Electronic tax requirements are becoming more and more common, and not only among EU countries. It is worth mentioning recent developments in Egypt e-invoicing, the Kingdom of Saudi Arabia e-invoice resolution, and the United States e-invoicing market pilot. As the latest country set to join this club, Serbia is implementing mandatory e-invoicing from May 2022. Phase one will see it applied to the public sector.

Legal background

The introduction of electronic invoicing in Serbia is mainly based on act no 44/2021, which dates to April 29, 2021. This legislation regulates issuance, delivery, receipt, processing, and storage of electronic invoices, as well as their content. It also provides a framework for the e-invoicing system, which will be managed by the Serbian government.

The entry into force of obligatory e-invoicing in Serbia will be rolled out in these stages:

⎯ The obligation of a public sector entity to receive and keep an electronic invoice issued, as well as the obligation to issue an electronic invoice to another public sector entity, will apply from May 2022.

⎯ The obligation of a public sector entity to issue an electronic invoice to a private sector entity will apply from July 1, 2022.

⎯ The obligation of a private sector entity to issue an electronic invoice to a public sector entity will apply from May 2022.

⎯ The obligation of a private sector entity to receive and keep an electronic invoice issued by a public sector entity, as well as electronic invoices issued by a private sector entity, will apply from 1 July, 2022.

⎯ The obligation to issue and keep electronic invoices in transactions between private sector entities shall apply from 1 January 2023.

Non-compliance with the electronic invoicing requirement is subject to penalties of up to 2 million Serbian dinars (around 17,000 euros).

Technical outline

In principle, the Serbian e-invoicing system follows the so-called clearance model, which is already in place for example in Italy (SdI). This means that transmission and preliminary validation of electronic invoices is performed through an interface that is managed by the tax authorities. In Serbia, the national e-invoicing system is simply called the Sistem E-Faktura (www.efaktura.gov.rs). In addition, an ancillary system has been introduced to help taxpayers with the processing and storage of invoices, the Sistem za Upravljanje Fakturama (SUF), which can be found at www.esuf.rs and www.esuf.gov.rs.

To start using the electronic invoicing system, a taxpayer first needs to register through the dedicated portal, which can be accessed at www.eid.gov.rs. Registration requires authentication using a qualified electronic certificate.

There are two main ways of creating, submitting, and receiving Serbian electronic invoices:

1) Manually through the e-invoicing portal

2) Directly from the taxpayer ERP system, such as through SAP using a dedicated API (application programming interface) provided by the Serbian tax authorities

Small taxpayers that do not issue a lot of invoices may want to take the manual option. However, for medium-sized and large taxpayers, which are likely to have comprehensive ERP systems, there is no practical alternative to connecting their ERP to the national electronic invoicing system through an API.

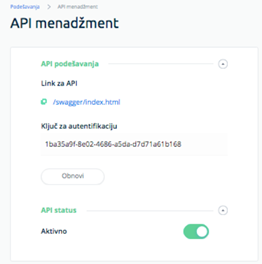

The Serbian e-invoicing API is REST API, which offers a number of methods for enabling communication with the government’s system. For example, issuing an invoice needs to be done using the ‘POST’ method. Once this has been performed successfully, the taxpayer receives a JSON response containing a unique invoice identifier (salesInvoiceId key). In order to use the API, taxpayers need to turn it on and generate a dedicated identification key. This should be done through the e-invoice portal (www.efaktura.gov.rs).

Similar to most e-tax requirements, Serbian electronic invoices need to be issued in XML format. Serbian XML e-invoices need to be in line with the UBL 2.1. standard. UBL (universal business language) is a set of standardized XML business documents, such as purchase orders, invoices, and logistics documents. The UBL standard is maintained by the OASIS Open organization.

The content of Serbian e-invoices is demanding. There are dozens of fields to be provided in the XML file, covering seller and buyer data, product data on goods, detailed VAT data, payment instructions, and so on.

Moreover, each document needs to be marked with a specific code indicating the type of invoice. For example, 380 refers to a standard invoice, 384 to a corrective invoice, and 386 to an advance payment invoice. There are two more codes: 381 and 383 indicating very specific non-standard scenarios.

A separate dictionary of codes is introduced for VAT categories (the TaxCategory field). For example, ‘S’ means standard rate, ‘AE’ means reverse charge settlement, and ‘E’ means exempt from VAT.

High time to start implementation of e-Invoicing

Entities operating in the public sector should already start the implementation of solutions that enable transmission of e-invoices from May 2022. There is already a test environment (www.demoefaktura.mfin.gov.rs), provided by the Serbian Ministry of Finance, in which taxpayers can validate their systems.

However, companies that have to start using electronic invoices as of July 2022 (G2B) or January 2023 (B2B) should initiate steps towards the adoption of e-invoicing now. This is especially important given that there is not much information about Serbian e-invoicing available in English. Indeed, there is detailed technical guidance and even video instructions published by the Serbian tax authorities. However, all the resources are in Serbian. That might be an additional issue for multinational corporations, where many functions, such as IT or tax compliance, are centralized and e-invoicing is often managed by non-local employees.