What is e-bilanz in Germany?

E-bilanz, or the e-balance sheet, is a balance sheet in electronic form. According to Section 5b of the German Income Tax Act (EStG), certain taxpayers must submit the balance sheet with their income statement (profit and loss account) to the tax authority in electronic format. This reporting obligation began in 2014.

Who is obliged to submit e-bilanz?

The mandatory reporting of e-bilanz applies to the taxpayers (companies and individuals) who prepare financial statements and generate profit income (Gewinneinkünfte). These include:

- Traders in accordance with the commercial code.

- Non-traders, if the profit in the financial year exceeds EUR 60,000 or the turnover exceeds EUR 600,000.

- Self-employed individuals including farmers and foresters who are subject to accounting requirements or voluntary record keeping.

In addition, the electronic balance sheet must be prepared in the following cases:

- Opening a balance when setting up a company.

- Discontinuation of business in the event of a company sale or closure.

- Change of profit calculation method.

Anyone who has to perform an income surplus calculation (EÜR) is exempt from the process, and is therefore not affected by the e-balance sheet.

Which data format must the German e-balance sheet have?

The file format for electronic transmission is XBRL (eXtensible Business Reporting Language) which is an information standard for business reporting based on XML. It is specially developed for the automation of business information.

Taxpayers should use accounting software that supports the XBRL format. This format is mandatory for the electronic balance sheet.

What is the e-bilanz taxonomy?

The e-bilanz format is based on a special scheme called taxonomy, which can be changed annually by the Federal Ministry of Finance. In order to comply with requirements of e-bilanz reporting, every general ledger account of the taxpayer must be mapped to the taxonomy.

In addition to the main taxonomy, there exist special industry taxonomies (for example, for companies in the finance, insurance, health, or agricultural sectors). Due to the detailed structure of the taxonomies, mapping of general ledgers is a demanding process.

How to transmit the e-bilanz data

The electronic record is sent via the online portal of the fiscal authority (called ELSTER), for which a certificate is required. The certificate ensures the identification of the owner and allows them to send the electronic balance sheet via the ELSTER portal.

What data does the e-balance sheet have to transmit?

- the tax balance sheet or commercial balance sheet with reconciliation,

- the tax profit and loss account,

- the profit and loss account,

- for partnerships, the development of the capital accounts,

- for sole proprietorships and partnerships, the determination of the taxable profit,

- the fixed assets schedule (since 2017)

- the tax comparison of business assets (compulsory from 2021, but voluntary until then),

- tax modifications (such as reconciliation or reclassification).

How can SNI help you?

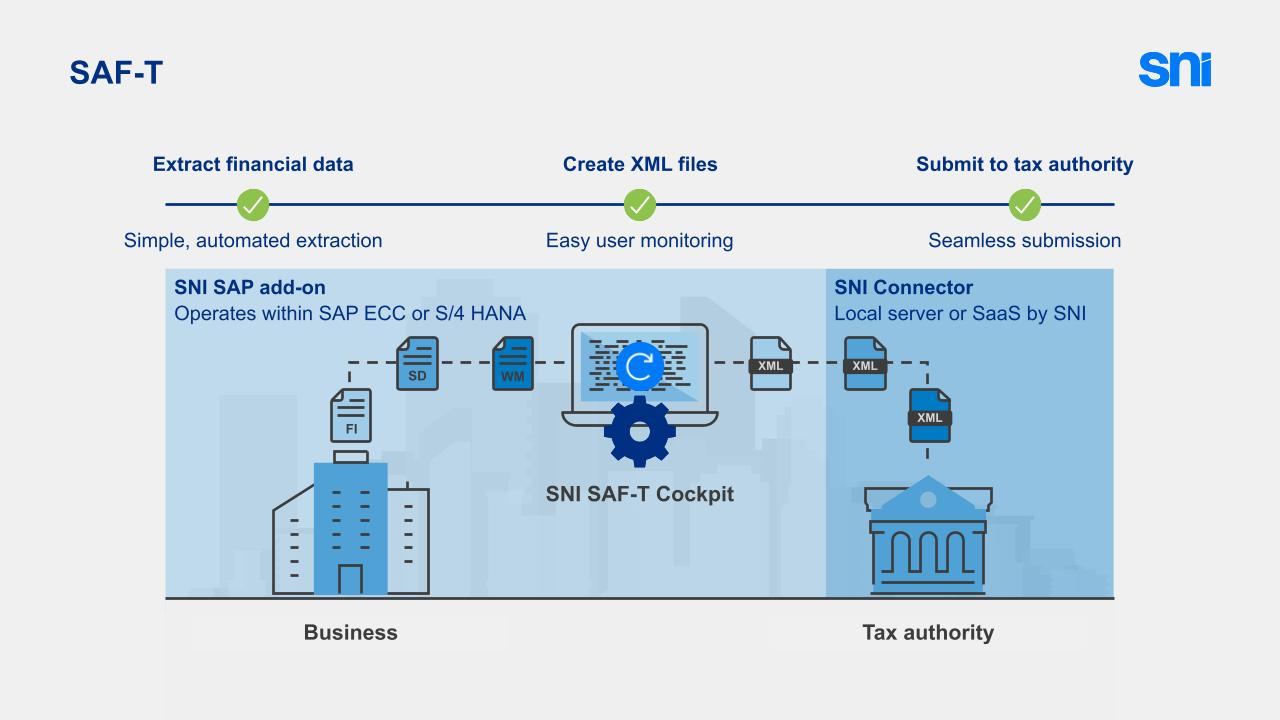

SNI’s solution is SAP certified, and works within SAP. The solution covers the mapping of general ledger accounts to the e-bilanz schemes (taxonomies). The electronic balance sheet and income statement document is created automatically from the extracted data in SAP. Finally, SNI delivers the e-documents to the government’s portal directly from SAP via a connector (on premise or in the cloud).

A single partner for all countries.

At SNI, our primary objective is to be the go-to global partner to help our customers remain compliant in this ever-changing digital world.

End-to-end solution: all three major steps in one single SAP add-on.

SNI covers all three 3 main layers of digital tax reporting:

- data extraction from SAP

- data mapping and processing

- communication with tax authorities