SNI’s solution for the SAP eDocuments Framework

The advancement of technology and digital transformation warrant a comprehensive understanding of e-document and e-Invoice compliance necessary for all global businesses. Businesses all over the world are building up labor forces that can take action and drive the development of the industry with new strategies and technologies.

For example, almost a decade ago, eDocuments were not widely used. The business world has now witnessed a lot of changes to the extent that most buyers and sellers do not want to transact in printed documents anymore. Today, more than 80% of all documents are being executed electronically through digital data storage devices. And this trend is gaining momentum.

If you are a business owner, a tax payer, an accountant, or an IT executive, read on to understand why e-Invoice and e-document compliance are essential and explore the main benefits of the SAP eDocument framework we support, such as:

- No additional subscription needed

- No partner needed to implement for each country

- No need to check updates

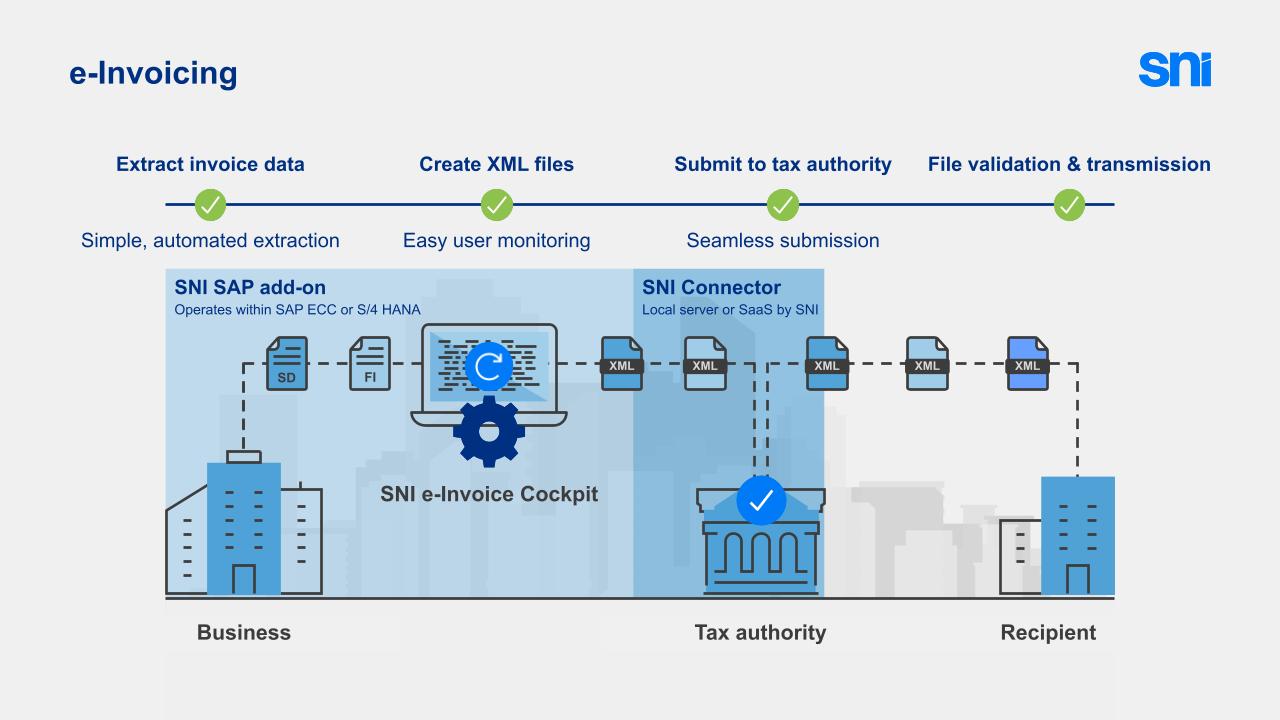

e-Invoicing

e-Invoice Reporting

What is an eDocument?

An eDocument is any transaction document that is exchanged between businesses in electronic format and structure.

The main aim of using eDocument is to eliminate paper, which leads to time savings, higher efficiency and productivity, a reduced carbon footprint, and the promotion of green business practices.

What is the SAP eDocument?

The SAP eDocument solution is used to create an SAP eDocument such as an invoice, waybill, debit/credit note, and archive to transform transactional data created in SAP ECC or S/4HANA system into predefined exchange formats and then transfer it electronically to external systems like legal or tax authorities.

Generally, the SAP eDocument is managed by the government. It often contains special fields and values that require specific information such as a VAT number, tax amount, product price, etc. The eDocument module allows you to create these documents with specific values and fields required by the government as well as storing and managing them in accordance with the law and regulations. In this way, you will expend less effort in the process.

How does SAP eDocument compliance work?

SAP provides a country-specific document format for each new legal requirement, which is based on the SAP eDocument Framework, and uses two other major SAP Components:

- SAP eDocument Framework is a framework that is used to generate electronic documents created by source applications in SAP ECC and S/4HANA. This is an open framework, where currently SAP, customers and partners create and extend compliance related solutions.

- SAP Application Interface Framework (AIF) is used to map transactional data to the regulation-required format (such as XML) and enables SAP Document Compliance to interface between source applications and SAP Cloud Platform Integration.

- SAP Cloud Platform Integration (CPI) is used as a communication platform to establish communication with external systems using web services. Pre-built end-to-end integration packages enable validations and authentication (digital signature), sending the eDocument to the receiver (tax authorities or the public administration) and sending the response back to the back-end system.

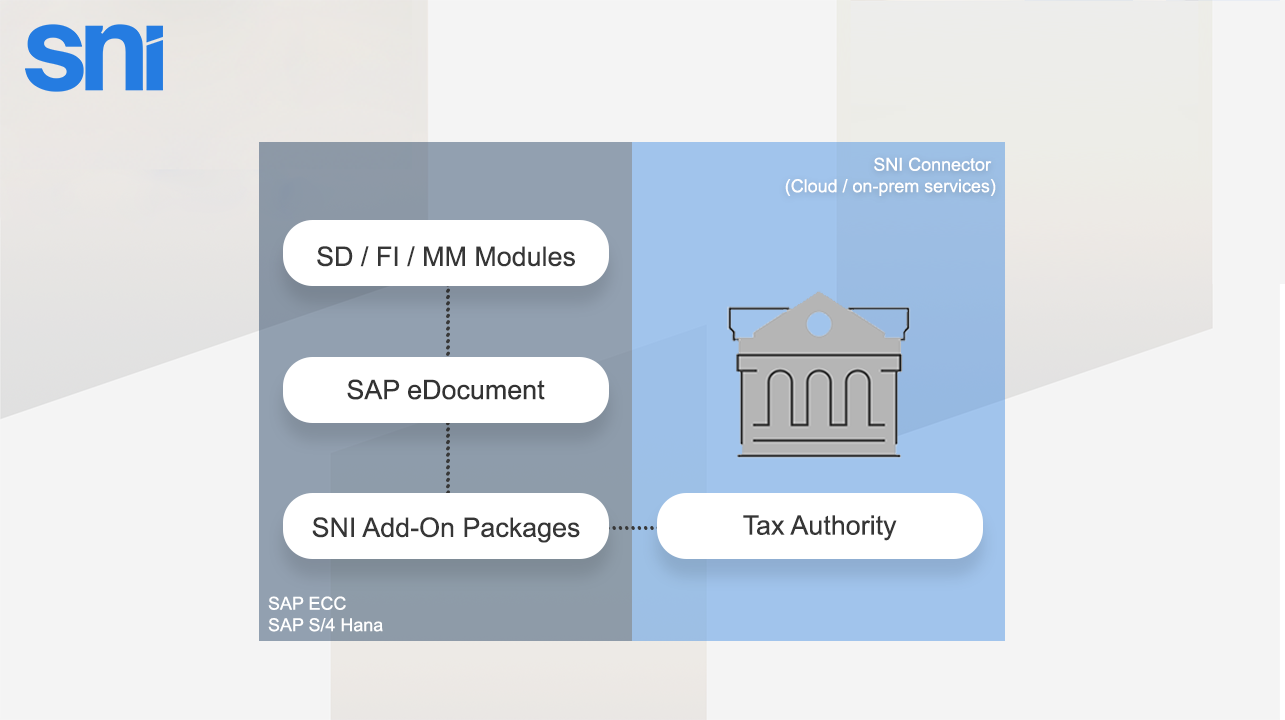

How can you integrate SAP ECC and SAP S/4HANA with SNI?

SAP’s eDocument Solution, with its eDocument Cockpit, requires several OSS Notes to be implemented. Accordingly, several new OSS Notes are required for each new country’s requirements. This is an implementation that should be done by consultants who are experts in the implementation and configuration of SAP Document Compliance. This, in addition to the high cost to the business, can risk on-time deliveries and meeting deadlines.

There are some reasons for businesses to use SAP Document Compliance, or at least some parts of it. Some SAP users really like the eDocument Cockpit, but there are various reasons why they don’t want to subscribe to SAP Integration Packages (like AIF or CPI), such as cost, time, and efficiency.

Others might not use SAP Document Compliance for technical reasons or other restrictions.

Whether you are an SAP or non-SAP user, SNI provides integration platform options for any preferred installation.

Considering all these processes; SNI provides an SAP eDocument platform, which includes all three basic steps that are necessary for digital tax reporting and e-Invoicing, such as;

-

- Data retrieving from SAP ECC and SAP S/4HANA

- Data mapping and processing (creation of XML file)

- Communication with tax authorities and archiving

To summarize, it is known that businesses must first extract the relevant invoice data from core modules (SD, MM,FI) to use these solutions. Later, this data can be viewed on the SAP eDocument monitor in businesses using the SAP eDocument Framework. For businesses that do not want to subscribe to SAP integration packages (AIF, CPI), SNI offers a solution service package that will convert source data into a mandatory file format and submit it to the tax office in accordance with the legislation.

SNI’s SAP eDocument integration package prepares a file that will be submitted to the tax office in accordance with the legislation by converting the source data to the mandatory file format. Then, depending on the legislation, it performs the necessary steps before submission, such as certification, digital signatures, and schema controls, and then submits the electronic invoice to the relevant tax authority. These steps can be done through the customer’s in-house server or SNI cloud server.

The main benefits of using our solution for the SAP eDocuments Framework

- The required regulatory compliance is provided with the standard SAP eDocument Framework without the need for an additional license or subscription.

- It does not require the installation of SAP OSS Notes, thus providing convenience in the integration process.

- There is absolutely no need to use a third-party SAP consultant when using the SNI solution, thus saving you time and money.

- SNI’s solutions are highly compatible with most SAP versions (ECC 4.7 and Higher R3 Versions, S/4HANA), so there is absolutely no need to upgrade your systems.