Mexico has been using e-Invoicing, locally called CFDI, since 2004. The PAC (authorized certification provider) third party plays an important role for certifying and generating e-Invoices. The obligation of implementing e-Invoices and live reporting first started in 2011 for large taxpayers and was extended to all businesses, including all types of transactions such as B2G, B2B, B2C transactions, and has even covered cross-border transactions since 2014. Also, starting on July 1, 2023, taxpayers who issue payroll CFDI need to issue them in version 4.0. The CFDI is made up of an XML file and a PDF-readable version, and must be digitally certified by the SAT. The necessary archiving period for issuers and recipients is 5 years.

Generating the CFDI

On January 1, 2022, the CFDI system was updated to version 4.0. Since April 1, 2023, it has been the only applicable version. All taxpayers are obliged to register with the SAT (Servicio de Administración Tributaria) to become a federal taxpayer. Taxpayers also need to obtain a unique electronic signature key (FIEL) and digital stamp (CSD) from the SAT. To validate and stamp invoices, they must appoint an authorized provider of digital tax receipts (Proveedores Autorizados de Certificación, or PAC), which is also responsible for providing secure storage.

The CFDI is issued after the following process:

- Produce an e-Invoice with the customer with a unique vendor invoice number.

- Electronically transmit it to the PAC, which validates and returns it with the vendor’s CSD stamp.

- Simultaneously, the stamped CFDI is sent to the SAT by the PAC.

- The PDF version of the invoice is then produced by the vendor’s accounting system.

- The XML version of a CFDI needs to include the issuer’s FIEL.

- To cancel a CFDI, the vendor must submit a request to the PAC. Then, within 72, hours the customer needs to approve or reject the request. Credit will not be allowed.

The format of CFDI 4.0

The new CFDI electronic invoice will feature the following changes:

- Addition of reason for canceling invoices with four standard options.

- Addition of “Payment Conditions” (Condiciones de Pago).

- Inclusion of “Issuer” (Emisor) in the XML file.

- Addition of the “Credential” (Credencial) element in “RelatedDocument” (DocumentoRelacionado).

- Addition of a new “Discrepancy” (Discrepancia) element.

- Modification of the “Payment” (Pago) element.

- Modification of the “PaymentTerm” (Condiciones de Pago) element.

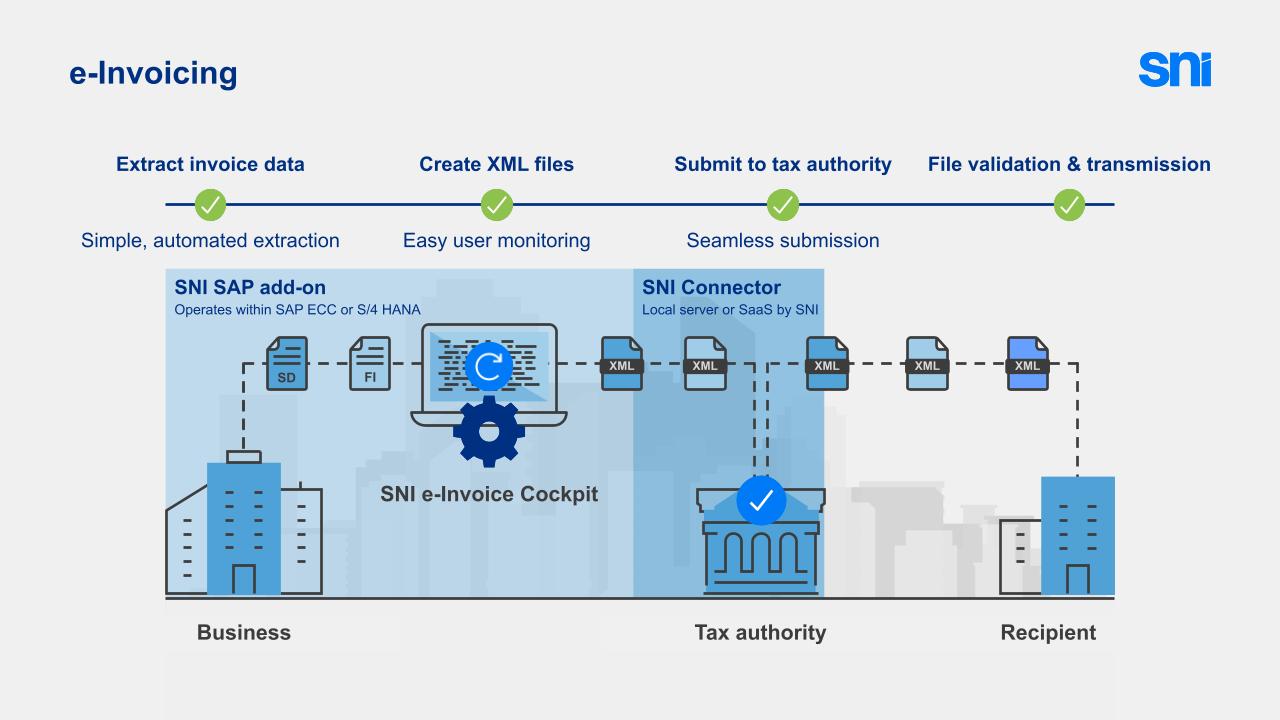

How can SNI help you?

The SNI offers an SAP add-on solution, which allows you to effortlessly produce invoices in the necessary format and seamlessly transmit them to authorized service providers for the Mexico B2B e-Invoicing system. Within the solution, you can streamline the processes of creating invoices and converting them into desired XML files through automation. Responsibility of signing and reporting CFDIs to the SAT lies with the approved service provider. SNI’s comprehensive SAP add-on solutions cover tasks such as data extraction, mapping, processing, and communication with the service provider, ensuring a seamless end-to-end e-invoicing experience.