unique ID to ensure data security of the transactions between companies. Separate schemes exist for credit note and debit note. Credit and debit notes have to include reference to the original document by providing its unique ID.

For the products supplied, companies will have to use the GS1 coding or an internal coding system linked to the Global Product Classification standards. The barcodes are used to provide standardized product coding for international business communication.

How to implement e-Invoicing in ERP system?

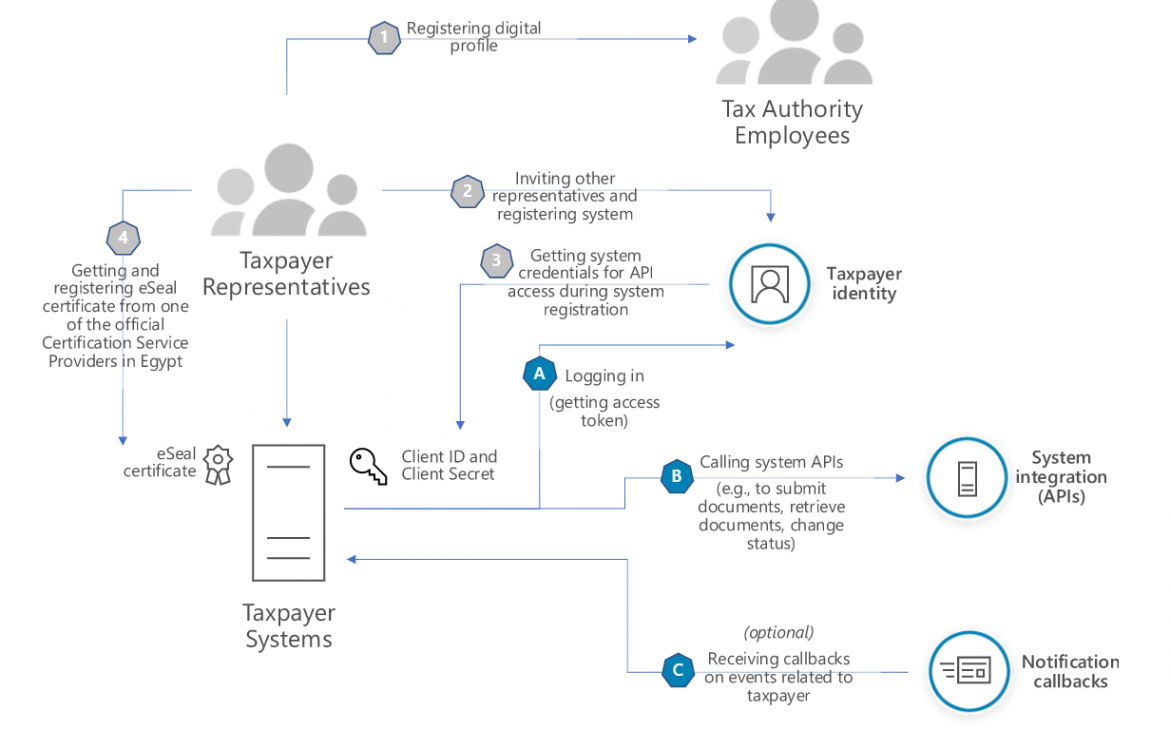

Egyptian tax authorities have published an overview of the steps to integrate the taxpayers’ ERP system with the electronic invoicing system.

- Registering digital profile

- Inviting other representatives and registering system

- Getting system credentials for API access during system registration

- Getting and registering eSeal certificate from one of the official Certification Service Providers in Egypt

- Logging in (getting access token)

- Calling system APIs (e.g., to submit documents, retrieve documents, change status)

- (optional) Receiving callbacks on events related to taxpayer

How can SNI help you?

SNI offers an end-to-end solution for compliance with the requirements provided by the Tax Authority in India. The solution performs data retrieval from our clients’ ERP systems, data mapping, processing, and communication with tax authorities in the presence of a government portal.

With this solution, end users can easily create e-invoices and monitor the XML and human readable HTML/PDF format and collect them in the user-friendly cockpit.

SNI’s solution provides complete support for both outbound and inbound invoices. Outbound invoices are transmitted to the tax authorities through official APIs or web services. Similarly, for inbound invoices (issued by suppliers to clients), solution automatically retrieves data at regular intervals using the appropriate APIs or web services provided by the tax authorities.

All inbound invoices are displayed on SNI’s Inbound Cockpit, a dedicated interface designed to enhance the user experience and allow efficient management. Each invoice is available in both XML and (human-readable) HTML/PDF formats, ensuring detailed insight and compliance with regulatory requirements.

SNI’s invoice reconciliation feature offers seamless validation of incoming invoices by automatically matching them with purchase orders, delivery notes, or other internal records. This feature simplifies the validation of incoming invoices, reduces manual effort, and minimizes errors thus offering a quick resolution. With enhanced accuracy and efficiency, businesses can gain better control over their financial workflows and ensure smooth operations.

SNI solution integrates with clients’ systems without the need for updates to existing system versions and is independent of SAP versions. SNI’s SAP solution is compatible with SAP ECC 4.7 and above, as well as SAP Business Technology Platform (BTP), SAP R3 and SAP S/4HANA. In addition, SNI provides ERP-independent solutions designed to integrate with any ERP system clients may use.