In recent years, Bolivia has undergone a significant transformation in its taxation system. In this article, we delve into the key aspects of the online billing system in Bolivia, where the Servicio de Impuestos Nacionales (SIN) plays a central role as a responsible authority.

Bolivia’s electronic invoicing system is known as the Virtual Invoicing System, abbreviated as SFV. The SIN (Servicio de Impuestos Nacionales) has introduced three invoicing methods to replace the older computerized invoicing models like the virtual office, the electronic web and the electronic by cycles.

- Electronic Invoicing Online: Mostly for businesses that require a high volume of invoicing and need agility in their operations.

- Computerized Invoicing Online: Similar to Online Electronic Billing, but designed for companies with a more moderate billing volume. In addition, digital signature is not required in that option.

- Web Portal Invoicing Online: Mostly for small businesses with a low turnover volume.

Timeline of implementation

The Bolivian responsible authority has published a regular list of taxpayers that have to comply with the taxation system in progress. Until now, there is six group have been published by the SIN with the planned timeline:

- The first group: December 2021

- The second group: August 2022

- The third group: 1 February 2023

- The fourth group: 1 February 2024

- The fifth group: 1 March 2024

- The sixth group: 1 April 2024

- The seventh group: 1 July 2024

- The eighth group: 1 October 2024

- The ninth group: 1 December 2024

- The tenth group: 1 February 2025

On the Bolivia tax authority website, obligated taxpayers are listed as a group with their tax number called “Numero de Identificacion Tributaria” (NIT).

Technical Details of Online Billing System

SIN mandates that all e-invoices must adhere to the XML 1.0 UTF-8 standard. Each document type is specific to the economic sector it belongs to, and its structure can be confirmed as accurate through validation using XSD schema files supplied by the National Tax Service (SIN). There are 27 types of invoices based on the service provided and the sector where the service is provided.

This standardized format ensures that invoices are structured in a way that is compatible with the tax authority’s systems. Proper XML formatting is crucial to ensuring the acceptance and recognition of your invoices.

The prerequisites for generating electronic invoices in Bolivia encompass the following:

- Possession of an Electronic Invoice Certificate (in the online modality).

- Authorization from the tax authority (SIN) for issuing computerized and web portal-based electronic invoices.

- Utilization of an information technology system that has received authorization from the tax authority.

It is important to note that so as to utilize invoices, taxpayers are required to acquire a digital signature or certificate, which is obtained through the Agency for the Development of the Information Society (ADSIB). In addition to that, Billing Systems Providers are only allowed to sign generated invoices and communicate with the tax authority’s portal and have to be authorized by the SIN.

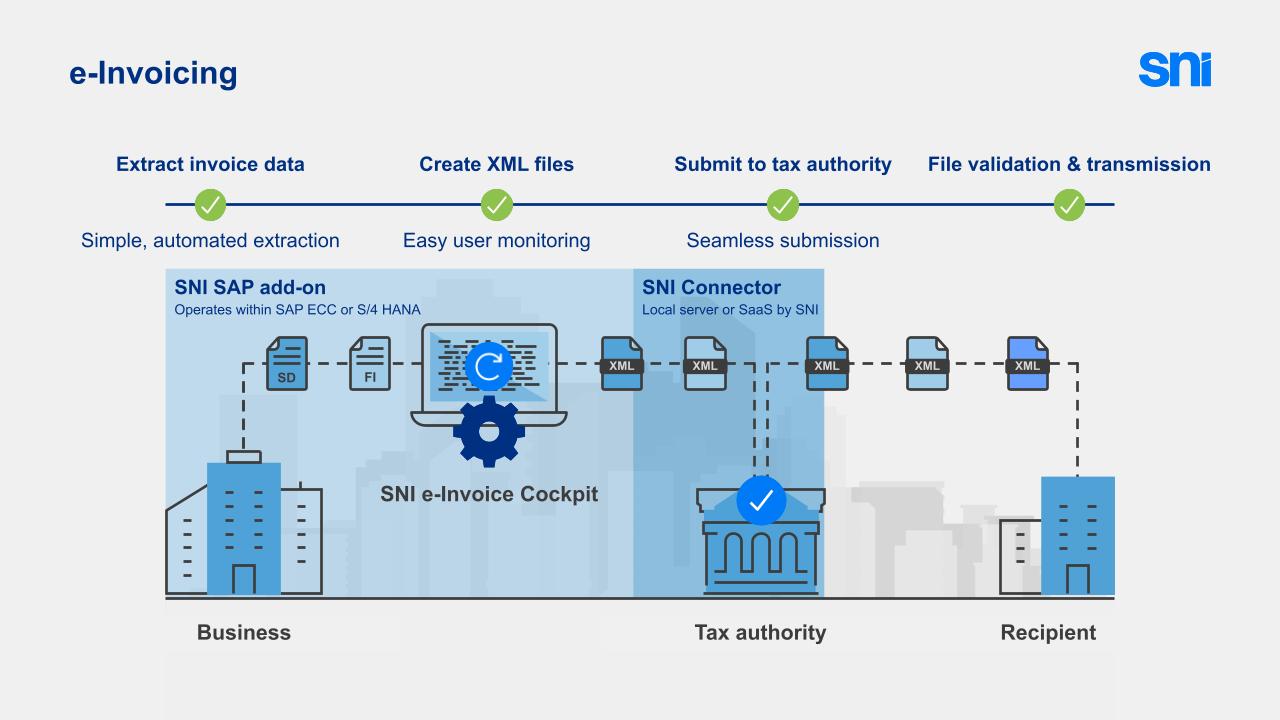

How can SNI help you?

SNI’s Bolivia e-Invoicing solution will enable you to generate invoices in the desired format and send it through Certified Billing Systems Providers.The invoice generation, XML conversion, and sending to the system provider. Data extraction, mapping and processing, and receiving validated e-Invoice through SNI’s end-to-end solutions.