In Chile, the national tax authority is Servicio de Impuestos Internos (SII), and the local term for e-Invoices is Electronic Tax Documents (DTEs). Since 2018, B2B e-Invoicing has been mandatory for all taxpayers, and in Chile all invoices are subject to real-time validation by the SII, and the required format is XML. A digital signature (known as the Authorization Code) is provided by the Chilean tax authority and provides and additional layer of security and validity.

What are the technical details of the system?

To issue DTEs, businesses need to register with the SII. If registration is successful, a Folio Authorization Code (CAF) digital signature will be given. It has a unique series of whole numbers for each invoice, and it is valid for one year. To comply with the Chilean tax authority, e-Invoices must be sent with a valid CAF. After verification and confirmation, the CAF on the invoice can be stamped. For pre-approval, taxpayers need to submit e-Invoices in XML format to a certified solution provider. The invoicing numbering is controlled by the SII. After the validation by SII, the e-Invoice is returned to the service provider to be forwarded to the customer. Products must not be delivered before the SII’s confirmation. The invoice needs to be booked into the customer’s accounting system, before the supplier confirms with the customer receipt of the approved invoice through a digitally-signed notification.

What is the content of an invoice?

All invoices must include the following information to be accepted in Chile:

- Unique Sequential Number

- Supplier Details

- Customer Details

- Description of the goods/services

- Total amount due and payment method

- Rate and amount of VAT for goods/services

The invoice must be accepted or rejected by the customer within the tax authority’s stipulated eight days. Otherwise the e-Invoice will be accepted automatically. Archiving invoices for six years is mandatory for recipients and issuers.

What are the submission methods of electronic tax documents?

Similar to other Latin American countries, for a simpler and more cost-effective solution, a third-party certified e-Invoicing service provider can be used. The provider will submit DTEs directly to the SII and provide a platform for issuing DTEs. In addition, they can assist with digital signatures. The provider will supply the required information for invoices, as well as a digital signature and a digital certificate. After registering with a service provider, e-Invoices can be created and sent to the Chilean tax authority. Also, the provider will help create the required file in XML format. After the validation and confirmation of the e-Invoice by the tax authority, the authorization will be given back to the service provider. When the e-Invoice is accepted, it is legally binding and can be sent to a customer. The e-Invoice will be stored by the service provider, and it can easily be sent to the customer through SII web endpoints, after which the customer will have eight days to respond. The customers can also request a refund and other changes. Once the e-Invoice is accepted by the customer, it becomes legally binding. Then the payment can be received by the seller.

How can businesses send invoices to the authority?

Businesses must apply for a CAF, which is a digital signature that shows the validation necessary for sending e-Invoices through the SII’s online portal. Once the CAF is obtained, invoices must be generated in XML format. The adapted software must include the following information:

- Customer and Supplier information

- Description of goods and services

- VAT rate

- Total amount due

Firstly, a validation of invoice by the SII is necessary. After the validation, the invoice with the CAF will be stamped by the SII. After that, the invoice is sent back to you, after which it can be sent to a customer electronically through a secure portal or email. The customer can process the invoice within eight days.

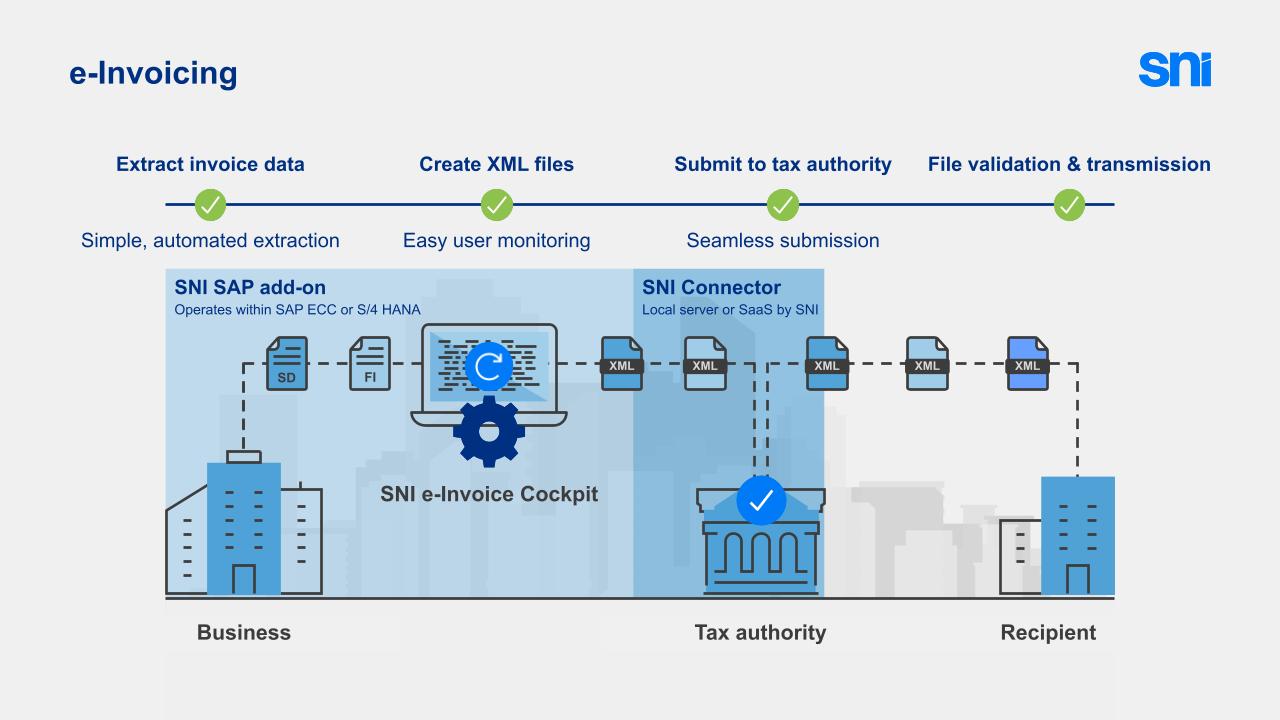

How can SNI help you?

SNI Chile B2B e-Invoicing SAP add-on solution will enable you to generate invoices in the required format and exchange them with approved service providers. The invoice creation and XML conversion functionalities can be automated in the SAP. Signing and reporting DTEs to SII is the responsibility of the approved service provider. Data extraction, mapping and processing, and communication with the service provider can be done in SNI’s end-to-end SAP add-on solutions.